News

Age of Indian Homebuyers – Across Decades and Cities

The age of property buyers is an important demographic variable which Indian real estate stakeholders from developers to marketers and advertisement agencies must focus on. Over the past one decade, there has been a tectonic shift in not just the overall buying pattern but also in the age of property buyers.

Until the late ’90s, many Indians preferred to buy homes using their savings rather than opting for home loans. As a result, most homebuyers were in the age group of 45-55 years or even closer to retirement – by then, they had accumulated sufficient wealth to support property purchase.

In this period, younger Indians with much lower savings kept away and were also very cautious about bank loans, seeing them as risky. Also, many banks were reluctant to lend large amounts (70-80% of a property’s overall purchase price today) back then.

In the 2000s, the winds of change blew and the age bracket of property buyers began to drop, coming down to 35-45 years. Home loans were readily available, and homebuyers warmed up significantly to the notion of using borrowed funds rather than depleting all their savings. The fact that home loans also carried attractive tax benefits certainly helped, too.

In this period, banks and other lending institutions began to re-strategize their approach, and youth became the target audience. The availability of finance became the key driver for this change.

In the late 2010, buyers were largely in the age groups of 35-45 years and 45-55 years, but the share of homebuyers in the 25-35 years age group was minimal. However, improved tax benefits motivated more working youths in this age bracket to opt for home loans. Millennials predominantly favoured paying EMIs for buying a home over the ‘dead’ expense of rentals.

The ranks of this vital age demographic swelled steadily till about 2015-16. Since then, many millennials are rethinking the notion of buying homes at this relatively early age. The tendency now is to avoid large investments and instead invest in other asset classes. However, this is by no means the larger norm.

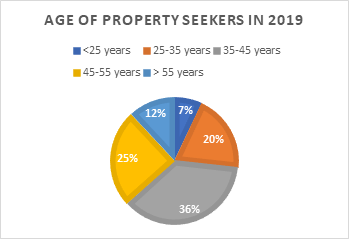

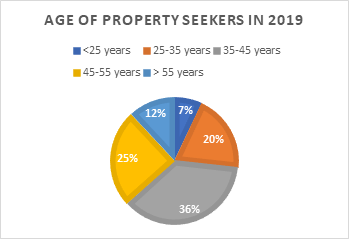

Analysing the age bracket of home seekers in the first half of 2019, ANAROCK’s consumer sentiment survey H1 2019 reveals that:

- At least 37% of participants serious on buying homes fall in the age bracket of 35-45 years, followed by 25% in the 45-55 years bracket.

- 20% are in the age bracket of 25-35 years, and at least 7% are under 25 years of age. The homebuyer share of these two age brackets was extremely limited in the early 2000s.

- Towards 2009-2010, easy home loan availability boosted the share of homebuyers in the 25-35 years age bracket

Source: ANAROCK Research

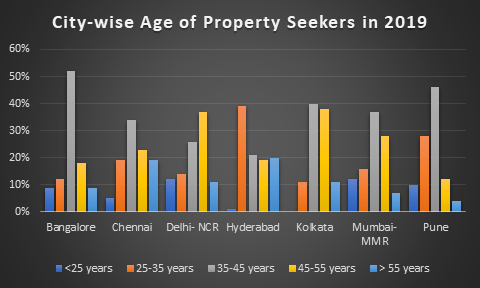

City-level Trends

- In MMR, 37% of home seekers are in the age group of 35-45 years, followed by 28% in the 45-55 years bracket. The fact that homes are costly here and call for huge down payments even if one avails of home loans causes a significantly high percentage of home seekers to fall in the latter age bracket. Nearly 16% are in the 25-35 age bracket, while another 12% – predominantly start-up honchos – fall in the below-25 age group.

- In Delhi-NCR the trend is reversed. At least 37% of home seekers are in the age group of 45-55 years, followed by 26% in the 35-45 years age bracket.

- Bangalore has at least 52% property seekers in the age bracket of 35-45 years. This coincides with the fact that the city has large population of professionals seeking home loans. 18% of Bangalore’s home seekers are in the age bracket of 45-55 years, and almost 21% are below 35 years of age.

- 39% of property seekers in Hyderabad and 28% in Pune are aged between 25-35 years. Both cities have a younger population who aspire to own homes early in life. However, in Pune the maximum (46%) share of home seekers is in the 35-45 years age bracket.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder