Report

Flex spaces will account for 20% market share of the total office leasing by end of 2022: research report by Savills India

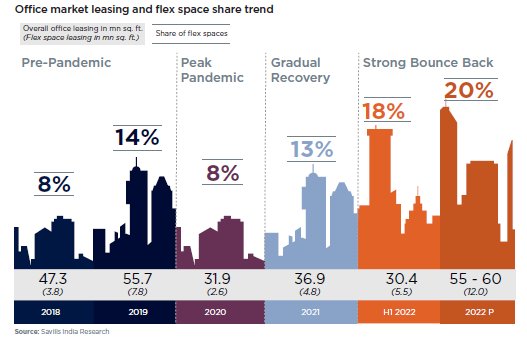

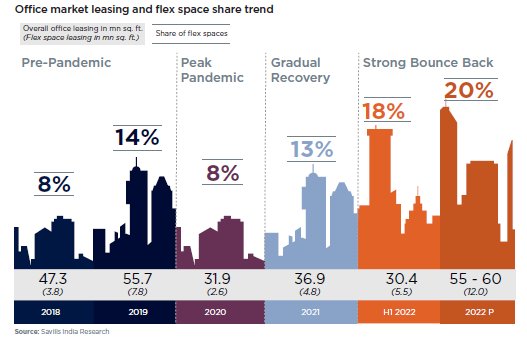

October 6, 2022: Flex spaces across India’s six major cities are set to witness a new peak in terms of gross absorption. International real estate advisory firm Savills India’s latest report expects the flex spaces sector to account for 20% market share of the overall office space demand reaching 12.0 mn sq ft by the end of 2022, surpassing the 14% share in 2019.

Flex spaces have continued to drive the strong resurgence of commercial real estate in 2022. The sector accounted for an 18% market share of the total office leasing activity witnessed in the first half of 2022. Coworking operators with out-of-box services and enterprise-level offerings have taken advantage of the dynamic commercial real estate requirements and regained the confidence of occupiers.

Cities: Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai, Pune

With employees returning to physical offices, agility and flexibility has become the core of the real estate decision-making process. Consequently, strong traction is evident in coworking desks taken up by occupiers in H1 2022. Coworking operators have leased over 75,000 seats in H1 2022, compared to 60,000 seats in 2021. Almost 75% of the demand for coworking desks in H1 2022 can be attributed to the three largest flex markets – 45% in Bengaluru, 20% in Pune, and 10% in Hyderabad. Total flex seat demand is anticipated to reach a new high with 150,000 seats, an increase of 1.5X YOY in 2022, as per Savills India’s Research.

Naveen Nandwani, MD- Commercial Advisory & Transactions, Savills India and head- Workthere India said, “As businesses evolve, shared spaces will continue to provide organizations a chance to design a highly fluid commercial real estate portfolio as per their business strategies. Real estate cost optimization and explosive growth in hybrid work are likely to be the driving factors for coworking sector growth in Tier II and III cities of the country.”

The report also highlights that the weighted average per seat rental witnessed a positive correlation with the demand for managed spaces in the country. With healthy coworking sector traction envisaged for the rest of the year, average monthly rentals in India are expected to touch INR 12,500/ seat by the end of 2022, a 13% YOY growth.

H1 2022 saw start-ups take up 13% share in flex seats while new age businesses such as FinTech, HealthTech, EdTech, RetailTech, etc. had a market share of 20% with a cumulative uptake of around 15,500 seats. Contrary to earlier times, where flex spaces were held appropriate for most start-ups and mid-range companies, almost 52% of flex space leasing has come from MNCs. In the age of hybrid and work from anywhere culture, MNCs are embracing coworking spaces to encourage employees to work in locations closer to their homes, while keeping a check on dynamic real estate requirements.

Interestingly, the average transaction size of coworking spaces is almost 53% higher than the average of other sectors from 2020 to H1 2022. The sector has already witnessed 35 transactions of 50,000 sq. ft. or more in H1 2022, exceeding the full-year big-ticket activity of 2021. The dominance of big-ticket transactions is also reflected in the number of desks taken up by large occupiers in coworking centers across the country.

Savills India also conducted a survey-based analysis to understand the mind-set of senior level executives in the BFSI sector. The analysis provides interesting clues about the changing perception of BFSI occupiers towards shared office spaces and its practical usage. 76% of the respondents in the survey have already taken up or are open towards leasing coworking spaces in the near term. The survey provides a demonstration that while dynamic requirements and cost advantage are the top drivers for BFSI companies adopting flexible spaces, the BFSI sector in today’s world, is fairly comfortable with existing technology and safety aspect of flexible spaces.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News3 weeks ago

News3 weeks agoSacred Cities See a Retail Boom as Spiritual Tourism Surge: CBRE Report