Current affairs

The Dollar Real(i)ty

With the weakening trend of rupee, NRI community has a natural affinity towards India as a realty hub and their real estate investment decisions may provide a psychological boost to both NRIs as well as developers, writes Madhusudan Sahoo

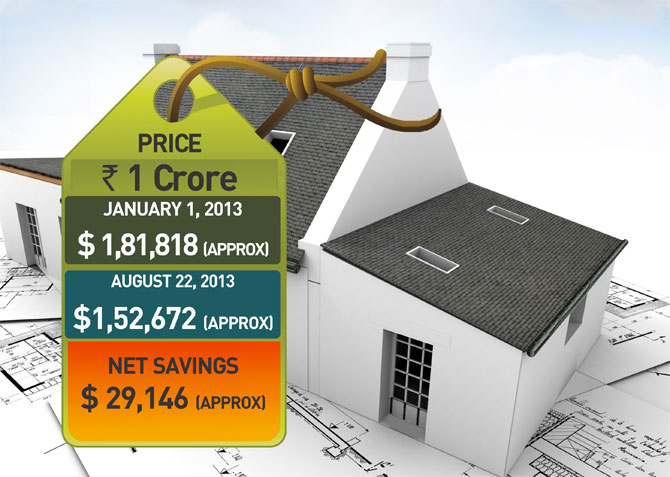

With an unexpected fall of rupee and steep hike in property prices — both commercial and residential, the prospective buyers in India, it seems, are more concerned about the depreciating trend than ever before, while non-resident Indians (NRIs) cheer about it for anticipating more value out of their investments in Indian real estate projects.

— Soumya Dutta, Managing Director, Eforex India Ltd

As per Jones Lang LaSalle India’s data, Indian property prices witnessed significant increases, averaging 40-42 per cent across all major markets. Adding the woes to the realty sector, the rupee has also depreciated by over 12 per cent since May and the trend is expected to continue for some time now. The rupee is expected to remain under pressure throughout this year owing to yawning current account deficit and large foreign institutional investor (FII) outflows on the back of US quantitative easing.

— Nishant Singhal, Director, Strategy & Alliances, Investors Clinic Infrastructure .

“What should be noted is that not only global factors but weak domestic economy as well as political uncertainties are affecting rupee adversely. When it comes to the realty sector, with the latest move by the Government to hike foreign direct investment (FDI) in the sector to 100 per cent has helped boost the dollar inflows. Realty sector is one of the booming sectors in present conditions, especially for the NRI investors,” said Soumya Dutta, managing director, Eforex India Ltd.

According to the statistics, there has been a marked rise in the amount of investment by NRI in the realty sector during which rupee has declined

However, real estate consultancy firm Cushman & Wakefield has said that the fall in the Indian rupee’s value provides a psychological boost to both the NRIs as well as developers. “If the rupee maintains its current levels, developers could see more interest from the NRI buyers as long as the capital value levels are also maintained and do not see a big hike during the period,” said Shveta Jain, the company’s executive director (residential).

“Though it is commonly felt that with each depreciation cycle, NRIs will find it cheaper to invest in the sector, this does not happen immediately,” Jain said.

Experts are of the view that the decline trend would continue for some time due to foreign institutional investor outflows, rising trade deficit and strengthening dollar. Looking forward to the future trend of the realty markets, for an NRI buyer, a typical purchase transaction may be at least for a period of 2-3 months. During this period, the rupee may strengthen and the present advantages that would be accruing due to the rupee’s depreciation could be lost.

— M Narendra, Chairman and Managing Director of the Indian Overseas Bank

Dutta, however, said the rupee would not appreciate in a hurry and would continue to be under pressure. Like most currencies, the monthly volatility is very high and this is something that buyers abroad are quite used to in their own currency.

“There are ways to counter a possible appreciation of course by freezing the Indian rupee value at the onset or using the futures markets, either in India or abroad, by selling in forward and thereby hedging the value. This can of course go both ways but I would presume that overseas investors would factor this risk. Excessive devaluation of course can play spoilsport for the investors as the value of Indian properties in foreign currency would become cheaper and would make the investments unviable,” Dutta added.

However, Samarjit Singh, director, IndiaHomes said, “It depends on the current rate of exchange and mode of payment chosen to buy a property. In tandem to ripe market situation, NRIs can cash upon the weakened rupee by opting for a down payment plan instead of construction linked. This is how the buyer is enabled to pay more than 90 per cent of the price right at the time of booking a property and also avail a discount from the developer.”

— Anshuman Magazine, Chairman & MD, CBRE South Asia (P) Ltd

“NRIs constitute about 15-20 per cent only of the entire buying ecosystem. The government does not have any inhibitive currently on these purchase, but they are planning some investment growth activities through their investment promotional council, to create an environment appropriate for non-residents to put money,” said Nishant Singhal, director, Strategy & Alliances, Investors Clinic Infrastructure .

On the contrary, the rupee depreciation has eroded the value of NRI investments in India by nearly 20 per cent in dollar terms. “The drop in asset prices in the real estate sector is over and above the losses due to rupee depreciation,” said Sachin Shah, fund manager, Emkay Investment Managers.

