Main

“India needs a strong Bankruptcy Code to prevent and pre-empt defaults”

New Delhi, February 8, 2019: Bankruptcy is a common phenomenon in vibrant economies and it actually helps the economy grow strong, stated Professor Edwards I Altman, Professor, Finance, Emeritus, TRIUM and New York University’s Stern School of Business.

Speaking at an event organized by ASSOCHAM in Mumbai on Global Credit Cycle: Where are we and what have we learnt after 50 years, Prof Altman informed that most governments try to suppress the procedure of companies going bankrupt fearing job loss of the people working there.

“However it is necessary for companies to go bankrupt so that their loans are restructured ; it’s nothing to be ashamed of. It’s only shameful if you don’t learn from the mistakes,” he said.

Giving the example of the American multinational company, General Motors, which filed for bankruptcy in the year 2008, Prof Altman explained that it was because of the same move, the company was able to restructure its loans and is a BBB company today.

“When you file for bankruptcy, you eliminate a lot of process which your company still has to do if it gets a bailout package, like paying interest on your debts and dealing with the union. Bankruptcy helps restructure the loans faster,” He added.

He explained that a Z score kind of a model which he had developed 50 years ago would help predict and preempt bankruptcies in Indian companies. “We did a lot of research based on the data available on 10 of the large companies which filed for bankruptcy recently. The figures can easily predict when a company would file for bankruptcy,” he said.

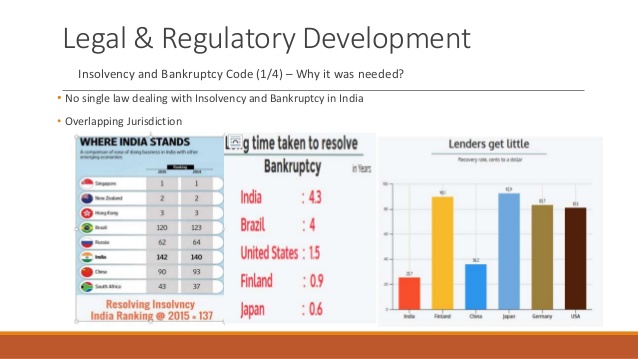

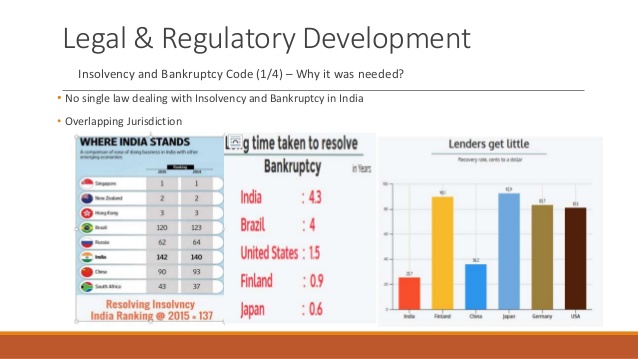

He also pointed out that while the rate of recovery is around 45 cents to a dollar for US based companies, the same is just 30 cents to a dollar in India. “This means that there is a lower recovery rate for non- performing assets in India,” Prof Altman pointed out.

B K Goenka, President, ASSOCHAM asserted that India needs to grow at 8-10% per annum, However, increasing trend of bankruptcy cases is not a healthy sign and the situation is alarming. “Despite Government of India stepping-in, the normalcy has not got restored in the credit market. Thus if one could predict possible bankruptcy of such large institutions, the over leverage could have been avoided and necessary actions could have been taken by the government much before the collapse of the financial market,” he pointed out.

“Professor Edward Altman’s lifetime of work on developing the Altman Z-score, a model which can predict the probability of a firm going bankrupt almost two years in advance has truly been a game-changer for the western economies. With India being the world’s fastest growing major economy at present, it is becoming crucial to develop a prevention mechanism, capturing the realities of Indian business environment on the lines of Altman Z-score. This will help in mitigating risks by spotting trends of financial stress building up in companies well in advance, especially in the banking and finance sector.” – Mr. Sunil Kanoria, Vice Chairman, Srei Infrastructure Finance Limited.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder