Guest Column

2015-16 to be better year for realty shares

Finally, a fantastic year has come to an end! FY15 was a year which anyone who invests in stock market will not forget easily. Nifty rose 1,787 points, delivered 26.65 per cent return and first time acrossed 7,ooo-s.ooo and 9,0oo-levels. The highlights of the year were: 1) Formation of Narendra Modi-led Government at the Centre, 2) Crude oil price decline, 3) European stimulus package, 4) End of QE3 in the USA and 5) Fll inflow of Rs.70 lakh crore in Indian market {Rs 1.08 lakh acre in equity + Rs 1.62 lakh acre in debt).

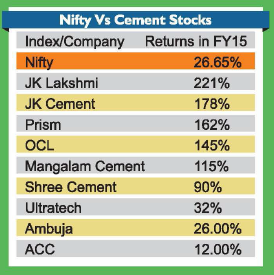

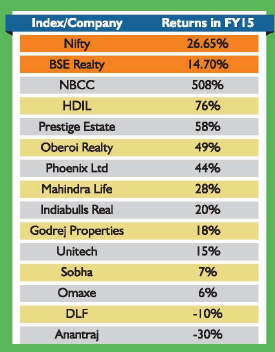

Despite this happy ending, real estate sector had little to cheer about. Real estate under performed benchmark Nifty as Realty Index just rose 14.70

per cent during this bull run. However out of 13 BSE Realty Index companies, six beat Nifty Returns while nine companies outperformed Realty Index. NBCC was the star of this year while DLF and Anantraj were among the laggards.

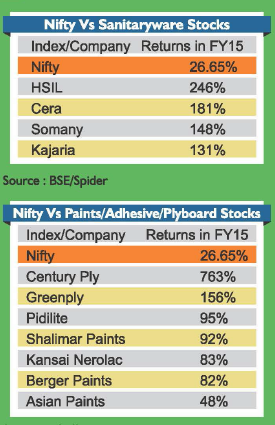

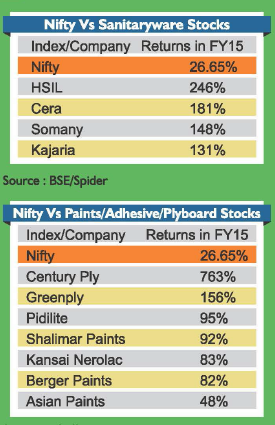

• Sanitary and cement segments performed in anticipation of rising demand from Modi’s ‘toilet-making’ theme and from the rising Government expenditure on infrastructure respectively. Rising demand of decorative paints and economic revival are creating demand for plyboard.

• In the Union Budget 2015-16, total allocation to infrastructure — including from Central public sector enterprises (CPSEs) — has been increased by Z700 billion and allocations to roads and rail were increased by 7140 billion and 7100 billion, so the demand for cement is expected to rise.

• The Government is eager to clear the Land Acquisition Bill soon and ECB norms are expected to be less stringent. Penetration of real estate companies in Tier-II cities will give further fillip. Commodity prices have started to soften and are going to give margins boost-up. Keeping all these factors in mind, one can say that FY 2016-17 is expected to be a better year than the Fy 15.

Raw material suppliers enjoyed bull run :FY1 5 was the year of sanitary, cement, paint and plyboard companies. Sanitary and cement segments performed in antidpation of rising demand from Modi’s ‘toilet-making’ theme and from the rising Government expenditure on infrastructure respectively. Rising demand of decorative paints and economic revival are creating demand for plyboard. According to the 2011 census, 113 million rural households in the country do not have a toilet. Nearty 60 per cent of rural India defecates in the open (December 2013, NSSO). The Government has set the target of ending open defecation both in urban and rural areas by 2022. It envisages building 1 .24 crore latrines annually, which translates into constructing CM!f’ 1 0 lakh toilets fNefY month aaoss the states. So, sanitary companies are antidpating good orders from the Government initiative. In the Union Budget 2015-16, total allocation to infrastructure – including from Central public sector enterprises (CPSEs)has been in a eased by Rs 700 billion and allocations to roads and rail were increased by Rs 140 billion and Rs 1 00 billion, so the demand for cement is expected to rise. If we analyse returns of cement (barring Ambuja, ACQ, sanitary, paints and plyboard shares, we find that all segments outperformed Nifty Returns and even sanitary and plyboard shares have given more than 1 00 per cent retums in a year. Century plyboard was the mega star among all.

• We are corning out of an environment where business sentiment was weak and unemployment on the higher side. Both these factors affected demard. High interest rate. No clarity on land acquisition. High commodity (cement, metal, sanitary) prices.

• High debt burden on companies and banks are reluctant to givefurther loans.

• Loss of faith among investors in timely execution of projects.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News3 weeks ago

News3 weeks agoSacred Cities See a Retail Boom as Spiritual Tourism Surge: CBRE Report