With the rupee again touching the 61-mark against the dollar in July-end, the government swung into damage control mode and said it may use public sector companies and state-run banks to raise dollar debt overseas besides leaning on expatriate Indians to access funds abroad to defend the rupee and finance the current account deficit.

“Unless the macro-economic environment improves, the rupee may remain under pressure. As election is coming, government’s measures on this looks doubtful,” said Alex Mathew, head of research, Geojit BNP Paribas.

— Lalit Jain, Chairman, CREDAI and CMD, Kumar Urban Development Ltd

All bankers, developers, property consultants and host of financial institutions bring schemes that are made to look attractive for NRIs when the rupee is volatile. For the real estate segment, interest rates on non-resident external account and foreign currency non-residential account deposits look very lucrative when NRIs take into account standalone rupee returns.

According to international property consultant Jones Lang LaSalle India, it is strongly recommended that NRIs should never take decisions based on emotional aspects such as buying real estate in hometowns with expectation of high returns.

“Real estate decisions ought to be based on sound and judgmental advice from a professional with pure investment objectives and with no emotional aspect attached to it. Markets such as Hyderabad, Bangalore and Pune currently offer decent opportunities in terms of value. Chennai also offers good opportunities,” said Om Ahuja is chief executive officer (CEO), residential services, Jones Lang LaSalle India.

“Falling rupee should not always be seen as an opportunity but certainly can be seen an option to explore good investment options with 8-10 years investment horizon,” Ahuja added.

Similarly, the bankers also agreed that developers should focus on their sales activities. “So far the real estate industries are concerned, at current rupee levels and sluggish market, realtors need to be proactive in in their sales and products. As the dollar gaining ground, the foreign developers may take interest to invest in Indian projects for better returns,” said M Narendra, chairman and managing director (CMD) of the Indian Overseas Bank. “NRIs could possibly benefit substantially from some attractive options available in the markets,” he said.

Realty analysts are of view that NRIs have always been the soft targets when it comes to such tricky situations on the sector. “The government has been a major enabler with its rulings for real estate sector. Profits from favourable adjustments in FEMA act and the proposed regulatory mechanism for this sector have significantly boosted confidence of NRIs in Indian realty,” Singh from IndiaHomes added.

Welcoming the proposed regulator on the sector, he said it would help streamline the operations along with strengthening the buyer segment in real estate. This will hopefully bring in the required governance and transparency to the end customer of real estate,” said Singhal from Clinic Infrastructure.

The reverse impact

The trend is not entirely in favour of people based abroad. If you repatriate your rupee investments to the country where you stay, you stand to lose. Also, for resident Indians whose children are studying abroad, the weak rupee adds to the burden as they have to shell out more in rupee terms. The same is true about travellers to foreign destinations.

How middleclass hit hard

Apart from cutting back on eating out, buying branded products or new cars, studying abroad etc, the country’s middle class is forced to cut back on property buying. “As their monthly expenditure has risen by 20 per cent, the middleclass segment is keeping away from these above expenses, a study by Assocham revealed recently.

The middle income group has been impacted most by inflation particularly in context of the rupee slumping to new lows and its cascading effect leading to price rise of petroleum products, edible oil, studying abroad, foreign trips, as their monthly expenditure has risen by 15-20 per cent, the study said.

How realty sector contributed to the economy

Despite the steep fall of rupee, the real estate and construction industry has to pay an integral part of the economy. Realty players anticipate that it w will play an important role in the development of the country’s infrastructure base and is one of the largest generators of economic activity.

According to a research conducted, India’s real estate sector is estimated to have a total supply pipeline of close to 3.6 billion sq-ft lined up for completion in the year 2013, with about 98 per cent of this being concentrated in the residential segment.

Anshuman Magazine, Chairman & MD, CBRE South Asia Pvt Ltd, said, “The potential for development and growth in the real estate sector is tremendous. It is expected to generate over 17 million employment opportunities across the country by 2025, thereby making a significant contribution to the GDP. However the industry does require the support and encouragement of policy makers in order to achieve its goals.”

India has witnessed strong economic growth in the last decade primarily on account of economic reforms that ushered in an era of liberalization and provided for increased participation from the private sector. This growth has percolated to the construction and real estate industry as well, which is a conduit for growth in a large number of ancillary industries in the country.

However, Lalit Jain, Chairman, CREDAI and CMD, Kumar Urban Development Ltd added, “For the first time a detailed attempt has been made to give facts on its importance in terms of GDP, industrial production employment opportunities. Prospects of the real estate sector have potential to accelerate growth.”

PE firms keen to pump in about rs 12k cr in Indian realty sector

Private equity (PE) players have shown keen interest in the market with a number of deals in discussion.

According to consultancy firm Cushman & Wakefield’s latest report on the PE in real estate investment states that around $2 billion (Rs 11,854 crore) is available with PE firms for deployment in the Indian real estate sector.

The interest comes despite the fact that PE investment flow in the first half of 2013 dropped by around 46 per cent.

The consultancy firm attributed the drop to the volatility in the market, including slower growth of the Indian economy, political stalemates and depreciation of the rupee.

Sanjay Dutt, executive managing director South Asia, Cushman & Wakefield commented that it is noteworthy that despite a slowdown in the construction market and reduced number of investment-worthy projects in India, real estate features as the fourth most invested sector by PE funds.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder