News

Retail leasing up 166% Y-o-Y in H1 2022

September 1, 2022: CBRE South Asia Pvt. Ltd, India’s leading real estate consulting firm, today announced the findings of its latest retail report, ‘CBRE India Retail Figures H1 2022’. The report indicates that the retail sector leasing in India increased by about 166% Y-o-Y crossing 1.5 million sq. ft. As of H1 2022, the total investment grade mall stock crossed over 77 million sq. ft.

The report points out that among the cities, Delhi-NCR and Pune, followed by Bangalore and Hyderabad, led the leasing activity, together accounting for more than 70% of the overall retail space take-up. As per the report, pent-up supply is likely to enter the market during H2 2022, and the total supply for the year is anticipated to surpass the pre-pandemic levels.

City-wise highlights:

Delhi-NCR Leasing back to pre-pandemic levels; led by domestic brands

• Space take-up of 47,000 sq. ft. by Hippo Stores in the Garden Galleria Mall in Noida was one of the prominent transactions.

• Key retail categories driving absorption in H1 2022 included Supermarket (23%), Homeware and Department Store (17%) and Fashion & Apparel (15%)

Bangalore Retail leasing led by newly operational malls

• Space take-up of 50,000 sq. ft. by PVR in the Salapuria Divinity Mall in South Bangalore was one of the prominent transactions.

• Key retail categories driving absorption in H1 2022 included Fashion & Apparel (31%), Entertainment (29%) and Consumer Electronics (21%)

Mumbai Retail leasing strengthened; led by EMEA-based and domestic brands

• Space take-up of 70,000 sq. ft. by Ikea in the R City Mall in Eastern suburbs was one of the prominent transactions.

• Key retail categories driving absorption in H1 2022 included Homeware and Department Store (55%), Food & Beverages (18%) and Fashion & Apparel (11%)

Hyderabad Retail leasing improved in malls; led by domestic brands

• Space take-up of 50,000 sq. ft. by INOX in the Necklace Pride Mall in Central Hyderabad was one of the prominent transactions.

• Key retail categories driving absorption in H1 2022 included Fashion & Apparel (35%), Entertainment (34%) and Consumer Electronics (10%)

Chennai Retail leasing improved; led by high streets

• Space take-up of 20,000 sq. ft. by ‘More’ supermarket in the OMR Zone1 was one of the prominent transactions.

• Key retail categories driving absorption in H1 2022 included Fashion & Apparel (25%), Homeware and Department Store (21%) and Supermarket (16%)

Pune Demand strengthened; expansion led leasing by apparel and fashion brands

• Space take-up of 7,500 sq. ft. by The Collective in Phoenix Market City was one of the prominent transactions.

• Key retail categories driving absorption in H1 2022 included Fashion & Apparel (63%), Supermarket (17%) and Food & Beverage (8%)

Kolkata Retail leasing improved

• Space take-up of 18,000 sq. ft. by Decathlon store in Austin Tower was one of the prominent transactions.

• Key retail categories driving absorption in H1 2022 included Sports goods (40%), Fashion & Apparel (20%) and Supermarket (18%)

Ahmedabad Leasing mainly driven by consumer electronics’ players

• Space take-up of 13,000 sq. ft. by RealMe store in Shyamal Iconic in Prahladnagar was one of the prominent transactions.

• Key retail categories driving absorption in H1 2022 included Consumer Electronics (70%), Health & Personal Care (12%) and Fashion & Apparel (10%)

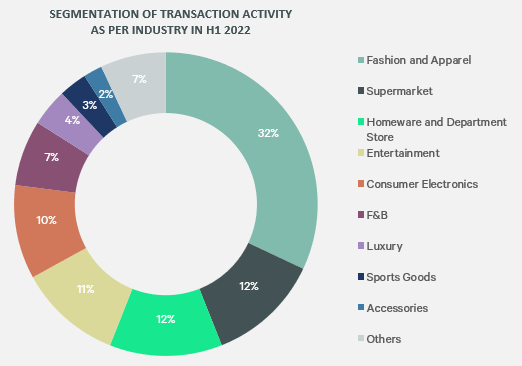

Fashion and apparel retailers continued to drive the leasing activity with a share of 32% in H1 2022. Other prominent categories that led the leasing activity during H1 2022 included supermarkets (12%) along with homeware and department stores (12%). The entertainment category, which was impacted the most during the pandemic, has also emerged as one of the top demand drivers during H1 2022, with an 11% share in the overall demand. Leasing momentum is expected to pick up in H2 2022 owing to the anticipated space take-up in newly completed malls.

The report also observed that due to strong demand from retailers across investment grade malls and prominent high streets, rental values increased on a half-yearly basis in select micro-markets across most cities. Among high streets, rents rose by about 5-12% across select locations in Delhi-NCR, Bangalore, Hyderabad, and Pune, and about 1-3% in Mumbai. While prominent mall clusters in Pune and Delhi-NCR witnessed rental growth of 5-11% on a half-yearly basis, a marginal increase of 1-3% was reported across one mall cluster in Mumbai.

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, said, “It is evident that retailers have regained confidence and are set for expansion mode. We anticipate that going forward, domestic brands will remain proactive in relocations/expansions, and a strong appetite from international retailers will continue.

We foresee retail leasing to touch 6-6.5 million sq. ft. in 2022, twice the 2021 quantum. Additionally, owing to the tremendous growth potential, we expect many international brands to launch stores in tier II and III markets.”

Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, said, “We expect nearly 5.5 – 6.0 million sq. ft. of new investment-grade malls to become operational during the year, an annual growth of nearly 40%. Accounting for nearly an 85% share in the overall investment-grade mall completions, Hyderabad, Delhi-NCR, and Bangalore are expected to dominate retail supply addition in H2. Moreover, Mumbai and Chennai are also anticipated to witness supply addition. Among the consumer segment, fashion and apparel retailers will continue to expand their physical sales networks and pay particular attention to enhancing flagship stores.”

Retail Outlook/Other observations

- Expansionary demand set to strengthen leasing: Domestic brands are likely to remain proactive in relocations and expansions. Among international retailers, brands with sound local market intelligence and established management teams are anticipated to drive leasing activity. On the other hand, new-to-market brands are likely to remain cautious and collaborate with domestic partners to launch in India. Overall leasing is expected to reach around 6.0 – 6.5 million sq. ft. in 2022.

- Pent-up Supply addition expected in H2 2022: Pent-up supply is expected to come on stream during H2 2022 as 5.5 – 6.0 million sq. ft. of new investment-grade malls are anticipated to become operational during the year, registering a 40% growth Y-o-Y.

- Experiential retail to remain In-Focus: Thematic stores, promotional events, and expanded display areas and showrooms are expected to grow in 2022, and retailers will continue to create engaging, immersive, and convenient experiences that would give customers a reason to visit stores.

- Innovation in tenant mix: The last two years have resulted in a rise in demand for service-oriented retailers, including beauty, medical, pet, childcare, and entertainment. Keeping in view the larger consumer experience, landlords are anticipated to place much greater importance on this sector in their tenant mix and, in doing so, could redefine ‘consumer spaces’.

- Omnichannel to remain relevant in times to come: Retailers will continue to rely heavily on omnichannel strategies to sell and deliver goods. Some may generate most of their revenue online but leverage a select number of brick-and-mortar showrooms for their products to be viewed and tested. On the other hand, a mall-based retailer that derives most of its revenue from store sales may use online/social media channels to market and sell goods.

- Retail partnerships to foster: Retailers continue to explore new business models and concepts, including fostering new partnerships and relationships, not only with landlords but also with international players to facilitate their seamless entry into India.

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder