Bytes

Borrowers may still see lowered EMI’s

“This is a surprise move by the RBI as we were expecting a 25-50 basis point reduction of the repo rate. The market has been gaining stability and post-Union Budget, further ease was on the cards. Even though the RBI has not provided any rate cut this time, fresh home loan borrowers should not worry much as they may still witness lowered EMIs because amid intensifying competition among lenders, banks might be forced to start cutting down the interest rates themselves.”

Rajesh Goyal V-P, Credai Western UP & MD, RG Group

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

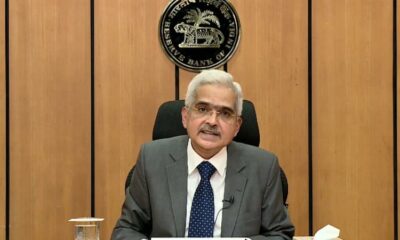

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News4 days ago

News4 days agoOlive Announces Dhruv Kalro as Co-Founder