Main

Huge Hopes On HSUI

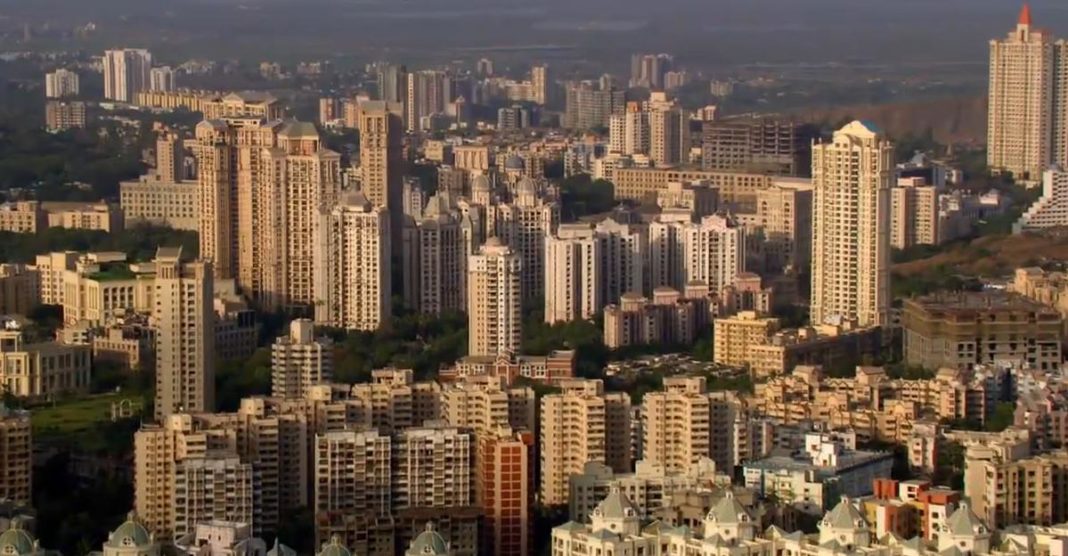

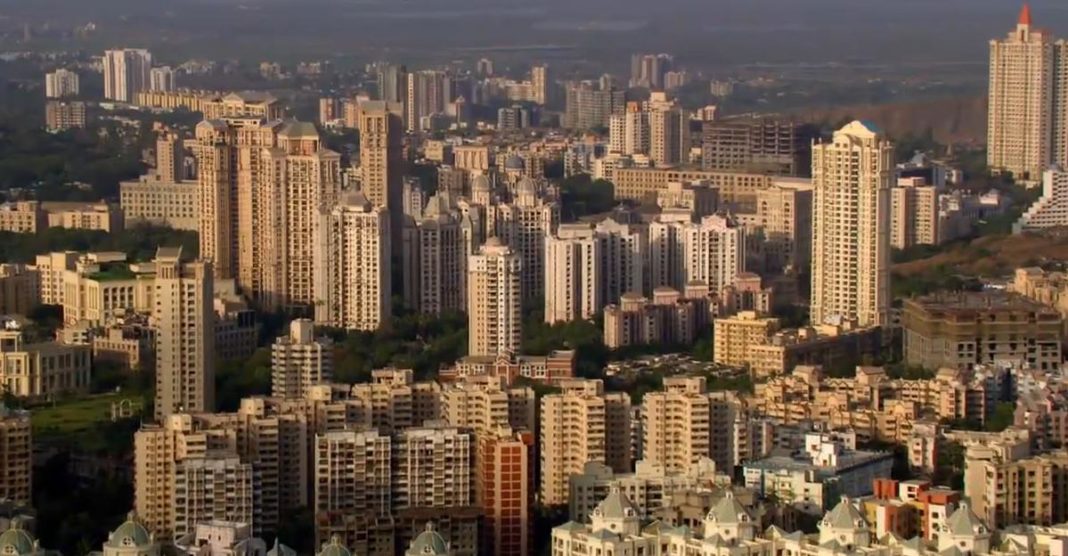

For just too long the country’s real estate sector has been a vilified one. To give it an image makeover and promote investment has been a long-stated policy of the government though only recently those intentions are translating into action. One of these endeavors is the launching of the housing Start-Up Index, which promises much transparency in the sector than ever before

Set to indicate the pattern of housing development in the country, the recently launched pilot Housing Start-Up Index (HSUI) under the auspices of the Ministry of Housing and Urban Poverty Alleviation (HUPA), is likely to shape up as a key indicator for the real estate sector as well as for all its allied industries.

Housing starts of any new dwelling units for which construction has begun in a given period, have been considered a leading indicator of economic activity, given its forward and backward linkages with other sectors of economy.

“Since housing-starts reflect a long-term commitment of investment for the real estate sector and individual households, it is likely to give a robust signal to all real estate linked industries,” says Prof Amitabh Kundu, professor of economics at the Centre for the Study of Regional Development at Jawaharlal Nehru University, New Delhi.

• What is HSUI?

HSUI is a tool that measures the increase in the number of houses beginning construction and would be indicative of an increase in investment, business and consumer optimism and vice versa

• What would be the impact of HSUI on the realty sector?

The infrastructure and real estate sector would be the direct beneficiaries as well as the about 254 ancillary industries. The benefits hopefully will trickle down to the consumers

HSUI is a tool that measures the increase in the number of houses beginning construction and would be indicative of an increase in investment, business and consumer optimism and vice versa. Progress in the housing sector starts reflecting the demand for houses and hence, a positive signal for the construction industry, particularly as the industry has backward and forward linkages with a large

number of industries.

Last month, HUPA launched a pilot index that will seek to validate the methodology developed for the purpose empirically. HUPA plans to cover in 300 urban and semi urban cities in near future.

“This pilot index covers 27 cities and efforts will be made for its expansion to cover 300 cities in the near future,” Dr Girija Vyas, minister, HUPA, said while releasing the results of HSUI.

Elaborating the macroeconomic linkages of the housing sector due to the spillover effects on nearly 254 ancillary industries, Vyas said that the HSUI promises to be a key macroeconomic indicator given that the housing industry contributes to about 10 per cent of the country’s GDP.

Sachin Sandhir, MD, RICS South Asia

According to HUPA, internationally only six developed countries namely Canada, United States, Japan, France, Australia and New Zealand are compiling data related to housing starts on a regular basis.

“The index will measure the level of construction activity in a given period for a region and is considered one ofthe leading indicators of economic activity. The index will help gauge the activity in the construction sector that employs a significant amount of the country’s work force,” says Sachin Sandhir, managing director, RICS South Asia.

Not only on the real estate industry, HSUI is expected to have huge impact in the entire infrastructure sector, say experts.

• Progress in the housing sector starts reflecting in the demand for houses, and hence a positive signal for the construction industry.

• Experts believe that as housing industry has backward and forward linkages with a large number of industries, the HSUI would be much more important than the start-up index for any other individual industry.

It will depict forward trends in the economy. An economy that is growing rapidly has an increased demand for housing and HSUI could be used to forecast demand for new houses. The index would also act as an indicator of economic growth as more houses would lead to increased demand for input materials like steel, cement and credit

Gaurav Kumar Mehra, CEO & MD, Felicity Concepts

“Infrastructure and real estate sector would be the direct beneficiaries. The benefits hopefully will trickle down to the consumers as well. However, release of the index with adequate sample size and high reliability would require a much stronger commitment from HUPA and RBI than what exist today. The real estate sector should build pressure on the statistical system in the country to take up this responsibility without any further delay. The sector should be prepared to share a part ofthe cost for this initiative without which this vision is unlikely to materialise,” adds Kundu.

With HSUI covering rural areas, activities measured in these regions can be used to bring out an information-based analysis on the housing requirements in villages and semi-urban areas too.

“This would help in reducing the demand-supply mismatch in the housing sector. As our cities are expanding, a number of semi-urban and rural areas are gradually getting transformed into city’s peripheral districts and secondary areas. For example, in case of Delhi-NCR, various towns have been absorbed within city limits in recent past,” adds Sandhir.

Brokers in the sector also believe thatthe housing index will give insights into consumer activity, as construction of new houses typically requires large investment.

“It will depict forward trends in the economy. An economy that is growing rapidly has an increased demand for housing and HSUI could be used to forecast demand for new houses. The index would also act as an indicator of economic growth as more houses would lead to increased demand for input materials like steel, cement and credit,” says Gaurav Kumar Mehra, chief executive officer and managing director, Felicity Concepts.

The interesting trend in the results of the pilot index showed a decline in housing starts in million plus cities such as Kolkata, Chennai and Bengaluru and a rise in smaller cities such as Ahmedabad, Bhopal, Hubli, Dehradun, Sangli etc.

• The interesting trend in the results of the pilot index showed a decline in housing starts in million plus cities such as Kolkatta, Chennai and Bengaluru and a rise in smaller cities such as Ahmedabad, Bhopal, Hubli, Dehradun, Sangli etc.

• This pilot index covers 27 cities and efforts will be made for it expansion to cover 300 cities in near future.

“Such trends are useful indicators of the pattern of development, in our country, which in turn helps policy makers and administrators to understand the future focus and thrust areas not only in terms of housing provision, but all the associated infrastructure and civic amenities required,” Dr Vyas adds.

Recognising the significant multiplier effect of the housing sector, RBI initiated the task for development of the HSUI for India in 2009 by constituting a Technical Advisory Group (TAG) on HSUI under the chairmanship of Prof Kundu. Other members were from Central Statistical Organisation (CSO), National Sample Survey Organisation (NSSO), National Housing Bank (NHB), National Buildings Organisation (NBO), Housing and Urban Development Corporation (HUDCO), State Bank of India (SBI) and Directorate of Economics and Statistics (DES) of four states.

The TAG was entrusted with the responsibility of providing the approach to generate a data base and suggest a feasible methodological framework for development of HSUI for the Indian economy and institutional arrangement for regular compilation of HSUI.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder