News

JLL: Mumbai staring at lack of right office supply from 2018

The following is the report by Ashutosh Limaye, National Director – Research, JLL India.

Mumbai figures in top five cities that will add the maximum number of office buildings in the next 18 months, according to a recent global survey done by JLL. The financial capital of India will add 16 per cent of its current stock to grow its office footprint. Since the Grade-A stock in 1Q15 stood at 96 million square feet, a stock of about 15 million sq ft could be added in the next one and a half year, if delays in construction are not accounted for. However, given the poor track record of developers in sticking to construction deadlines, the supply could be around 12 million sq ft, which is also significant.

Interestingly, in the JLL survey covering all office sub-markets in each city, emerging economies dominate the top 10 city list with their office supply pipelines. Shanghai comes on top with 42 per cent of its current stock to be added in the next 18 months, followed by Mexico City and Sao Paulo adding 22.5 per cent each and Dubai adding 20 per cent. The other cities from emerging economies that figure in the top 10 list include Beijing (12 per cent), Moscow (9 per cent) and Hong Kong (5 per cent).

Among the mature economies, Singapore City will add 14 per cent, London will add 6 per cent, Sydney and Paris will both add 5 per cent, Frankfurt will add 2 per cent and New York will add only 1 per cent of their current office stock.

What needs to be noted about Mumbai is that the bulk of this projected 16 per cent office supply consists of buildings launched many years ago. Before the global financial crisis in 2008, a healthy demand existed for office spaces and developers launched many new projects to cater to it.

Post-crisis, work on these buildings slowed down or halted altogether as builders faced dismal demand and recession. Only a few developers could change or scrap their projects. The rest just decided to slow down. They are the ones who will finish their projects in the next 18 months.

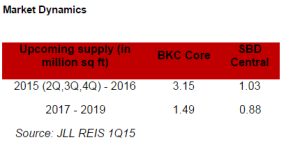

Moreover, Mumbai has hardly seen any new launches in the last few years. This will have implications in the next three years, with the supply pipeline drying up in the right locations like BKC Core and SBD (Central). On the other hand, peripheral areas such as Thane and Navi Mumbai will see an oversupply, which will actually be the supply that had got delayed due to the global financial crisis and would get constructed during this time period.

About 14 million sq ft of office spaces that will be constructed between 2017 and 2019 will come up largely in the peripheral areas, which will not help enough because they will be in the wrong locations. Grade-A supply to come up between 2017 and 2019 in the Bandra Kurla Complex (BKC) core business district and secondary business district (SBD)-Central will be just 2.37 million sq ft in an ideal scenario, i.e. when delays do not occur in construction work, out of this total expected supply of 14 mn sq ft.

This will be a lower than the expected supply of 4.18 mn sq ft from these two business districts in the next 18 months. Realistically, however, the supply can be expected to be only around 3.5 mn sq ft. Interestingly, the expected demand for office spaces in these two areas in the same period will stand around 5 mn sq ft and is expected to grow beyond 2019. In other words, the time is right for developers to launch new commercial projects in the city and suburbs.

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoOlive Announces Dhruv Kalro as Co-Founder