News

Home Buyers’ Expectations From Union Budget 2014

HOME BUYERS’ EXPECTATIONS FROM UNION BUDGET 2014: ROTI, KAPDA & MAKAAN, A BUDGET RESEARCH BY MAKAAN.COM

Union Budget, a yearly affair of Government of India, displays the outlines of yearly economic planning, which is among the most significant economic and financial event. It provides an estimate of expenditures and revenues. As the budget establishes the cost constraint for a program, project, or operation, the upcoming Union Budget 2014 is awaited by all sectors of the economy, including real estate. In India, buying a property is considered to be a milestone in terms of financial investments and home buyers keep a look out for the steps taken during the Budget to decide their next course of action

With the intention to gauge the expectations of home buyers from Union Budget 2014-15, MAKAAN.COM [1], India’s fastest growing property site, conducted a research christened Roti, Kapda & Makaan 2014. The research was carried in the month of January & February 2014 among 1836 home buyers in the cities of Mumbai, Delhi NCR, Bangalore, Chennai, Hyderabad, Pune, Kolkata, Ahmedabad, Chandigarh, Indore and more

THE KEY FINDINGS OF THE RESEARCH ARE:

INDIAN HOME BUYERS WANT AN EIGHTH FUNDAMENTAL RIGHT: RIGHT TO OWN A HOUSE

Fundamental rights are regarded as a set of legal protections that belong without presumption or cost of privilege to all human beings under a jurisdiction. As part of the research, Makaan.com asked the home buyers whether owning a house should be a fundamental right of Indian citizens. The results screamed in affirmation as a whopping 90% of homebuyers said that owning a house should be a fundamental right of the Indian citizens.

As per the home buyers if such an amendment is passed in the Union Budget 2014, it will fulfill one of the basic needs of human being, i.e. MAKAAN [1]and will also provide the much needed boost to the real estate sector and the economy on the whole. Only 5% home buyers each said that right to own a house should not be a made a fundamental right and that they cannot comment on the topic

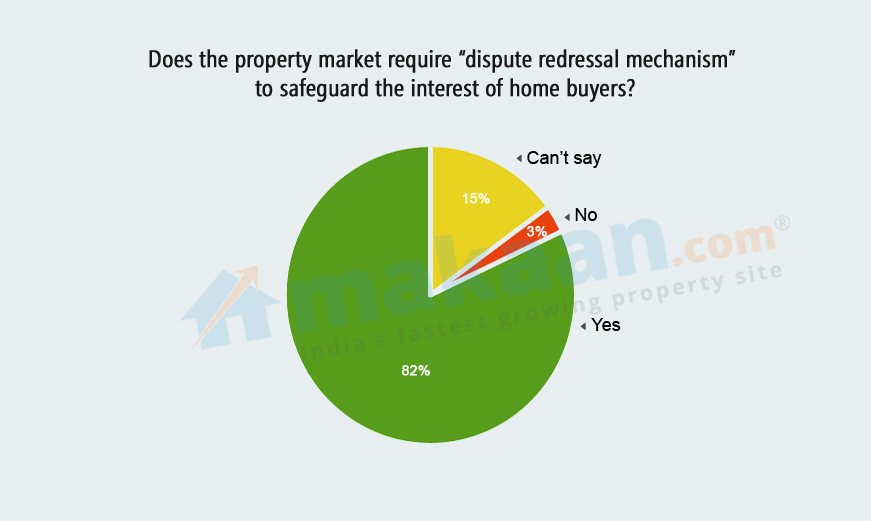

PRESSING REQUIREMENT FOR DISPUTE REDRESSAL MECHANISM; 82% OF HOMEBUYERS BELIEVE THAT IT WILL SAFEGUARD THEIR INTERESTS

Since the APPROVAL OF REAL ESTATE REGULATORY BILL [2], the home buyers have taken a sigh of relief as they feel that further on they will not be cheated through misleading advertisements and selling on the basis of super area. However, home buyers feel that still there are a lot of grey areas that are left unaddressed and rules cannot be made for every situation. On being probed on the current state of dispute redressal system, home buyers expressed their dissatisfaction and 82% are of the opinion that the property market urgently requires a “dispute redressal mechanism” to safeguard their interest. They are hopeful that Finance Minister will take steps in setting this mechanism as part of 2014 Budget

As there have been a growing number of cases of project delays and allotment cancellations, home buyers are discouraged and are finding it difficult to cope with such situations; therefore, the desire for the redressal mechanism is becoming stronger.

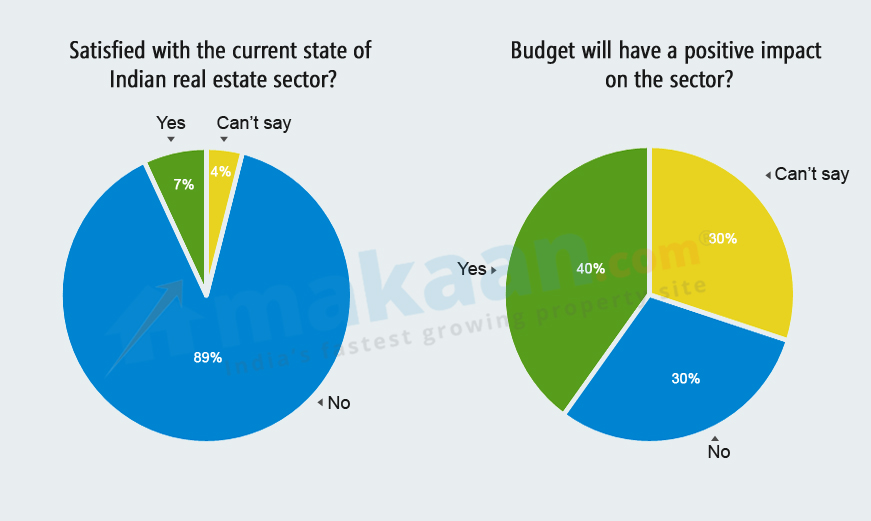

ALTHOUGH DISSATISFIED WITH THE CURRENT STATE OF REAL ESTATE SECTOR, HOME BUYERS ARE HOPEFUL OF A POSITIVE IMPACT FROM UNION BUDGET 2014

The year 2013 gave the real estate industry a few reasons to smile, for example, introduction of REAL ESTATE REGULATORY BILL [4] and LAND ACQUISITION BILL [5] in the parliament. However, on a majority scale, the home buyers remained discouraged and adopted a wait and watch policy due to high property prices and home loan interest rates. This dissatisfaction of the home buyers comes out quite evidently in the next research question asked by Makaan.com regarding the state of real estate sector. Almost 90% of home buyers said that they are dissatisfied with the current state of real estate sector in India.

Although dissatisfied with the present property market, the home buyers have not let go all hope and are anxiously looking forward to decide their next course of action. When asked whether Union Budget 2014 will have a positive impact on REAL ESTATE [1] sector, the majority answered in affirmation. Now, it needs to be seen whether the Finance Minister will consider the aspirations of the home buyers and give them enough reasons to smile and think that the Budget has had a positive impact

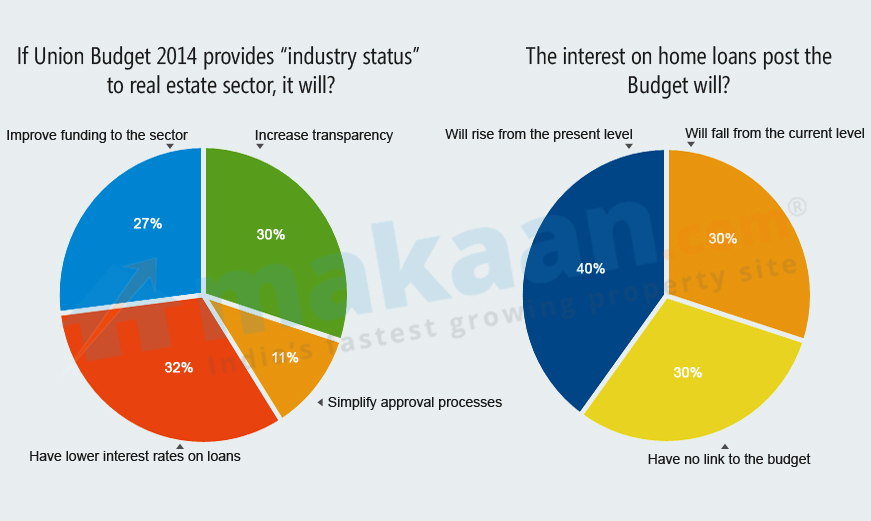

INTEREST ON HOME LOANS WILL RISE POST UNION BUDGET 2014; HOWEVER, PROVISION OF “INDUSTRY STATUS” WILL BRING THEM DOWN

Being the owner of a home is one of the most common desires of India citizens and available option of home loans is the greatest help one could get in fulfilling his/her dream of owning a home. There is a very less percentage of home owners who do not have a home loan in their name. The amount of EMI paid by a home owner/buyer is of great concern; therefore, they constantly track the interest rate on home loans.

Makaan.com asked them what will happen to interest on home loan post the Budget. 40% of home buyers feel that the home loan interest rate will rise from the present level. This is one expectation that is really close to realization due to the recent KEY RATE INCREASE BY RBI

What if the Budget provides “industry status” to the real estate sector? A long talked topic among the developers, builders and firms of the PROPERTY [1]market. Industry status will help in bringing in a practical system of working and growth. Indian real estate firms look forward to the government to accord industry status to the real estate sector as only then will the developers and builders be able to fully enjoy the benefits of organized financing, insurance and fiscal incentives. 32% of home buyers feel that “industry status” will lower the interest rates. The interesting trend here is that although the home buyers feel that post the Budget the home loan interest rate will increase, the provision of “industry status” will bring them down.

Another 30% feel that “industry status” will increase transparency within the sector. Accordance of “industry status” to real estate in India is an issue that needs to be addressed soon. Recognition would ease financing prospects, as well as standardize and unify taxes for the industry

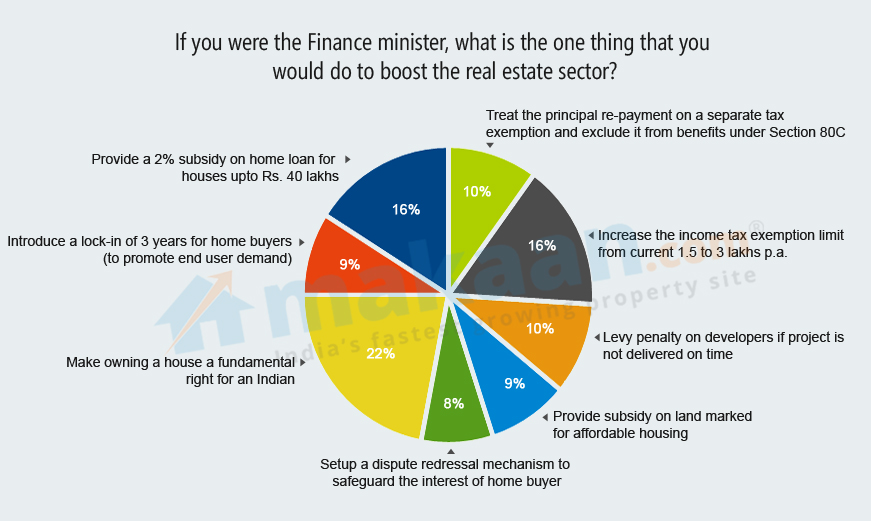

IF I WERE THE FINANCE MINISTER, I’D BOOST THE REAL ESTATE SECTOR BY GIVING OUT TO THE MASSES

As part of the research, Makaan.com asked the home buyers to do a role reversal with the FM and suggest measures that can help create a positive impact on the Indian realty sector. Let’s look at the proprieties from the eye of the home buyers; if they were in power:

* Majority of national home buyers (22%) feel that if they were in place of the Finance Minister, they would make owning a house a fundamental right of the Indian citizen. As per them, this step will give the much needed boost to the real estate sector.

* 16% of the home buyers feel that they would provide 2% subsidy on home loan for houses upto Rs. 40 lakhs as a short term incentive.

* The Income Tax Act offers encouragement to buyers to invest in a residential PROPERTY [1]. The current income tax exemption limit for the interest payment towards the home loan is 1.5 lakh per annum. This exemption was introduced over a decade back and has not been revised.

With the increase in property prices over the past 10-12 years, this limit is no longer adequate and home buyers want this to be increased.

16% buyers want the limit to be doubled and hiked to 3 lakhs.

* Home buyers also do not want to spare the defaulters and 10% say that if they are the FM, they will levy penalty on developers if a project is not delivered on time.

It needs to be seen if Finance Minister will consider these suggestions from the Indian home buyers. We will have to wait for the end of the month for this answer.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News3 weeks ago

News3 weeks agoSacred Cities See a Retail Boom as Spiritual Tourism Surge: CBRE Report