Report

Flex space stock to cross 80 m sqft by ‘25

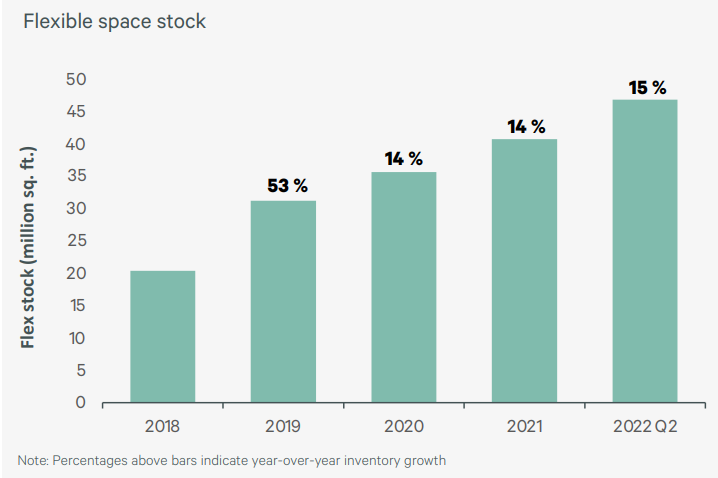

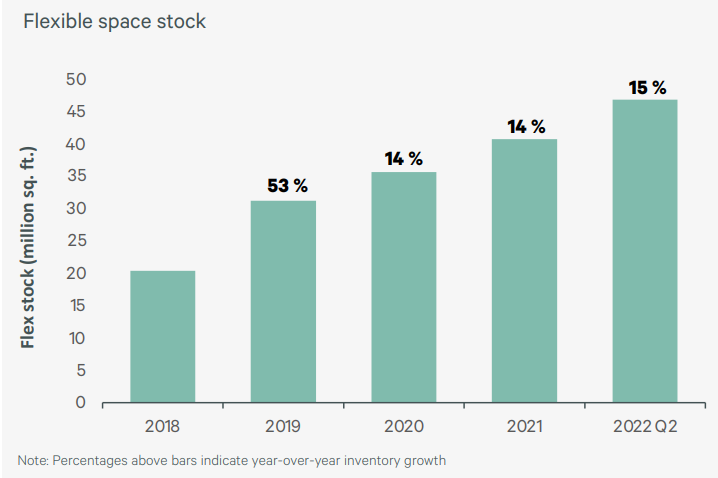

September 23, 2022: CBRE South Asia Pvt. Ltd, on Friday announced the findings of its latest adaptive spaces report titled, ‘The Era of Flexibility in India’. According to the latest report, the flex space stock in India is expected to cross 80 million sq. ft. by the end of 2025 from the current stock of ~47 million sq. ft.

The report highlights that CapEx savings, managing headcount volatility, implementing hybrid working, and avoiding upfront fit-out costs would drive flexible space take-up in the coming years. Bangalore, with 14.6 million sq. ft., dominated India’s current flexible space stock as of H1 2022, followed by Delhi NCR with 9.1 million sq. ft., Hyderabad with 7.1 million sq. ft., Pune at 5.6 million sq. ft., and Mumbai 5.3 million sq. ft. Other cities with flexible space stock include Ahmedabad, Kolkata, Chennai, and Kochi.

Occupiers are refining their portfolios and workplace strategies to accommodate hybrid working arrangements. Existing real estate portfolios have to support new workstyles, viz., an office-centric future, a virtual first future, or a balanced approach. The report highlights that companies that continue to adopt flexible spaces would be better positioned to embrace hybrid working arrangements, support their employees, and remain agile in their real estate strategies. Providing interim solutions for a dispersed workforce, expanding local options for staff, and offering on-demand meetings and collaboration space for employees are some of the key drivers for flexible office space.

According to the report, the occupiers are exploring ‘Core + Flex’, a popular strategy offering occupiers a way to seamlessly integrate traditional leased and flexible office space in their portfolios. ‘Core + Flex’ allows occupiers to be more financially efficient while providing employees with a consistent experience and company culture. This is an attractive strategy for occupiers to manage lease expirations and minimize underutilization of space.

Operators are designing the next generation of flexible office spaces that will include the right mix of private and open space to meet occupier needs. Medium and large-sized team requirements include value data security, company branding, and a highly agile space that can be reconfigured easily. Report findings highlight the continued growth of on-demand and subscription-based membership structures since it provides employees with highly configurable models that allow providers to cater to real-time demand and manage it using technology-driven apps and dashboards.

While these operators are already providing a range of solutions to occupiers seeking greater flexibility, the spectrum is widening even further. A major value-add for an occupier would be in the customization options that the operators provide.

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, said, “The need for agility is more imperative than ever before, as workforce behaviors have transformed during the pandemic and are unlikely to return to pre-pandemic norms. As occupiers plan real estate strategies amid the uncertain scenario, flexible spaces are becoming a useful solution. Most companies are likely to lean towards the diverse locations and cost-effective nature of flexible solutions.”

Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, said, “Flexible spaces continue to hold sway among corporates, with occupiers of all sizes increasing the percentage of flexible spaces in their real estate portfolio. Most companies now use flexible spaces to enter a new market, offer on-demand meeting and collaboration spaces for employees, and test alternate workplace designs. The trend indicates that while flexible space offerings continue to evolve, delivering them in a way that makes it easier for the occupier is more important than ever”.

-

Interviews4 weeks ago

Interviews4 weeks agoHigh Rental Yield, Price Appreciation, Stable Growth, Make Sydney an Ideal Realty Investment Option: Haansal Estate

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News1 week ago

News1 week agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News2 weeks ago

News2 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts