News

Constructing Cheer

Just as the R&M editorial team was about to lock the November issue, news trickled in of the surprise sweetener for the realty sector in the form of relaxation in rules for FDI in the construction sector. With its umbilical ties to the realty sector, the Government decision is replete with significance and we thought of dealing with it in the next issue keeping deadline primacy in mind. But the jubilant responses from across the developer community induced us to bring to you a quick recap of the Government decision along with the industry feedback.

On October 29, as if to pre-empt our cover story this month which focuses on the gamut of expected Government action on the realty front in November-December, a surprise development took place in the corridors of power-a decision that the Indian realty sector was looking forward to very hopefully for quite some time.

That day, a meeting of the Union Cabinet approved a Department of Industrial Policy & Promotion (DIPP) proposal to relax rules for allowing Foreign Direct Investment (FDI) in the construction sector, including housing, by reducing the minimum built-up area and capital requirement for foreign investment in such projects.

These decisions are expected to bring in seminal changes in how realty projects- especially medium and smaller ones-are funded.

In effect, the Cabinet decided to drop the minimum 10-hectare rule for serviced housing plots and slashed the minimum floor area for construction development projects to 20,000 square metres from the present 50,000 sq mt to be eligible for overseas investment. The minimum capital requirement was also halved to $5 million from $10 million and exit norms substantially eased.

What it means is that from now on,for construction development projects, FDI can now come in with a minimum floor area of 20,000 sq m, against the lower threshold of 50,000 sq m till now. Subject to these conditions, 100 per cent FDI will be permitted in the sector. While the three-year lock-in for FDI investors will broadly remain, the FIPB will consider their proposals for exit before completion of the project on a case-by-case basis.

Also, a foreign investor will now be required to bring a minimum FDI of $5 million only within six months of the start of the project, as against $10 million earlier.

The proposal for FDI in construction sector was moved by the DIPP, under the Commerce and Industry Ministry to attract more foreign investment in construction and real estate sector which has been facing a prolonged liquidity crunch.

The latest decisions will accelerate the flow of funds to relatively small real estate projects that have thus far remained out of bounds for foreign investors and will kindle the pent-up demand for affordable housing.

“Subsequent tranches of FDI can be brought till the period of 10 years from the commencement of the project or before the completion of the project, whichever expires earlier,” said the government statement.

• On October 29, a surprise development took place in the corridors of power — a decision that the Indian realty sector was looking forward to very hopefully for quite some time.

• These decisions are expected to bring in seminal changes in how realty projects — especially medium and smaller ones — are funded.

• The Cabinet decided to drop the minimum 10-hectare rule for serviced housing plots and slashed the minimum floor area for construction-development projects to 20,000 square metres from the present 50,000 sq mt to be eligible for overseas investment.

The real estate industry hailed the new FDI rules, saying the move would help cash-starved developers raise significant amount of foreign funds and also complete the stuck projects.

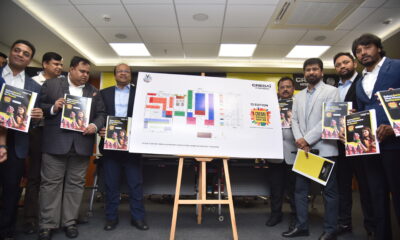

Realtors’ apex body Credai President C Shekar Reddy said it would help developers get an extra route to fund their projects. This applause was unanimous from across the sector.

Rohit Raj Modi, Honorary Secretary, Credai, and Director, Ashiana Group, said: “It is indeed a welcome step by the Government. With these reforms in place, they would now be able to manage their fund quite well.” He added that the sector had been reeling under an acute funding pressure and foreign investment had also gone down in the last few years.

According to Dhiraj Jain, Director, Mahagun Group: “The decision will provide a relief to the sector and result in smooth completion of projects with fresh FDI inflow. Availability of funds will also help developers to carry on the projects in time besides providing an alternative source for funds.”

Aman Agarwal, Director, KV Developers, said: “The move to relax FDI limit will help increase the development of low-cost and affordable housing furthering the government’s vision”. He said this move will be a boon for developers as well as real estate industry. Supertech CMD RK Arora, who is also the Credai vice president (Yamuna Expressway), told Realty & More: “The easing of FDI norms in the construction sector is going to benefit both the developers and customers at large by adding, more number of projects and highly developed infrastructure such as roads, highways, sewage, water, power, etc.” Arora said: “A 100 Rer cent FDI approval means more capital can be invested in towns and cities for the development of both residential and commercial spaces.”

Vikas Sahani, CMD, Property Guru, was of the opinion that with the latest decision, the government had articulated its vision to provide ‘Housing for All’ by 2022. “Allowing FDI in the construction sector with reduction in the size of projects eligible for FDI from 50,000 sq m to 20,000 sq m and raising the cap on FDI from $5 million to $10 million will encourage developers to complete their projects on time and help in fulfilling the shortage of around 25 million houses in the country,” he said.

ROHIT RAJ MODI, Director, Ashiana Group

Owais Usmani, MD, Presidency lnfraheights, said: “Relaxation of FDIIimit in construction and real estate development under the automatic route is a clear roadmap for inviting investments. Relaxation of limit for minimum investment is an invitation to small players and increased NRI investment. The reduction in built-up area and size of projects will allow mid-sized and smaller developers with good track records better access to FDI and boost affordable housing in the country.”

DHIRAJ JAIN, Director, Mahagun Group

• A foreign investor will now be required to bring a minimum FDI of $5 million only within six months of the start of the project, as against $10 million earlier.

• The latest decisions will accelerate the flow of funds to relatively small real estate projects that have thus far remained out of bounds for foreign investors and will kindle the pent-up demand for affordable housing.

• Realtors’ apex body Credai President C Shekar Reddy said it would help developers get an extra route to fund their projects.

The announcement of FDI in construction and real estate will boost investments in the industry, according to Dujender Bhardwaj, Executive Director, ABCZ Builders. He said: “This step can open several doors to the real estate sector. In relation to townships, housing development of projects under the automatic route was the first step towards promoting the participation of the foreign investors in real estate. It can be said that further growth in the construction industry looks hopeful.”

OWAIS USMANI MD, Presidency lnfra heights

AMAN AGARWAL Director, KV Developers

VIKAS SAHANI CMD, Property Guru

RK ARORA, CMD, Supertech

DUJENDER BHARDWAJ, Executive Director, ABCZ Builders

PRADEEP JAIN, Chairman, Parsvnath Developers

“With the latest development. small developers will have multiple options for project funding and by reducing minimum build-up area and capital requirement, the government has opened the FDI doors for smaller players.••

VIKRAM NATH, Director, Logix Group

PRASHANT TIWARI, Chairman, Prateek Group

AJAY AGGARWAL, Director, Avalon Group

“Bigger reforms are required to make it easier to do business in India.”

DAVID WALKER, Managing Director, SARE Homes

Pradeep Jain, Chairman of Parsvnath Developers, said that in order to attract more foreign investment in the construction and real estate sector, this is a remarkable step. Jain told Realty & More: “We are thankful to the government for this move. The sector is reeling through an acute funding pressure. The foreign investment in real estate has also gone down in last few years. Hence, this move has sent a positive signal for the real estate sector which will be seen in the coming days.”

Equally ecstatic was the reaction of Vikram Nath, Director, Logix Group, who dubbed it as a “great move from the Government”. The sector, he said, has been going through difficult phase for the last couple of years causing a liquidity deficit leading to delay in completion of projects. “With the latest development, project funding and by reducing minimum buildup area and capital requirement, the Government has opened the FDI doors for smaller players,” he added.

Prashant Tiwari, Chairman of Prateek Group and Vice-President of Credai-NCR, Western UP division, hailed it as “one of the most promising decisions of the recent times.” Tiwari said: “The much-needed breather for the sector will further entice developers to be more aggressive in the segment and would take development beyond metro cities.” Tiwari added: “This will ease the burden of lending for banking and non-banking institutions, which till date have been bearing the load of capital needs for the real estate sector.”

Ajay Aggarwal, Director, Avalon Group, was crisp in his comments when he said: “It’s a very positive announcement and I believe that policy reforms are much needed to ensure India’s higher growth and lower inflation. This will boost the industry in terms of capital mixture and employment generation.”

Though agreeing with the majority by welcoming the Government’s announcement of easing of funding rules for FDI in construction sector, David Walker, Managing Director, SAKE Homes, said: “It does not constitute the big reforms that are required to attract the approximately $1 trillion over five years (2012-17) to overhaul its infrastructure sector such as ports, airports and highways to boost growth.”

“Bigger reforms are required to make it easier to do business in India,” Walker added, bringing to notice the fact that India has recently slipped by two points to 142 in a ranking of 189 countries rating the ease to do business globally

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News3 weeks ago

News3 weeks agoSacred Cities See a Retail Boom as Spiritual Tourism Surge: CBRE Report