Top Stories

Windfall

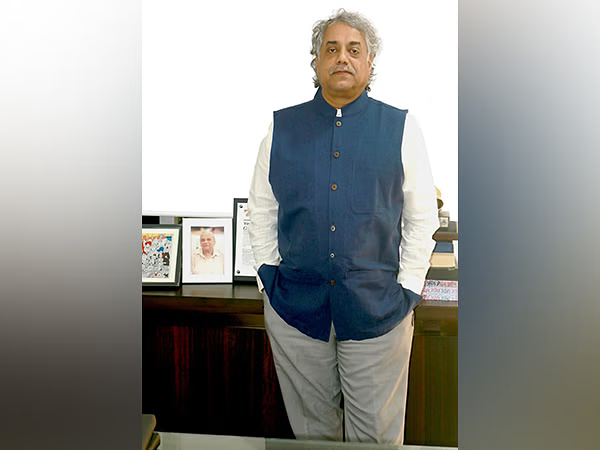

“The name is Raghuram Rajan, I do what I do”, said the Reserve Bank Governor after delivering a major surprise, cutting the key policy rate – the repo rate by half a per cent, or 50 basis points, to 6.75 per cent when the consensus was that the cut would be by just 25 basis points. And this pre-festival bonanza couldn’t have come at a better time for the real estate industry which can now safely look forward to increased sales during the crucial weeks ahead.

Before most of the developers could share their own attractive packages with the customers for the festival season ahead, RBI Governor Raghuram Rajan surprised them all by announcing a deeper-than expected rate cut in his fourth monetary policy review of the year. The decision, which is certain to provide the much needed push to overall economic recovery, couldn’t have been better-timed as far as the real estate industry is concerned. With festival season around the corner and home loan EMls set to fall, the homebuyers’ sentiments will be on an upswing and developers can hope to reap a windfall in the days ahead ..

Bowing to impassioned calls by Corporate India, as also the nudge from the Finance Ministry, the Reserve Bank of India on September 29 cut the repurchase, or repo, rate by 50 basis points to 6.75 per cent, while keeping CRR and SLR unchanged at 4 per cent and 21 .5 per cent, respectively. This marks the fourth repo rate cut by the RBI since January 2015.

In the monetary policy statement, the RBI said that inflation at historic low-levels, US Federal Reserve’s decision to postpone a rate hike and higher sowing area despite a weak monsoon have pushed the bank to cut rates. However Governor Rajan warned that the rate cut isn’t a “Diwali bonus”, and that it is based on the progress on the ground. He also urged the banks to cut the lending rates to make loans more affordable for people.

With the latest 50 bps reduction, the apex bank has cut rates by a total 1.25 per cent this year, while only about 30 bps has been passed on by the banks to borrowers. The industry, as well as the loan-seekers’ eyes are now glued on the banks to see how much of the benefit is actually transmitted down the line to boost investment and economy.

The first signals of the positive intentions of the banks came minutes after the RBI policy was announced as Andhra Bank slashed its benchmark lending rate by 25 bps. Later, on the same day, country’s biggest lender State Bank of India announced a 40 – basis-point cut in its base rate with effect from October 5. The new home loan rates of SBI have now fallen to 9.3 per cent and 9.35 pc. The other banks, both public and private sector, are unlikely to be left behind in the matter of interest rate cuts and the question is only of when and how much.

Now, with the low-interest rate regime having been ushered in by the central bank of the country, the developer community is in a position to step into the pre-festival sales pitch with renewed hope and confidence. The response of the developers received by Realty & More on the day of the RBI announcement is a clear testimony to that. While welcoming Rajan’s surprise action, the unanimous call was only for a quick follow-up action from banks.

benefit the end-user.”

Navin Raheja Chairman of another industry body Naredco, also said, “The decision of RBI to cut the interest rates was overdue in the environment of lower inflation and poor domestic demand.” The homebuyers, he said, were upbeat but in a wait-and-watch mode due to high prevailing interest rates. “We are hopeful that with this announcement of rate cut, the banks will take the cue and pass on the benefits to the end-users which will trigger the demand and offtake of housing ahead of the festive season,” Raheja said.

No less upbeat was the response received by Realty & More from prominent real estate firms and other stakeholders from across the country. Brotin Banerjee, CEO and MD, Tata Housing Development Company, said, “With festive season around the corner, this was the perfect time for the RBI Governor to announce the rate cut of this magnitude.” In Banerjee’s view, the cumulative cut of 125 basis points since January this year “will give a very good push in improving both the consumer sentiment and the real estate.” He said that cheaper, low-value housing loans will also help in augmenting the affordable housing segment. However, he added, “It is important that the banks translate the rate cuts into lower lending rates so that consumers can leverage the true benefits of the announcement.”

Anuj Puri, Chairman & Country Head, JLL India, told R&M, “As opposed to the market’s expectation of a 25 basis points cut, the RBI has delivered an astounding 50 basis points reduction.” With this, he said, “It has clearly abandoned its cautious baby-steps approach and assumed a bolder stance, obviously because the current economic fundamentals provide it with the room to do so.” Puri also said, “1 do not think any further rate cuts are likely in this financial year, especially since the RBI foresees a moderate growth in inflation rate in the interim months.”

According to Deepak Kapoor, President, Credai Western Up, “Since home loans are linked to base rates, the reduction in repo rate will benefit borrowers and reduce the EMls for homebuyers. We were expecting the rate cut to be reduced by 25 bps but to our amazement it was slashed down to 50 bps. This is a great move by RBI and we are happy that homebuyers will reap rich benefits out of it. The rate cut has come on the right time when everyone is gearing up for festive season. This is the perfect time when potential customers plan to invest in property.”

Manoj Gaur, MD, Gaursons India, said, “There were huge expectations by the sector form RBI this time and finally these have been fulfilled. We were looking ahead for rate cut which could boost the real estate sector in a big way. With festive season around the corner, the timing of the RBI to reduce the rate could not have been better. The banks should now quickly reciprocate and reduce the interest rates on loans so that the borrowers can also yield the gains. Once the lending rates will be reduced by banks, we believe that the homebuyers will feel encouraged to come and invest in properties.”

In Prateek Group Chairman Prashant Tiwari’s view, the reduction in repo rate by RBI was an awaited move. The results of this rate-cut, he said, “will be reaped by homebuyers in the form of reduced home loan interest rates.” Tiwari said, “The realty sector will get the much-needed boost that it was looking for and overall market outlook will also improve. The huge rate cut has come as a surprise and has infused positive vibes in the realty market. “However, he was of the opinion that along with the reduction in repo rate, RBI could have also considered the cut in CRR “as it would have improved the liquidity with banks which would have allowed banks to increase the supply of loanable money leading to improved sentiment in the real estate sector”.

RK Arora, Chairman of Supertech Limited, was of the opinion that that RBI announcement was long overdue and is a positive step towards investment in general and in real estate in particular. Further, he said, “The decision to reduce the risk weight to 50 per cent on affordable housing for individual housing loans, is also encouraging for housing real estate sector as it would also help Banks/Fls to reduce more interest rate in lending in housing sector.”

Aman Nagar, Director, Paras Buildtech, told R&M, “The decision to cut repo rate in current scenario is really a very welcoming move at this crucial moment when the real estate market is largely impacted by slow market movement, due to low demand.” Nagar said, “We hail RBI Governor’s highly positive move taken at the onset of festive season as it will definitely help the overall market to gain momentum.”

Brijesh Bhanote, Director, Sales and Marketing, Lotus Greens Developers, commented: “The current deceleration by RBI of reducing repo rate by 50 basis points while keeping the CRR and SLR unchanged, has come as big announcement for both aspiring homebuyers and developers.” Following this move, he said, “Hopefully, most of the banks will be softening their home loan rates elevating festive mood of homebuyers.”

According to Sanjay Rastogi, Director, Saviour Builders, “The revision in rates is very much favourable for real estate sector and will boost the demand for properties. Real estate, being a rate-sensitive sector, will gain from the reduction in repo rates. The rate cut holds a great significance as the banks will now incise their interest rates on loans and the benefit will be passed to borrowers at last.”

Anil Kumar Tulsiani, CMD, Tulsiani Construction & Developers, also said, “The drop in rate cut will improve the market sentiments and will give the required thrust to real estate market. The reduction in EMls as a result of rate cut will bring huge respite to homebuyers. With the fall in interest rates, the demand for home loans will continue to grow stronger. This unexpected rate cut of 50 bps has made the festive season more blissful for us and our customers as well”

In his response, Gaurav Gupta, spokesperson, Credai RNE, said, “It is the best gift RBI has given to customer before the upcoming festive season. The sector, he said, needed it badly to come back to right track. “For affordable housing it is very important that the interest rates are low. The Government’s vision of ‘Housing for All’ cannot be fulfilled with high rate of interest,” he added.

Orris Infrastructures CMD Vijay Gupta told R&M this is the much-needed relief provided by the RBI at the onset of festive season. “The 50 basis points cut in repo rate will definitely help strengthen the market sentiments and boost the housing demand, he said, while adding, “If everything goes as expected we are looking forward to huge demand coming from the homebuyers on the back of reduced home loan rates.”

Om Chaudhry, CEO & Founder, FIRE Capital and Chairman of Astrum Homes, said, “Reduction in repo rate by 50 basis points is a much-needed step to improve the market sentiments and real estate sector. The reduction is very timely as the festive season is approaching.” However, he also said, “The reduction in CRR would have been much appreciated as it would have given a free hand to the banks to increase the supply of the loanable money”.

Rajgala Shah, partner, Zara Habitats, said, “The rate cut is an indication of the strong economic growth to come and a much-needed shot in the arm for driving up real estate demand and development as both the consumer and the developer will be able to get loans at a reduced rate of interest. It will ensure that money is invested in real estate which is the safest asset class that holds its value.”

Mukesh Khurana, MD, Rudra Buildwell, told us, “Since the beginning of this calendar year, RBI had assured of a rate cut cycle this year which it has followed owning to the economic recovery and fair chances of meeting the target inflation by January next year. This move is greatly welcomed especially for this sector considering the rising inventory levels which will now see a momentum if banks reduce the lending rates, something that is quite evident”.

Exuding confidence, Ankit Aggarwal, (MD, Devika Group, summed up the developer community’s sentiments appropriately when he said, “We were pretty sure of a rate cut in this bi-monthly policy of RBI as the next two months are full of festivals and this time around sentiments are usually flowing well. A reduced lending rate ahead of festival season will make the property prices look lighter to the customers as monthly installments will come down.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder