News

Housing market in top 7 cities may attain a new peak by the year 2023

The unprecedented rise in homeownership sentiment, faster adoption of technology and digital marketing, and innovative business practices have served to soften the overall impact of COVID-19 on the Indian residential sector. In fact, the housing market in the top 7 cities is likely to attain a new peak by 2023, when housing sales are estimated to cross 3.17 lakh units and new launches by 2.62 lakh units during the year.

City-wise, MMR and Bengaluru are all set to lead from the front with maximum housing sales and new launches in 2023. Of the total estimated housing sales and new launches in 2023:

- MMR is likely to comprise a 28% share of total sales and nearly 30% of new launches

- Bengaluru is estimated to have a 20% share of homes sold and a 17% share of units launched

- NCR may comprise an 18% share of sales and 15% of new launches

- Pune will retain its strength among the most active markets and may corner a 15% sales share and 18% new launches share

- Kolkata, Chennai and Hyderabad may each account for approx. 6% of sales and 8% of new launches

(Calculations based on y-o-y and q-o-q absorption and launch data trends in the respective cities & ongoing trends)

2021 is expected to fare better than 2020, but it is unlikely to reach the levels of 2019 – the most recent peak year.

Encouragingly, the ongoing trend of sales exceeding supply is likely to continue and 2021 is expected to witness an increase of 35% in housing launches and a 30% increase in sales over the previous year. However, against the peak year of 2019, supply and sales may be lower by 28% and 31% respectively.

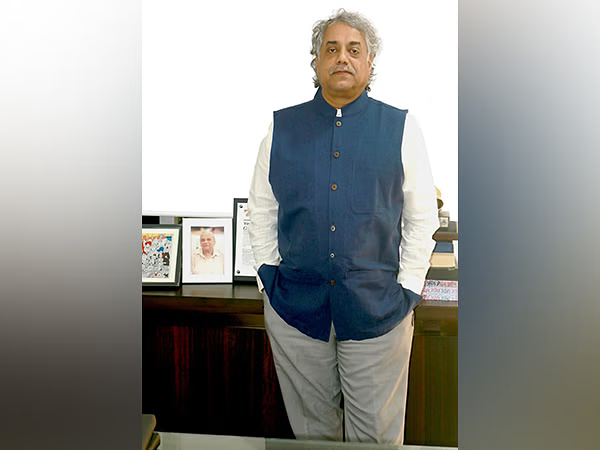

“The trend of demand remaining buoyant can be attributed to several factors,” says Anuj Puri. “These include but are not limited to sustained low interest rates, an overall improvement on the job market, resumed economic activity and sustained stock market growth, various government interventions to combat the pandemic’s deleterious effects, and an increasing desire to own physical assets during times of unprecedented uncertainty.”

With the vaccination drive gaining significant momentum and the spread of COVID-19 under better control for now, 2023 will very likely emerge as the new peak year that breaches 2019 levels with supply that year growing by 11% and sales by 22% over 2019.”

A new peak in 2023 notwithstanding, we are unlikely to see the levels of supply and sales witnessed in 2014 anytime soon.

Source: ANAROCK Research

Key Changes: 2014-2016 Vs 2017-2019

Amid rapid transformation in the sector, two key changes are visible:

- Supply rationalization: Developers decided to throttle back supply to keep demand buoyant

| Time period | 2014-2016 | 2017-2019 |

| Supply (Units) | 1,185,000 | 5,78,700 |

| % change | NA | -51% |

Source: ANAROCK Research

(Data for the top 7 cities only)

- Sales exceed supply: With end-users the primary sales drivers amid controlled supply, sales began exceeding the supply. This trend is likely to continue in the future as well.

| Period | 2014-2016 | 2017-2019 |

| Supply (Units) | 1,185,000 | 578,700 |

| Sales (Units) | 890,500 | 720,800 |

| Sales/Supply Ratio | 0.75 | 1.25 |

Source: ANAROCK Research

(Data for the top 7 cities only)

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder