Report

Retail leasing up 114% Y-o-Y, crossesing 3.4 mn sq.ft. in 9 months

November 03, 2022 – CBRE South Asia Pvt. Ltd, ‘India Market Monitor – Q3 2022’. The report highlights the growth, trends, and dynamics across all segments of the real estate sector in India.

According to the report, the retail leasing in India increased by 114% Y-o-Y between Jan–Sept 2022. Supply grew by 102% Q-o-Q in Q3 2022. The report also pointed out that among the cities, Hyderabad (29%), Delhi-NCR (25%), Mumbai (13%) and Bangalore (12%) together accounted for 79% of the overall retail space absorption.

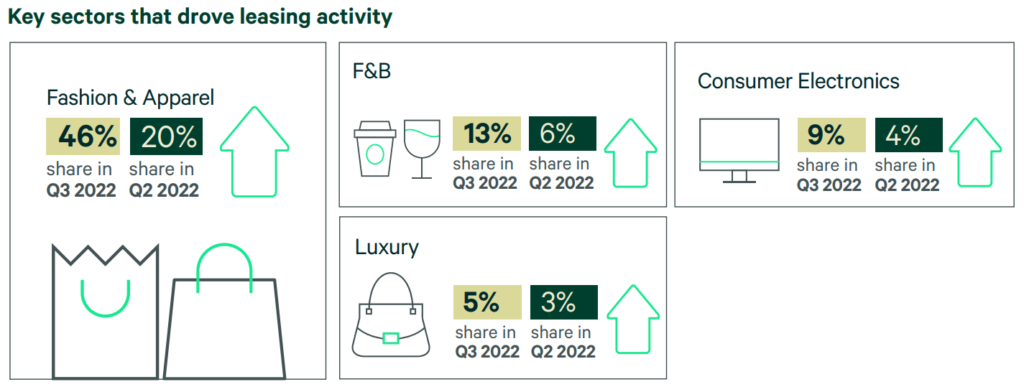

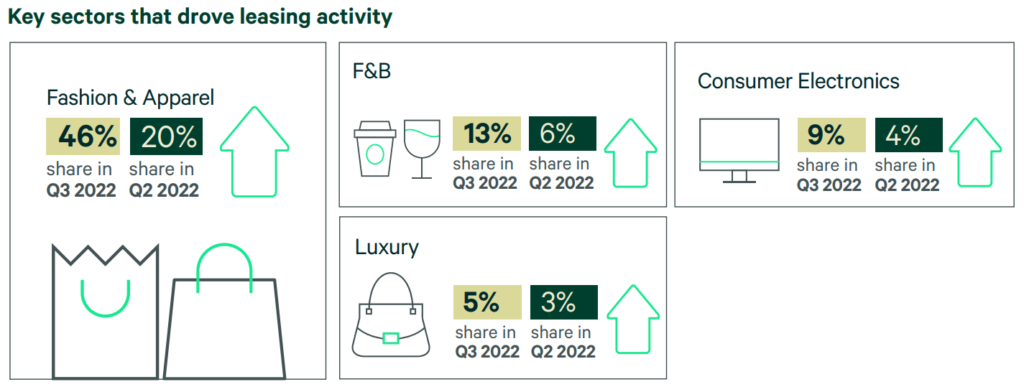

Fashion and apparel retailers continued to drive the leasing activity with a share of 46% in Q3 2022. Other prominent categories that led absorption during Q3 2022 included food & beverage (13%) followed by consumer electronics (9%).

The report also reported quarterly rental growth in select pockets of Delhi-NCR (Green Park 5-7%), Ahmedabad (Prahlad Nagar 3-5%) and Mumbai (South Mumbai 1-2%). The regional share of leasing activity was led by Domestic corporates (73%), EMEA corporates (16%), American corporates (9%) in Q3 2022.

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, “Nearly 40% Y-o-Y growth in leasing activity was observed in the retail sector in Q3 2022 and 114% Y-o-Y between Jan–Sept 2022. Owing to the high growth potential, we expect many international brands to continue to view India as a growth market.”

Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, said “Retail leasing is expected to further strengthen during the current festive season. In Q3 2022, the overall retail absorption and supply was 1.1 mn sq. ft. and 0.5 mn sq. ft. respectively. Strong leasing momentum across Hyderabad, Delhi-NCR, Mumbai and Bangalore indicates regained retailer confidence and expansion potential.”

Other observations

Retail outlook:

- Leasing to strengthen further considering the festive season; international and domestic brands to continue to expand

- Direct-to-consumer brands to lead the fray among demand drivers; entry of more international brands likely through both offline and online channels

- Tier-II, III and even IV locations to gain traction as retailers look to leverage the spending power of these towns and cities

- Despite a robust supply pipeline, lack of ready quality supply, especially in prime locations, likely to impact retailer sentiments

Investments: Steady capital inflows witnessed in real estate

- Total capital inflows in 9M 2022 up by nearly 10% Y-o-Y (USD 5.3 billion)

- Overall capital inflows in Q3 2022 up by 7% Y-o-Y (USD 1.4 billion)

- Mumbai, Bangalore and Hyderabad dominated total investment quantum in Q3 2022, with a cumulative share of about 66%

- Land / development sites dominated investments with a share of 51%; followed by built-up office assets (49%)

- Institutional investors led investment activity with a share of nearly 59%, followed by developers (19%)

- Domestic investors dominated the investment volume in Q3 2022 with a share of 51%. Foreign investors garnered the remaining share. Among them, investors from Singapore (24%), followed by Abu Dhabi (14%) pumped in major capital in India

- ~38% of the total capital inflows in site / land acquisitions during Q3 2022 were deployed for residential developments, while 30% was committed for the office sector

Outlook:

- Y-o-Y uptick of 5-10% likely in 2022; cumulative investments could cross the USD 6-billion mark

- Churn in institutional shareholders of existing REITs anticipated as investors look to partially book profits

- Platform-level deals between foreign investors and domestic property companies to gain momentum; to drive next phase of greenfield asset development

- Monetary tightening measures to increase financing costs, thereby putting pressure on margins

Industrial & Logistics: Leasing activity picks up in Q3 2022, a nod towards the resilience of the Indian I&L sector. Supply addition remains slow but likely to pick up in the coming quarters.

- ~ 22 mn sq. ft. leasing activity witnessed in 9M 2022, almost stable on a Y-o-Y basis

- ~ 13 mn sq. ft. – total supply addition in 9M 2022

- 9.2 mn sq. ft absorption recorded in Q3 2022

- 40% Q-o-Q rise and 18% Y-o-Y growth in leasing in Q3 2022

- Delhi-NCR and Mumbai led absorption, together accounting 57% share in leasing activity in Q3 2022

- Key sectors that dominated leasing included players from the 3PL (50%), engineering & manufacturing (17%), retail (9%), e-commerce (7%) and FMCG (4%) sectors

- Regionally, domestic corporates (77%) dominated space take-up, followed by EMEA corporates (13%)

- Total 2.9 mn sq. ft. supply witnessed in Q3 2022

- 68% was the combined share of Bangalore, Chennai, and Hyderabad in the supply addition in Q3 2022

- Quarterly rental growth was witnessed mainly in Pune, Delhi-NCR, Bangalore and Kolkata

Outlook:

- Leasing expected to remain range-bound at 28-32 mn sq. ft. in 2022, supply addition to pick up pace in Q4 to total 18 – 20 million sq. ft. in the entire year

- 3PL to continue driving leasing activity; festive season to uplift the market sentiments of retail, e-commerce and manufacturing sectors which would positively impact space take-up

- Despite easing global supply chain pressures, occupiers to continue following ‘just-in-case’ as well as ‘just-in-time’ strategies to remain prepared for any potential risks

- Holistic policy initiatives such as PM GatiShakti, National Logistics Policy, etc. anticipated to transform the sector and bring it at par with global standards

Office: Compared to 9M 2021, the office sector witnessed a significant recovery in leasing activity in 9M 2022 with the easing of COVID-19 restrictions, a gradual acceleration of return to office (RTO), expansion by occupiers and the release of post-pandemic pent-up demand.

- ~ 42.1 mn sq. ft leasing witnessed in 9M 2022, a rise of almost 66% Y-o-Y

- Total supply addition of 35.6 mn sq. ft. recorded in in 9M 2022; a growth of 4% Y-o-Y

- 12.7 mn sq. ft. absorption in Q3 2022

- 9.5 mn sq. ft. supply in Q3 2022

- The leasing was led by cities such as Bangalore, Mumbai, and Delhi-NCR, which together accounted for a share of 65% in Q3 2022

- 62% was the combined share of Bangalore, Delhi-NCR, and Hyderabad in the supply addition in Q3 2022

- Rental recovery continued across several cities due to sustained recovery in leasing, moderating vacancy levels and persistent demand for investment-grade assets.

- Multiple micro-markets across Delhi-NCR, Mumbai, Chennai, and Pune, in addition to NBD Manyata in Bangalore, witnessed a rental growth of about 1-6% Q-o-Q

- Key sectors that drove leasing in Q3 2022 include technology (24%), flexible space operators (23%), BFSI (20%), and engineering & manufacturing (13%).

- Regionally, domestic corporates (64%) and American corporates (20%) dominated the space take-up during the quarter

Outlook:

- Sustained leasing activity expected in the coming quarters, although there could be some impact from global economic headwinds

- Supply pipeline remains strong; sustained leasing to cause vacancy levels to fall slightly or remain range-bound

- Global headwinds such as inflation and rising fit-out costs could cause occupiers to relook at their CapEx and real estate plans

- Return to office to pick up pace but would remain punctuated by hybrid working; however, companies would need to clearly define their working models going forward

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoOlive Announces Dhruv Kalro as Co-Founder