News

Indian real estate: 2015 in review and gazing into 2016: JLL

The following is the report by Anuj Puri, Chairman and Country Head at JLL India

Today, the world sees India as a land of opportunity for business and investment. RBI head Raghuram Rajan said in mid-September that while fellow BRICs have deep problems, India appears to be an island of relative calm in an ocean of turmoil. This scenario continues; as per recent government data, economic growth reached 7.4 pc in the second quarter of the current financial year, riding on a spike in manufacturing and a pickup in investment demand.

Globally positioning India as an investment destination and improving India’s diplomatic and trade relation, Prime Minister Narendra Modi’s foreign jaunts have helped India attract more FDI. From the nations he visited during the financial year 2014-15, India received FDI of USD 19.78 billion. Moreover, foreign direct investment (FDI) in India increased by 27 pc in 2014-15 to USD 30.93 billion.

In other fronts as well, it is time to retrospect on how 2015 was for the real estate sector, and to crystal-gaze into 2016.

Commercial real estate

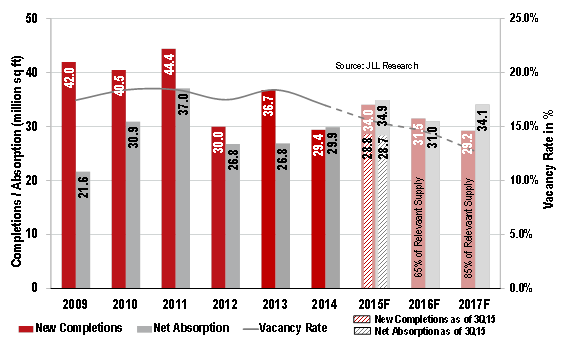

India’s office space absorption during 2015 stood at 35 million sq ft – the second-highest figure in the country’s history after 2011. The demand for office space in 2011 came from occupiers taking advantage of low rents after the global financial crisis. This time, however, it was the result of corporates implementing their growth plans.

While pan-India vacancy still stands at 16 pc, realistic vacancy actually stands around 8-9 pc – the total vacant supply is not always relevant for corporate occupiers. This is because most of them do not consider Grade-A buildings that are strata-sold or located in areas with inherent disadvantages and connectivity issues, or have been vacated from recent occupier exits and no longer match Grade-A requirements.

Cities such as Pune, Bangaluru, Hyderabad and Chennai have a vacancy rate of just 5-10 pc, prompting the need for fresh supply to meet growing demand. Developers have been shying away from commercial projects because, though land and construction costs have been rising, rents have not reached a point where developers can get about 20 pc IRR. However, as rents climb faster, developers will start constructing – at least in the good markets.

Rents rose across Indian cities in 2015. The pace was faster in the secondary business districts (SBDs) and certain peripheral business districts (PBDs) of tier-I cities than in the established central business districts (CBDs). The micro-markets seeing more leasing activity in different cities in 2015 will continue to see action in 2016, while lesser-preferred locations will see a higher vacancy rate. As and when supply dries up and vacancy drops further, occupiers will start taking up spaces in these locations, as well.

In 2015, office space demand was mainly driven by IT/ ITeS, e-commerce, start-ups and large consulting firms. Players in many other sectors like FMCG, BFSI (front office), manufacturing, telecom and pharma did not come into the market – however, this should happen in 2016 and 2017. Next year will also see demand for built-to-suit (BTS) properties, especially from the larger IT occupiers. While the absorption in 2015 is similar to 2011, it is distributed across new and old buildings; previously, it was largely in newly completed buildings.

Demand will remain consistent over most of 2016, with occupiers showing a positive bias. Given the low supply and continued demand for commercial spaces, corporate occupiers will continue to firm up their expansion plans. While 2016 will bring continued demand for leased spaces, quality supply will be lower. This means that unmet demand will reflect in higher occupancy of Grade-B office spaces.

After the opening up of real estate sector to FDI, the profile of developers, as well as ownership patterns, will start changing. This will lead to a drop of ownership requirements by Indian developers and a rise in ownership by PE funds and MNC developers.

Office Space: Supply & Demand

Real Estate Capital Markets

2015 has been an interesting year for capital market activities in real estate. While the PE focus continued to remain high on residential and office projects, entity-level investments and platform-level deals also came into the limelight, indicating increase in investor confidence.

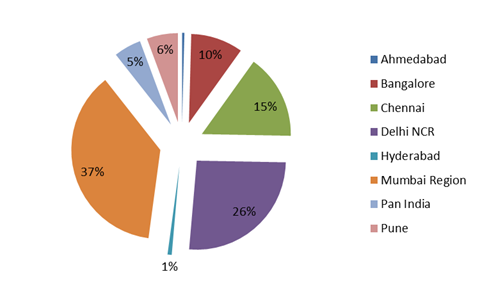

In terms of asset focus, residential projects attracted a considerable share of funding; however, equity investment in this space is still insignificant. Income-yielding office projects attracted a majority of equity investments. In terms of the geographical spread, focus was restricted to tier-I cities with NCR, Mumbai and Bangalore attracting a majority of investments (73%); reflecting learnings from past experience.

Breakup Of City-level Investments

While residential and office will continue to attract a majority of investments in 2016, retail is expected to start seeing better traction. Investors will remain focused on the top seven cities. Over the past few months, we have already seen interest from Chinese and Japanese investors to bring long-term money to India next year.

Overall, the stage is set for a superlative show next year. In fact, 2016 may well bring the kind of investment activities that were seen in 2007 – the previous peak year which saw investments of more than USD 8 billion into Indian real estate.

Residential Real Estate

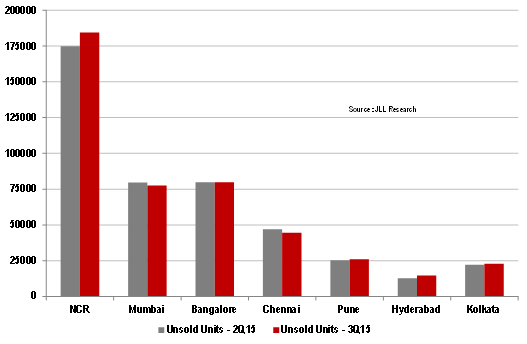

2015 did not bring the hoped-for growth in residential real estate. However, the silver lining is that the bad days seem to have bottomed out; sales have picked up in a few cities like Mumbai, Hyderabad and Bangalore. Launches have reduced in cities like Mumbai, slightly lowering the inventory. Developers’ initiatives like offering attractive schemes and deal terms, coupled with lowering of interest rates by the Reserve Bank of India (RBI), have activated fence-sitters.

Declining Unsold Inventory In Mumbai, Chennai & Bangalore

The challenges of demand-supply mismatch and high unsold inventory across the country remain, but the signs are nevertheless encouraging – cities like Mumbai, Bangalore, Pune and Hyderabad are slowly but surely crawling back to positive growth. 2016 may well bring an end to the long and painful journey this sector has had, and signal an upward growth trajectory. It will definitely mature further into an organised industry in which some lesser-organised players become casualties.

Retail Real Estate

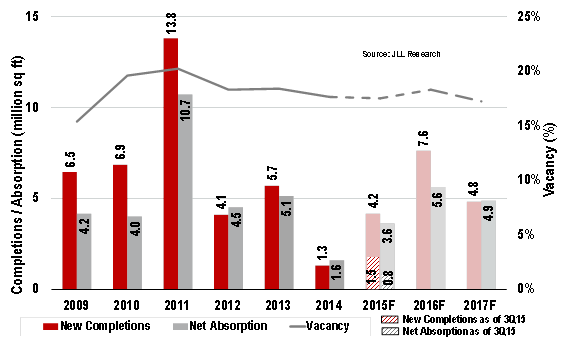

The year 2015 saw hardly any quality retail space come in. Apart from that, the two big trends observed were:

1. Consolidation of retail real estate by brands and retailers who focused on their profit-making stores and closed down loss-making ones, and

2. The entry of institutional investors. Thanks to relaxation of sourcing norms, single-brand retail companies will find more reason to explore the Indian market and also be able to undertake e-commerce business independently.

In 2016, more mature investors will come in and buy built-up retail spaces. Once they have the relevant experience and foothold in India, they will start investing in ‘greenfield’ assets. Retailers are maturing as competition heats with the entry of bigger brands into the country. Stronger players will successfully attract private equity (PE) investments over the coming years. PE may also go into select mall investments, especially in under-represented markets or for mature assets’ buyout.

Quality mall space is coming up with strong pre-commitments, indicating that retailers remain bullish about India’s long-term consumption story. Retailers will start experimenting with formats and sizes for the same brands, adapting to markets as they start moving up the value chain. 2015 saw food and beverage (F&B) emerge as a strong category, and this will continue in 2016. Entertainment options will also improve, and technology-led retail will start entering in the single-brand retail store category.

However, 2016 will see a continued dearth of quality retail spaces. Retailers will have to revisit their real estate strategy and have a flexible approach, customised to different micro-markets. Investments by both home-grown and international brands will strengthen in tier-II and tier-III markets as they expand beyond tier-I cities.

Retail Space: Supply & Demand

Industrial & Warehousing

2015 saw the wheels in motion for the industrial / manufacturing sector to get seriously rolling in 2016. Under the ‘Make in India’ programme, states can come up with advanced policies, which will help them fuel their industrial growth.

Maharashtra, Gujarat and Andhra Pradesh have historically been front-runners in attracting industrial investments. Under the ‘Make in India’ initiative, states like Punjab, Haryana and Karnataka are also taking bold steps towards better industrial policies. Online, time-bound approvals are expected to further improve the ease of doing business in India.

The warehousing sector is reaching an inflection point and will take a huge leap forward once the goods and services tax (GST) is rolled out next year. Apart from GST, e-commerce is expected to significantly drive the demand for warehouses in India in the near future. With nearly 25% of all warehousing absorption being driven by e-commerce players, it is currently the biggest demand driver for the sector. This industry is expected to invest an additional USD 2-3 billion into warehousing over the next 2-3 years.

Indian warehousing is seeing a higher supply of organised Grade-A and B warehouses than in the past. In 2015, the cumulative warehousing supply (Grade-A and B) across eight Indian cities stood at around 97 million sq ft, as against 79 million sq ft last year. This supply is expected to reach 116 million sq ft in 2016. With industrial corridors like Delhi-Mumbai industrial corridor (DMIC) and the expansion and improvement of road network, things are indeed looking up for the industrial and warehousing sectors.

Cumulative Grade-A & B Warehouse Space In Eight Cities

Hospitality

India’s hotel real estate sector landscape is evolving from being largely development-driven to becoming more transaction-driven. Early signs of improvement in hotel operating performances seen in 2015 – following a six-year period of intense economic downward pressures exacerbated by steady hotel supply increases – have rendered the hotel real estate market ripe for acquisition and consolidation.

2015 alone saw nine hotel transactions (excluding partial equity stake buyouts or refinance) equal to the combined number seen in the last two years. Most of these were in the luxury and upscale hotel segments – a major change from previous years. Another key highlight of year 2015 was the transaction of eight operational hotels (nearly twice the number of 2012, the next-highest year.)

The year 2015 stands out due to the nature of deals recorded. The year 2016 is expected to carry on from the momentum garnered in the year 2015 predicated on the U-shaped recovery in the economy and the current state of the hotel sector.

Healthcare & Education

The education and healthcare sectors in India are presently facing a huge shortfall of supply which is may soon be met by various international and national players. This will boost the growth of relevant real estate in the time to come. Growing and emerging residential nodes will enable growth in the healthcare and education sectors, with downstream investments likely come into both sectors from domestic as well as international players.

The education industry, which crossed USD 70 billion by 2015, will require an additional 16 million sq ft of relevant real estate in the next four years. It is poised to see major growth in the future, as India will have the world’s largest population in the 18-24 age group and second-largest graduate talent pipeline globally by the end of 2020.

2016 is likely to bring various new transactions in the education space across the country, primarily related to elementary and K12 schools, and technical institutes.

The healthcare sector is expected to nearly double in value from the current USD 144 billion to USD 280 billion by 2020. More than 150 hospitals could start operations in the next four years, and this will by itself account for about 22.5 million square feet (i.e. 45,000-50,000 beds) of healthcare-related real estate. Currently, the bed-to-population ratio in India is 0.9 beds per thousand populations, which is way below the global standards of 4.0 beds per thousand population. India requires 600,000 to 700,000 additional beds over the next 5-6 years to meet the demand for healthcare facilities, apart from improvement in quality of existing beds. Given this demand for capital, the number of transactions in the healthcare space is expected to witness an increase in near future.

Regulatory Framework

A lot of groundwork has been done with the central government’s initiatives:

· Once ‘Housing for All by 2022’, the Smart Cities mission, Atal Mission for Rejuvenation and Urban Transformation (AMRUT), etc. begin to roll in earnest, we will see significantly heightened activity in infrastructure and related sectors.

· Norms for FDI in the real estate sector have been eased. The government has relaxed FDI norms in 15 sectors including real estate, defence, single-brand retail, construction development and civil aviation. Under these new rules, non-repatriable investments by NRIs as also PIOs will be treated as domestic investments and not be subject to foreign direct investment caps.

· In order to attract larger investments which are only possible through incorporated entities, the special dispensation of NRIs has now been also extended to companies, trusts and partnership firms which are incorporated outside India and owned and controlled by NRIs. Henceforth, such entities owned and controlled by NRIs will be treated at par with NRIs for investment in India.

· Licencing norms have been relaxed in states like Haryana, which will help release land for affordable housing. Currently, unavailability of land is the biggest challenge to affordable housing.

· The Indian Parliament is likely to pass the Real Estate (Regulation and Development) Bill soon. This will bring efficiency, transparency and accountability into the real estate sector, as will the introduction of new financing instruments that have immense potential to improve India’s transparency.

· Despite REITs opening up late last year, not a single REIT got listed in 2015. In the current real estate taxation environment, there are not enough attractive returns available retail investors. However, 2016 may see some REITs to get launched on the back of reduced interest rates and rise in rental income from office real estate.

Looking Forward

India is an underserved economy in terms of real estate requirements. There is a wedge between demand and supply of housing, largely as a result of information asymmetry. However, with increased market transparency, this demand/supply mismatch can offer immense opportunities for developers and investors alike.

The real estate industry is maturing. Until 2014, it was unregulated, fragmented and highly inefficient. Though 2016 will bring in regulation, it will remain fragmented and moderately inefficient. We could see it become a well-regulated, consolidated and moderately efficient industry by around 2020. Growth in the Indian economy will definitely see favourable reflection in the real estate sector, as well.

-

Interviews4 weeks ago

Interviews4 weeks agoHigh Rental Yield, Price Appreciation, Stable Growth, Make Sydney an Ideal Realty Investment Option: Haansal Estate

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts