Report

Data centres draw an investment of $396 mn in 2020

Analysing under-construction projects and capital invested or committed, an ANAROCK-Mace report titled ‘Navigating the India Data Centre Lifecycle – Trends & Perspectives’ reveals that India will see at least 28 large hyperscale data centres constructed over the next three years. These will span over 16+ mn sq. ft. with at least 1,400+ MW of IT power capacity, equalling nearly 0.6 mn sq. ft. and 50 MW per facility on an average per hyperscale data centre.

The Indian data centre industry has attracted close to USD 977 mn in PE and strategic investments since 2008, of which nearly 40% or approx. USD 396 mn were infused between Jan-Sept 2020 period alone.

Indians’ data consumption increased from 0.3 GB/user/month in 2014 to 10 GB/user/month in 2018; per capita consumption to hit 25GB/month by 2025 – total data traffic in the country likely to touch 21 EB (exabytes) per month.

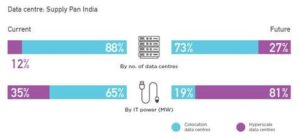

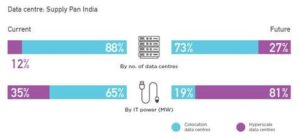

The report finds that India currently has ~126 third-party data centres (colocation or hyperscale) spanning 7.5+ mn sft, and a cumulative IT Power Capacity of 590+ MW. While 53 players own /operate these 126 third-party data centres, the capacity is highly concentrated among the top 12 players who operate ~95 pc of the total IT Power capacity in the country.

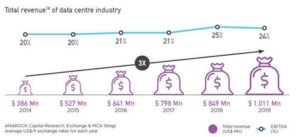

The report also tracks investments into digital infrastructure for data storage in India from exchange and MCA filings of the top 12 data centre operators, and finds that the last decade saw this industry’s net fixed assets increase 25 pc p.a. – from USD 115 mn in 2010 to USD 1.1 bn in 2019.

Upcoming supply is expected to be concentrated amongst Mumbai and Chennai, followed by NCR and Hyderabad also getting a fair share of interest. Mumbai and Chennai together will witness ~60% of total future capacity, with NCR and Hyderabad contributing another 33%.

Other Key Report Highlights

- Data centres are now the hottest alternative real estate asset – With the focus shifting to large hyperscale developments, the underlying property is becoming more valuable. Approx. USD 9.5 bn of capital is in various stages of being announced, committed or waiting to be committed into Indian data centres.

- Two exciting capital trends emerging – Data centres as alternative real estate assets providing yield income to large infrastructure investors, and the creation of large platforms between operators on one hand and investors/developers on the other.

- State governments providing fiscal and other benefits for setting up data parks – Benefits by Maharashtra, Gujarat, Telangana, Uttar Pradesh and Haryana state govts. range from subsidies on land, power, or other infrastructure and tax or duty waivers to granting of infrastructure / industry status and classification as essential service, and more.

Need for proximity to customers – Tier 1 cities will see a fair share of data centre developments, especially in light of expected 5G rollout. Data consumption in Tier 2 cities will generate demand for smaller colocation facilities, given the growing data consumption of other urban cities.

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder