Report

All Time High- Overall Space Take-up In Logistics And Warehousing; Crosses 24 Million Sq. Ft. In 2018

RECORDS A GROWTH RATE OF MORE THAN 40% OVER 2017: CBRE REPORT, H2 2018

- The second half of 2018 witnessed robust leasing activity with about 14.3 million sq. ft. of space take-up, a 46% increase on a half-yearly basis.

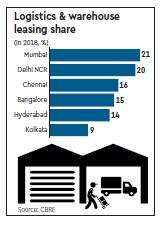

- Mumbai dominated leasing activity with a share of about 21%, followed by Delhi-NCR (20%) and Chennai (16%) & remained the top demand drivers in H2 2018

- Count of large-sized deals (more than 100,000 sq. ft.) almost doubled in 2018 compared to 2017

- 3PL led leasing activity in 2018, followed by Engineering & Manufacturing with a 22% share

- Rentals continued to appreciate for several micro-markets across cities in Indi

New Delhi, Feb 21st, 2019: CBRE South Asia Pvt. Ltd, India’s leading real estate consulting firm, today announced the findings of its latest report ‘India Industrial and Logistics Market View, H2 2018’.

The findings of the report interestingly stated that the overall space take-up in the logistics and warehousing sector crossed 24 million SQ. FT. IN 2018 – AN ALL-TIME HIGH. Recording a growth rate of more than 40% compared to 2017, the report said that implementation of GST led to far-reaching implications on industries, more so in the warehousing and logistics sector. Overall in 2018, Mumbai, followed by NCR, Bangalore and Chennai dominated leasing, accounting for more than 70% of the space take-up. The second half of 2018 witnessed robust leasing activity with about 14.3 million sq. ft. of space take-up, a 46% increase on a half-yearly basis. Mumbai dominated leasing activity with a share of about 21%, followed by Delhi-NCR (20%) and Chennai (16%), the report, said.

Anshuman Magazine, Chairman and CEO, India, South East Asia, Middle East and Africa, CBRE said: “We are very positive about the government’s vision to increase the sector’s contribution to the overall GDP; through more incentives for players and streamlining regulations. With technology permeating the logistics sector, coupled with the government’s push to the sector; corporates will be driven to opt for large, modern warehouses as they would seek to leverage the new GST regime as well as consolidate and expand their operations. This demand we feel would further be boosted by the entry of various private equity firms and foreign players in the Indian logistics market.”

As per the findings, the count of large-sized deals (more than 100,000 sq. ft.) almost doubled in 2018 compared to 2017. The implementation of GST coupled with quality supply from reputed developers resulted in the average size of deals increasing from 75,000 sq. ft. in 2017 to about 90,000 sq. ft. in 2018. Similarly, the second half of 2018 witnessed about 28% of the leasing in the large-sized transactions (more than 100,000 sq. ft.)

Commenting on the sector, Jasmine Singh, Senior Executive Director – Advisory & Transaction Services, India, CBRE said, “We foresee Indian e-commerce companies, 3PL players and online grocery chains to increasingly use innovative tech solutions to improve inventory management. The sector is also likely to observe increased levels of institutional funding and more formal sources of capital as private equity firms and developers are already indicating interest to acquire land parcels across various locations.”

Sectors that contributed to the growth of leasing activity in H2 2018 were majorly led by 3PL service providers with a share of about 40%, followed by engineering and manufacturing (22%), e-commerce (21%). Sectors such as retail, FMCG, electronics also contributed to the overall leasing activity.

The overall demand for logistics and warehousing space was largely concentrated in Mumbai (21%), Delhi-NCR (20%) and Chennai (16%), closely followed by Bangalore (15%). Hyderabad and Kolkata accounted for 14% and 9% respectively; while the cities of Pune and Ahmedabad collectively held a 5% share in overall demand. When compared on a half-yearly basis, almost every city witnessed growth in leasing activity. While Chennai witnessed a growth of about 104%, Hyderabad and Kolkata witnessed a growth of 93% and 73% respectively. Other cities such as Mumbai (54%), Delhi-NCR (41%) and Pune (17%) also witnessed growth.

The report further stated that rentals continued to appreciate several micro-markets across cities. The Western corridor in Hyderabad observed the highest rental appreciation at 20% on a half-yearly basis followed by the Western and Northern belts in Chennai; with rental increments of 8 – 11% on a half-yearly basis. Meanwhile, other micro-markets such as NH-8 in Delhi-NCR, the Northern Corridor in Hyderabad, and NH-24 in Ghaziabad, reported a rental appreciation of 1-3% on a half-yearly basis. The increase could be attributed to sustained demand and regular inquiries from various occupiers. Rentals in other micro-markets across cities remained stable during the review period

City Highlights – H2, 2018

Delhi-NCR

- Delhi-NCR reported strong demand for warehousing space during the second half of 2018 as leasing activity grew by about 41% from H1 2018

- Driven by the 3PL (46%), E-Commerce (29%), and Retail (25%) sectors, leasing activity was concentrated across independent developments in the micro-markets of Farukh Nagar, Taoru Road, Binola and Jamalpur in Gurgaon

- No supply addition was recorded during this review period. The city witnessed rental appreciation in the range of 1-3% on a half-yearly basis in the micro-markets of Gurgaon and Ghaziabad

Mumbai

- Mumbai continued to witness robust leasing activity during the second half of 2018, with the closure of several media to large-sized transactions

- The city witnessed a nearly 54% increase in absorption levels in comparison to H1 2018. Although 3PL players dominated space take-up (leasing approximately 71%), occupiers from other sectors such as e-commerce (8%) and paint & chemicals (8%) were also active across micro-markets

- The city witnessed a supply addition of about 2.1 million sq. ft. during the review period. In addition, the city also witnessed new project launches of approximately 0.9 million sq. ft. Rental values remained stable during the current quarter

Bangalore

- Leasing activity in Bangalore largely remained stable during the second half of 2018 vis-a-vis H1 2018. Space take-up was largely concentrated in West Bangalore, followed by East Bangalore and South Bangalore

- Demand was largely dominated by retail players, followed by 3PL, manufacturing and e-commerce companies

- Rental values remained largely stable across (H-o-H) North, East, West and South Bangalore

Chennai

- Chennai continued to witness robust leasing activity during the second half-year of 2018 with several large to medium scale leases getting concluded

- The Northern Industrial Belt dominated overall leasing with a share of more than 52% of total absorption during the review period

- Leasing activity was driven by engineering & manufacturing, 3PL, electrical & electronics and e-commerce corporates.

- The city also witnessed new supply addition (dominated by Northern Chennai) of about 0.6 million sq. ft. with small-medium sized warehousing developments witnessing completions

- Owing to limited supply and increased demand from engineering & manufacturing, 3PL and electrical & electronics occupiers, rental increments of about 8-11% were witnessed in core locations such as the Western and Northern belt

Hyderabad

- Hyderabad witnessed a marginal increase in demand for warehousing space during the second half of 2018 in comparison with H1 2018

- Northern Corridor dominated total space take-up during the review period by contributing to about 76% of overall leasing. Leasing was largely led by occupiers from e-commerce, FMCG and 3PL segments in independent developments across micro-markets

- The Southern Corridor accounted for about 13% of the leasing activity followed by the Eastern Corridor (6%) and Western Corridor (5%)

- During the review period, FMCG players led the leasing activity and accounted to about 33% of the total space-take up, followed by 3PL (19%), e-commerce (18%), Electronics (10%) and Engineering & Manufacturing (7%)

- The city also witnessed supply addition of about 0.25 million sq. ft. in the Southern Corridor during the review period

Pune

- Pune witnessed an increase in leasing activity during H2 2018 compared to H1 2018

- The majority of the transactions were concluded in the medium to large-size formats; primarily by occupiers from the engineering and manufacturing, automobile and e-commerce sectors

- On the rental front, values remained stable across all micro-markets

Kolkata

- Kolkata witnessed a significant increase in demand in H2 2018, as leasing grew by about 70% when compared to H1 2018

- During the review period, the city witnessed two small-sized development completions by local developers on NH 6, totaling 55,000 sq. ft. Rental values remained stable across micro-markets

- Demand was led by occupiers from the e-commerce, telecommunication and engineering and manufacturing sectors; followed by 3PL and retail

Ahmedabad

- The city continued to witness significant traction during the second half compared to H1 2018

- Leasing activity was concentrated in the micro-markets of Aslali and Bavla, primarily led by engineering and manufacturing firms, followed by e-commerce

- The city did not witness any new supply addition during the review period. Rental values also remained largely stable across micro-markets

Outlook

Development of logistics-related infrastructures such as dedicated freight corridors, logistics parks, free trade warehousing zones and container freight stations are expected to improve efficiency. The development of new warehouse facilities by organized players is likely to propel demand as occupiers will focus on expansion and consolidation.

Tech innovation to shape the future of the sector

The use of fleet management software (provides live tracking of goods), RFID systems for inventory identification and automated pallet storage is growing quickly, as is the number of start-ups aimed at bridging the technology gap. The widespread deployment of IoT is expected to revolutionize operations by creating smart warehouses that improve supply chain efficiencies.

Modern warehouses to drive demand

Leading real estate developers have begun acquiring large land parcels for the development of warehousing facilities – a trend likely to continue through 2019. This would lead to an increase in the supply of modern warehouses over the coming years. While cities such as Mumbai, Pune and Chennai would remain major investment destinations, Delhi-NCR and Bangalore are also likely to be on the investors’ radar.

Increased participation from private developers and institutional funds

As the sector moves towards a more systematic mode of operation, the inflow of institutional funding and formal sources of capital have started to increase in the sector. As domestic players with larger warehouses emerge; deployment of capital in these fewer, better quality assets are likely to become easier.

Rental appreciation anticipated

Rental values for warehousing spaces across various micro-markets are anticipated to appreciate in the short to medium term. Considering persistent demand levels coupled with expected advanced developments by organized players is likely to enhance rental values across various micro-markets. Also, the growing demand for industrial spaces in various cities is also likely to fuel rental appreciation in forthcoming quarters

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News3 weeks ago

News3 weeks agoSacred Cities See a Retail Boom as Spiritual Tourism Surge: CBRE Report