Top Stories

A Small Big Step

In a development bound to enthuse the realty sector that has been clamouring for the ‘infrastructure sector’ tag, RBI has partially fulfilled the desire by granting that status to the critical affordable housing segment. It is now left for the Government to take the cue and grant the status to the entire real estate sector, reports Team R&M

In tandem with the Government’s new-found emphasis on realty sector in general and the ‘Housing for All by 2020’ mantra in particular, the Reserve Bank of India (RBI) has brought affordable housing segment under the infrastructure sector. What it means is that banks can lend to developers of such projects under the priority sector category.

On July 16, the RBI announced that affordable housing segment should be treated as infrastructure sector and banks will not be required to maintain statutory deposits like CRR and SLR with the RBI on funds raised for lending to the infrastructure sector, including the affordable housing segment. The RBI said that “apart from what is technically defined as infrastructure, affordable housing is another segment of the economy which requires long-term funding and is of critical importance.”

The RBI has also proposed to ease the way for banks to raise long-term resources to finance their long-term loans to infrastructure as well affordable housing. Allowing banks to raise long-term funds at cheaper rates, including through External Commercial Borrowing (ECB), will help developers and the Government agencies involved in the affordable housing projects to increase the supply of housing and reduce the demand-supply gap.

The announcement of granting infrastructure status to affordable housing besides partially meeting the longstanding demand of the real estate industry comes as a huge relief to middle and higher-middle income group home buyers. Consequent to the RBI announcement, interest rates on home loan of up to Rs 50 lakh to buy a house costing up to Rs60 lakh will come down by around one percentage point.

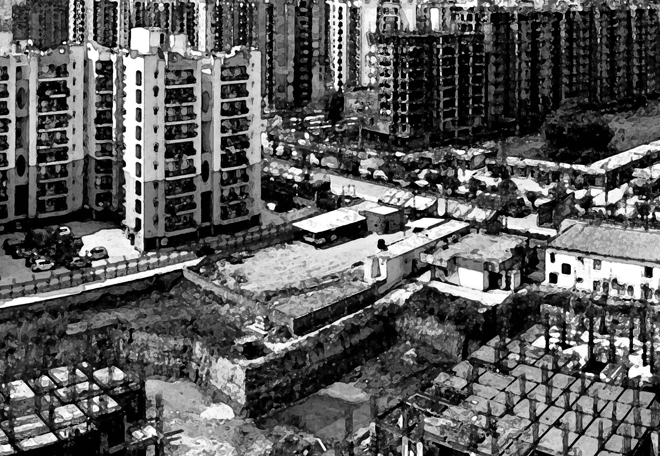

The revised RBI norms will particularly benefit the NCR market in areas like Noida, Greater Noida, Noida Extension, Yamuna Expressway, Ghaziabad, Sonepat, Greater Gurgaon and Faridabad where a 2 BHK apartment is available within Rs60 lakh.

Sanjay Dutt, Executive MD (South Asia) of Cushman and Wakefield, has been quoted in the media as saying: “The RBI decision finally addresses a huge concern of the real estate sector, which has been demanding ‘infrastructure industry’ status for a long time. Clubbing affordable housing with infrastructure and allowing priority sector lending will allow the sector to finally access cheaper funding”.

Concurring with the view, the Confederation of Real Estate Developers’ Associations of India (CREDAI) said its long pending demand for providing infrastructure status to affordable housing has been partially met by the RBI decision.

• On July 16, RBI brought affordable housing segment under the infrastructure sector. What it means is that banks can lend to developers of such projects under the priority sector category.

C Shekar Reddy, President, CREDAI, said: “By easing the financing norms for affordable housing, the RBI has put its best foot forward in order to achieve the Central Government’s goal of ‘Housing for Everyone’. The move of allowing the banks to issue long-term bonds in order to raise resources for lending to affordable housing is appreciable.”

SANJAY DUTT, Executive MD (South Asia), Cushman and Wakefield

•Banks will not be required to maintain statutory deposits like CRR and SLR with the RBI on funds raised for lending to the affordable housing segment.

•Allowing banks to raise long-term funds at cheaper rates, including through ECB, will help developers and the Government agencies involved in the affordable housing projects to increase the supply of housing and reduce the demand-supply gap.

•Interest rates on home loan of up to Rs 50 lakh to buy a house costing up to Rs60 lakh will come down by around one percentage point.

•The revised RBI norms will particularly benefit the NCR market in areas like Noida, Greater Noida, Noida Extension, Yamuna Expressway, Ghaziabad, Sonepat, Greater Gurgaon and Faridabad where a 2BHK apartment is available within Rs60 Lakh.

DINESH KASANA, MD, Crown Group

SHIVAKSHI GOGIA, CFO, Ascent Group

Reddy said the decision will make affordable housing projects attractive for developers and more builders will be coming together to initiate such projects throughout the country.

“This step will pave the way for liberalised funding, and with the increased exposure, the lending to the Affordable housing sector is expected to increase manifold. The builders will be able to pass on the benefits arising from this norm to end-users,” he added.

The national CREDAI chief said the revised norms will make affordable housing eligible for getting loans under the priority sector category, through which the home buyers in six metropolitan cities will be eligible for loans up to Rs 50 lakh.

Shivakshi Gogia, CFO of Ascent Group, said the RBI decision on priority sector lending for affordable houses will prove to be a boon for the middle and upper-middle class people. She said “with banks having increased funds at their disposable, their exposure is bound to go up, and that is good news for the sector”.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News3 weeks ago

News3 weeks agoSacred Cities See a Retail Boom as Spiritual Tourism Surge: CBRE Report