News

‘Office, retail, residential witness growth in NCR’

It is pertinent to observe how the Delhi-National Capital Region (Delhi-NCR) real estate markets have performed over the past year or so. All three sectors—office, retail and residential—are witnessing growth because of the suburban towns surrounding the prime city. The reasons for this are the large untapped development potential in the suburbs and the substantial financial viability and affordability that are available to both developers and end-users in these locations.

In a JLL report, it has been found that the past 18-month period of reflection following the recovery that began in 2010. It provides a qualitative overview of the three sectors – office, retail and residential with relevance to the Delhi NCR.

RESIDENTIAL SEGMENT

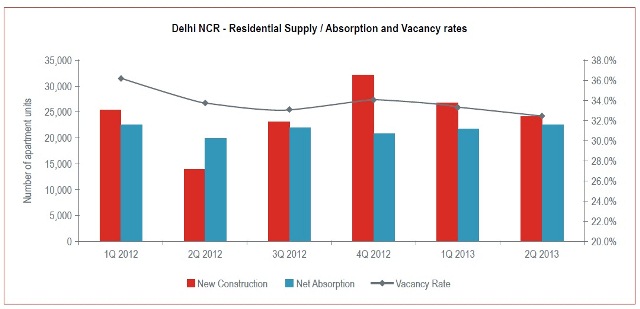

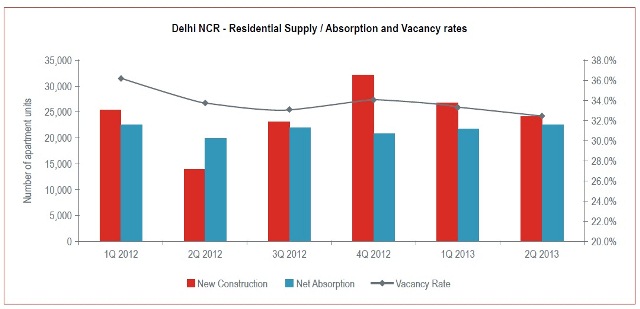

The residential sector has not been left untouched by the events that have influenced the domestic economy over the previous 18 months. These events along with the consistent increase in land valuations and input construction costs have led to sustained price increments across all residential markets in Delhi NCR, despite demand momentum being affected by such a price rise.

Like other real estate asset classes, the vibrant nature of residential sector is also attributed to the contribution of suburban cities, which along with Delhi form the Delhi NCR residential market.

Each residential market has its own typical development types, price points and buyer or investor categories. The Delhi NCR residential sector offers a wide range of projects across all categories classified by type (apartments, row houses, villas, plots) and price (affordable, mid, premium and luxury). There is a fair mix of both buyers and investors across all the residential markets, although investor contribution is significantly higher in Gurgaon and Noida residential markets as they offer a wider array of projects and are backed by healthy demand levels.

The prime city of Delhi has been a marginal contributor with select residential projects only and as such may not provide an accurate barometer of the Delhi NCR residential sector. Noida residential market has been the largest contributor to the new supply of private apartment units for the past 17 quarters, barring one.

This residential market is home to the Noida Extension residential corridor, which has been a significant contributor to apartment unit supply in the overall Delhi NCR residential market. As a result, Noida residential market has recorded the highest sales volumes over the last 18 months. The Noida-Greater Noida Expressway corridor has been the most vibrant, with projects available at varying price points and its location acting as a major pull factor. The hosting of the Formula 1 event in Greater Noida has also brought about interest in that residential corridor, which was otherwise facing stagnation because of low buyer/investor interest.

Gurgaon’s residential market has strong fundamentals of controlled supply and good traction from investors and buyers alike. It has scaled its previous market peaks recorded in 2008 and remains in demand. All of the major developers have their eyes set on the residential growth corridors of NH-8 and the Dwarka-Gurgaon Expressway, which account for most of the new supply in this market over the past 18-24 months period.

This residential market is also seeing good traction in terms of luxury apartment supply by prominent national developers. These growth corridors have seen a healthy increase in primary market price levels because of the healthy sales volumes in these sub-markets.

The other suburban residential markets of Ghaziabad and Faridabad cater primarily for affordable and mid-segment housing and their lower price points are a reflection of the relatively lower investor interest here. However, with an increased focus on affordable housing, developers are actively looking at the NH-24 stretch in Ghaziabad, which already has a sizeable living population in the developed residential corridors of Vaishali and Indirapuram. The Faridabad residential market has Greater Faridabad (also known as Neharpaar) as a growth corridor, offering projects at relatively affordable price points.

Overall, the Delhi NCR residential market has seen sustained price increases that have contributed to a steady cooling-off of the demand momentum over the past 12-18 months. However, we have not seen a definitive trend of falling sales, although the sales volumes as a percentage of available stock have shown a sluggish decrease, pointing to a creeping stagnancy in the residential markets.

The macroeconomic situation has not allowed the Reserve Bank of India to cut the repo rates, which could lead to a reduction in home loan interest rates and has acted as a catalyst for slowing demand. A reduction in apartment supply is also a pointer in this regard.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder