News

EV manufacturing to drive demand for 13 mn. sq. ft. of real estate by 2030

National – June 01, 2023 – CBRE South Asia Pvt. Ltd., on Thursday announced the findings of its report, ‘Electric Vehicles in India – New Wheels on the Roads’. The report focuses on the trends, growth, and influence of electric vehicles (EVs) on the real estate sector in India.

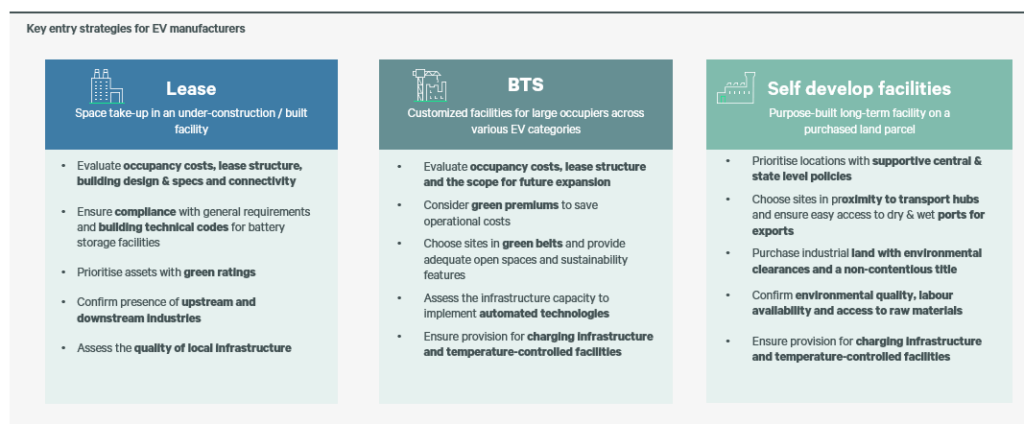

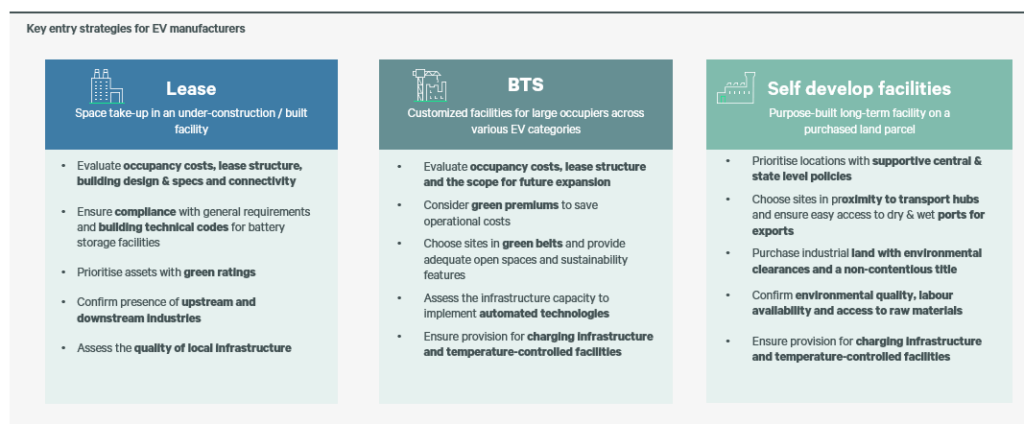

According to the report, real estate requirements of manufacturing facilities of 4-Wheeler & 2-Wheeler (4W & 2W) Electric Vehicles (EV) is estimated to be around ~ 13 million sq. ft. by 2030 as a result of the government’s EV adoption targets. In addition, EV battery manufacturing facilities would also increase exponentially and require 2,400 acres of land to accommodate the production of 200 GWh of batteries by 2030. As per the report’s estimates, by 2030, this real estate requirement will allow a production capacity of approximately 4 million units of 4Ws and 23 million units of 2Ws. Built-to-suit (BTS) and leased facilities are largely preferred by EV manufacturers at present in India due to ease of capital deployment, flexibility in lease terms, speed to market and location advantages. However, an owned facility provides more scope for customization, save monthly rental outgoings and has better prospects for land price appreciation.

Several policy enablers by state and union governments have enabled the creation of an indigenous EV manufacturing ecosystem by incentivizing fresh investments from global/domestic players. During the 2020-2023 period (YTD), Maharashtra and Tamil Nadu led EV investments with a 15% share each of the cumulative USD 28.8 bn investment. Meanwhile, Karnataka accounted for an 11% share, Gujarat 8%, and Uttar Pradesh and Telangana recorded a 7% share each.

Key investment announcements in the EV sector during Q1 2023 are mentioned below:

- Maharashtra – Gogoro Belrise Industries announced an investment of about USD 2.5 bn for charging infrastructure manufacturing facility

- Tamil Nadu – Ola Electric announced an investment of about USD 0.9 bn for a battery manufacturing facility

- Uttar Pradesh – Tauschen E-mobility announced an investment of about USD 0.2 bn for an EV manufacturing facility

For the current year, the EV sector has recorded investment announcements of about USD 6.2 bn to date. The year 2022 witnessed strong traction, with global and domestic players announcing investments of over USD 17.1 bn in the EV industry, a y-o-y increase of about 287% compared to USD 4.4 bn in 2021. In the same period, more than half of the investments were driven by EV component manufacturers.

EV investment trends (2020 – H1 2023)

EV manufacturers and multiple e-mobility start-ups are concentrating their presence in the primary automotive clusters in India. Uttar Pradesh took the lead in registered EV annual sales in 2022 with a 16% share, closely followed by Maharashtra with a 13% share and Karnataka with a 9% share. These three states together dominated India’s EV sales in 2022, accounting for approximately 40% of the overall sales volume.

The Indian EV market is expected to grow at a Compounded Annual Growth Rate (CAGR) of about 49% between 2021 – 2030 and cross annual sales of 17 million units by 2030.

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, said, “As we look ahead, the intersection of real estate and the EV sector presents exciting opportunities and challenges. The rapid growth in EV manufacturing is set to revolutionize the automotive industry, and it will undoubtedly have a profound impact on the real estate market.

By 2030, we anticipate a surge in demand for real estate, with a requirement of ~13 mn. sq. ft. dedicated to EV manufacturing facilities alone. The cumulative investment value in EVs over the last three years demonstrates the immense financial commitment and confidence placed in this sector. This investment not only signifies the financial potential of EVs but also underscores the transformative power they hold in shaping the future of mobility.”

Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, said, “The future of the EV industry is bright, and real estate will play a pivotal role in shaping its trajectory. As demand for EV manufacturing facilities, charging infrastructure, and associated services expands, the real estate sector will need to adapt and provide the necessary infrastructure and spaces to accommodate this growth.

At CBRE, we are committed to supporting the evolution of the EV sector and working closely with industry stakeholders to identify and address the real estate needs of this rapidly developing market. By leveraging our expertise and resources, we aim to facilitate the seamless integration of the EV ecosystem into the broader real estate landscape, fostering sustainable growth and innovation.”

Real Estate Strategies (Investors, Manufacturers, Developers/Landlords)

Industrial Parks & Stand-alone Manufacturing Facilities:Focus on speed-to-market to meet the rising demandFocus on multi-sourcing and near-shoring / friend-shoring strategies to improve supply chain efficiencies.Partner with 3PL players to improve supply chain networksSet up facilities near consumption hubs/transportation nodesTarget suitable facilities or partner with landlords to enhance assetsLeverage government incentives to strengthen EV manufacturing capabilitiesInstall new-age technologies to improve operational efficiencies

WarehousesSet up EV warehouses closer to auto clusters / manufacturing hubsSet up high-specification Grade A warehouses to store Lithium-ion batteries which would require controlled environmentsUpgrade modern warehouses to enhance storage efficienciesEnhance last-mile efficiencies by establishing distribution centres near the consumption hubs; partner with 3PL playersUse technologies such as warehouse managing system, thermal monitoring system for batteries, Automated Guided Vehicles (AGVs) to improve operational efficiencies in warehouses

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder