Bytes

It was expected but a cut would have helped

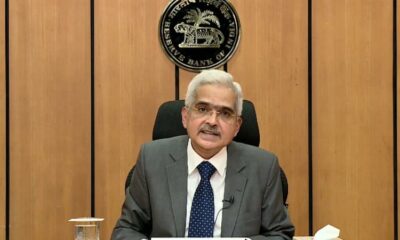

Manish Agarwal, MD, Satya Group and VP Credai NCR, said, “RBI maintaining a status quo on key rates changes was expected but for the real estate sector a cut would have helped in improving the market sentiments. Although RBI has reduced the rate by 25 bps in the last review but the sector required a cut of minimum 50 bps. For couple of years the real estate sector is in low phase and high interest rates have been one of the reasons due to which buyers are away from the market. We expect a good rate cut in the next review because a good monsoon is expected which will bring down the inflation especially in essential commodities and being a quarter were sales are high because of festive season. A good rate cut before the festive season will boost the market.”

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News3 weeks ago

News3 weeks agoSacred Cities See a Retail Boom as Spiritual Tourism Surge: CBRE Report