News

One-time loan restructuring RERA authorities will write to RBI this week UP RERA chief informs R&M- ICCPL Webseries-9

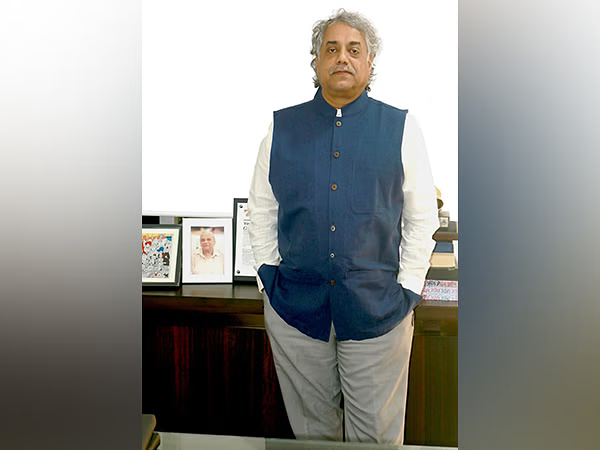

There was good news for developers in the midst of tough times as UP RERA Chairman Rajive Kumar announced that regulatory bodies would be writing within a week to the RBI seeking one-time debt restructuring for the real estate industry.

Kumar was speaking at the ninth edition of Realty Webseries hosted by realty magazine Realty & More and PR firm ICCPL on Saturday. The theme of the latest edition was ‘Three Years of RERA’.

The UP RERA chief informed at the webinar that “the issue of loan restructuring has been around for a long time and a letter to the RBI for loan restructuring would be going this week”.

He said the All India Forum of Real Estate Regulatory Authorities (AIFORERA), of which he is the Chairman, has decided to take up the issue with the RBI so that they might consider one-time restructuring. He said that the extension of six months to the projects on the grounds of force majeure is in the interest of the homebuyers, “If there is a reasonable expectation that with some extension as per law the present developer will be able to deliver, then probably that is the quickest way of coming to a conclusion

It’s worth recalling that prominent industry bodies Credai and Naredco have been demanding one-time restructuring of outstanding loans of developers for quite some time.

Talking about the journey of RERA, Kumar said that UP RERA got maximum number of complaints, and out of almost 26,000 complaints more than 19,000 have been disposed of. He also said that the authority is getting good response to e-courts and video conferences. “More than 90 per cent of the people who are listed for cases are happy with it and feel that this way of operating should continue in future also”, he said.

Touching upon the issue where homebuyers are not eligible for any delayed payment while builders are charge penalties for delay in payments in this period, Kumar said, “As far as UP RERA is concerned, in any of our orders for these six months, no interest will be due as far as the delay is concerned. However, if any installment is due then it is unfair of the builder to be asking for interest during this period.”

Manoj Gaur, MD, Gaurs Group, clarified that “It is clear on part of the Credai that if in these six months there is a pending installment of the buyer then no interest will be charged.”

RK Arora, Chairman, Supertech Group, talked about how RERA has created trust but issues such as NGT, land acquisition, etc. affect the delivery. Post-pandemic, he said, the real estate was facing fresh issues such as labour, raw material cost and liquidity problem.

Praising the efforts of RERA, Deepak Kapoor, Director, Gulshan Homz, said “RERA helped increase the trust between consumer and developer. The advantage is that RERA does not only listen to the buyers but also the problems being faced by the developers.”

Commenting on how things have changed post-RERA, Dhruv Agarwala, Group CEO, Housing.com, said, “The advent of RERA is a game-changer and consumers take it as recourse if something goes bad. The much-needed bridging of trust deficit has been achieved by RERA and there is a long way to go. Many developers were suffering from reputation crisis because of the handiwork of few and now the overall image of the sector has improved significantly post RERA.”

Concerned over delays due to late approvals by various authorities, Manoj Gaur said, “The Authorities should come under the ambit of RERA; similarly, banks and financial institutions should also come under RERA as many projects are not completed timely due to lack of timely funding.” For example, he said, “The Government launched stress fund of Rs 25000 crore, and till now not even Rs 250 crore has been disbursed.”

Ashish Bhutani, CEO, Bhutani Group, shared an experience where an overseas buyer showed increased faith in Indian realtors because of RERA. “Now, the developers do not have to make extra efforts to market products to prospective buyers, especially NRIs,” he said.

RERA expert Venket Rao said the complaints of homebuyers could rise due to the current pandemic and efforts needed to be made to resolve them amicably.

-

Interviews4 weeks ago

Interviews4 weeks agoHigh Rental Yield, Price Appreciation, Stable Growth, Make Sydney an Ideal Realty Investment Option: Haansal Estate

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts