News

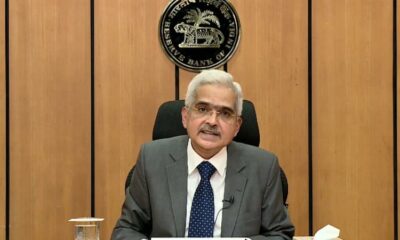

Banks can rejig loans based on project, not developer: RBI

The Reserve Bank of India (RBI) has permitted banks to restructure loans to real estate companies on the basis of the project rather than the developer.

It has also indicated that banks can restructure loans drawn by a borrower during the current fiscal, provided the account was classified as ‘standard’ (not overdue for more than 30 days) as on March 1, 2020.

These clarifications were issued by the central bank in a set of frequently asked questions (FAQs) on the resolution framework for COVID-related stress announced last month.

On real estate, the RBI said, “Only in respect of borrowers belonging to real estate sector, and have both residential and commercial real estate business, the prescribed thresholds for the financial parameters may be applied at the project level.”

The RBI also cleared the confusion on whether only that loan which was outstanding as on March 1, 2020 is available for resolution. It said the March 1 deadline is for determining eligibility, whereas the actual loan that may be considered for resolution will be the one that is outstanding as on the date of invocation of the resolution framework.

In its clarification, the Reserve Bank of India said that a basic requirement of its prescriptions for loan restructuring, issued in June 2019, was that there should be an inter-creditor agreement among all lenders. It added that this framework provides banks with enough flexibility to restructure loans on a project basis. That’s because the projects are considered separate legal entities and therefore there is no bar on creating separate escrow accounts.

-

Interviews4 weeks ago

Interviews4 weeks agoHigh Rental Yield, Price Appreciation, Stable Growth, Make Sydney an Ideal Realty Investment Option: Haansal Estate

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts