Main

Housing projects in India worth Rs 3.3 lakhs crores ($47 Billion) pending execution: PropEquity

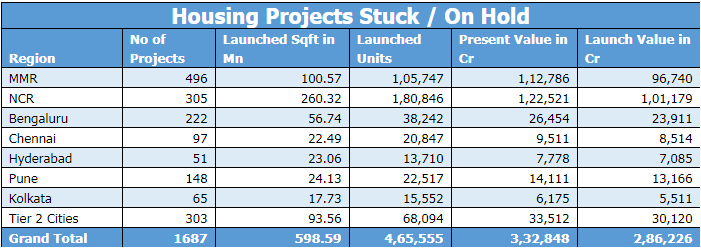

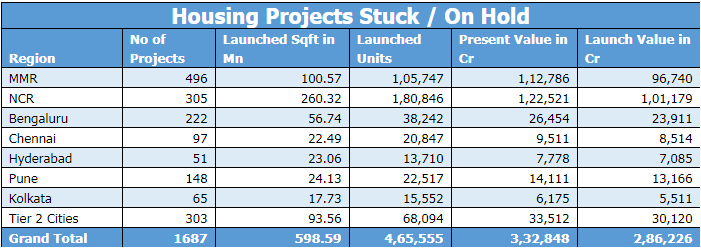

New Delhi, August 06: Real estate in India may be witnessing green shoots of recovery in select micro markets however over 4.65 lakh units of housing projects across India are significantly behind their delivery deadlines with daunting construction delays.

These projects are on hold for a variety of reasons including financial constraints, execution challenges, surplus supply due to over ambitious launches by developers, environmental clearances and slowing sales among others.

Total value of projects facing construction delays is Rs 3.3 lakh crore or over US $47 billion. Interestingly, in the National Capital Region (NCR) over 70% of the projects pending execution are fully sold out but not delivered post the completion deadline. Hence the developers here are under the maximum distress as they face the buyer pressure to complete the sold units.

Nearly 1.80 lakh units valued at Rs 1.22 lakh crore are facing an uncertain future in the NCR region (Gurgaon, Noida, Greater Noida, Ghaziabad, Faridabad).

In the Mumbai Metropolitan Region (MMR), 1.05 lakh units worth Rs 1.12 lakh crore are pending completion. Since over 40% of these projects are absorbed, there are fewer customers when compared to NCR, who are facing a scenario of non-delivery by developers. (MMR includes, Mumbai, Navi Mumbai and Thane).

“Although the markets are facing significant execution delays we do expect the reputed developers to perform well. We also anticipate that the resolution to this difficult scenario will occur in the form of consolidation that will be led by the larger and more capable developers who have the construction and execution capability to meet their promises.,” said Mr. Samir Jasuja, Founder and MD of PropEquity.

PropEquity Research

Kolkata and Hyderabad have been relatively insulated as compared to other regions as only 15,552 and 13,710 units respectively are pending execution with a valuation of Rs 6,175crore and Rs 7,778crore respectively. Both these cities were able to sell less than half of these projects.

As Bangalore is an end-user driven market, only 40% of the projects pending execution were sold as these projects found few takers only. Total value of these projects stood at Rs 26,454 crore for 38,242 units.

Pune, which has 22,517 units on hold, witnessed only 35% absorption of these units. Comparatively, Chennai with 20,847 units facing execution challenges saw 47% of these projects being sold with a total value of Rs 9,511crore.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder