Report

Trends that shaped India’s real estate in 2022 – NoBroker Annual Real Estate Report

January 20, 2023: NoBroker has recently released its annual Real Estate Report for the year 2022. A press release issued by the company says that, the report broke down the key trends that defined the real estate sector by combining platform data of 30 million users with survey responses from over 26,000 customers across Bangalore, Mumbai, Pune, Chennai, Hyderabad, and Delhi-NCR.

Speaking on the report, Saurabh Garg, Co-founder & CBO – NoBroker.com, said, “Indian real estate, in 2022, has been an exciting space to watch. Buoyed by favourable tailwinds, the sector overcame the inertia of the past several year’s inertia to achieve record growth. 2022 saw record-high capital appreciation and rent inflation. The momentum is expected to continue well into 2023 as ready-to-move-in residential units, rental properties in gated societies, and plotted developments are very much in demand.”

Pent-up demand drives up home prices, buying activity, and rent inflation

Perhaps the most defining trend of 2022 was the post-pandemic pent-up demand. 67% of potential buyers said that pandemic-induced insecurity positively impacted their home purchase decisions.

Migrant professionals also returning to work from offices in key cities resulted in high demand for rental properties. But due to Covid-19, construction activity came to a halt resulting in less supply of housing units. This resulted in major cities registering rent inflation between 12% – 40%. Rents will stabilize in a couple of months as construction activity and new project launches catch up with the current demand. The homebuying outlook for 2023 also remains positive, with 77% of respondents indicating they are looking to buy a house next year.

The consumer demand in 2022 also demonstrated robustness despite changes in market conditions. While initially driven by factors such as historically low home loan interest rates and developer discounts, it remained strong even when home loan interest rates and house prices increased in the latter part of the year. In fact, the demand for ready-to-move-in properties far outstripped the supply, driving major buyer interest toward new project launches.

Over one-third (36%) of homebuyers on NoBroker.com were millennials between the ages of 25 and 40 years, indicating a mindset shift in a generation earlier characterized by preferring utility/rental over ownership.

Residential real estate becomes a lucrative investment opportunity for NRI and domestic buyers

Real estate also emerged as a lucrative investment opportunity in 2022. While 82% of respondents wanted to buy a property for end-use, 18% indicated that they wanted to buy property as an investment. This trend was driven by several factors, including robust long-term capital appreciation and improved rental yields. Rental yields increased by 3-5% across top metro cities, while the average price of 2BHK units also saw healthy appreciation, with Chennai (7.9%) and Hyderabad (7.35%) registering the maximum price appreciation.

In the survey, 71% of respondents indicated that they would prefer to invest in real estate over other investment instruments such as gold, SIP/stocks, or Bitcoin. In fact, 89% of landlords mentioned that they were looking to invest in another property. 73% also felt that they find it much easier to rent out their property now. 56% of them have even admitted that they increased their rent post covid.

The demand for plotted land saw an increase with about 12% of people showing interest. This growth in demand for plotted land drove a massive increase in land launches across metro cities; with even the largest of developers launching plot projects, the number of new land launches increased by over 100% in 2022.

With the declining value of the Indian Rupee giving them a significant advantage, NRI’s interest in the Indian real estate space also surged this year. The NRI segment on NoBroker.com grew by 33%, with a majority of demand coming from nations such as the US, the UK, the UAE, Australia, and Singapore. Developers catered to this growing overseas demand with high-quality luxury housing projects, the demand for which outpaced the demand for mid-segment homes.

Even in the domestic market, more spacious living spaces continued to be a priority, with nearly half (42%) of buyers preferring 3 and 4BHK properties, a further increase from 2021. According to the report, 16% of the respondents had set aside a budget of INR 1 crore or more, highlighting the strong sentiment for a more luxurious and comfortable living experience.

Regardless of whether they resided in India or abroad, buyers in the Indian property space demonstrated a preference for residential real estate (84%) over commercial real estate (16%). That said, investment appetite in commercial real estate doubled over the previous year when only 8% of the respondents had indicated their willingness to invest in commercial projects. The growth outlook for commercial real estate, however, remains positive beyond 2022, as the space normalises and returns to pre-pandemic levels.

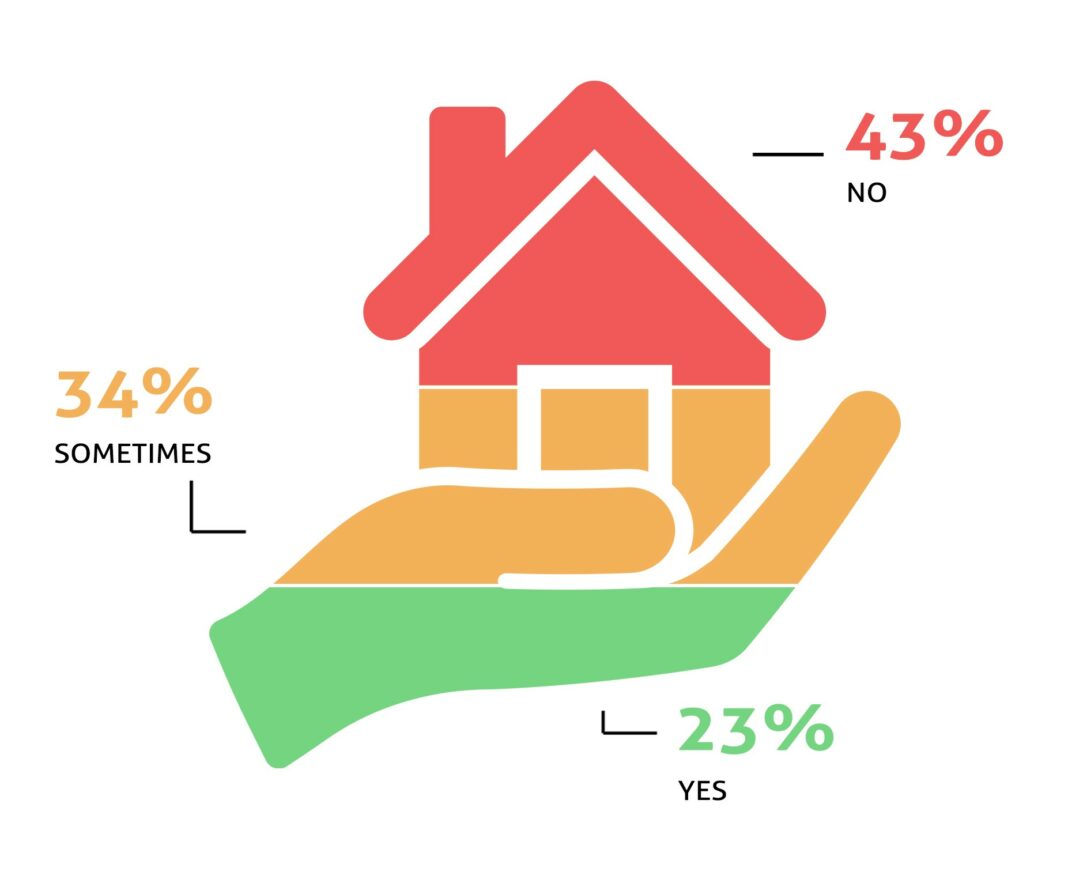

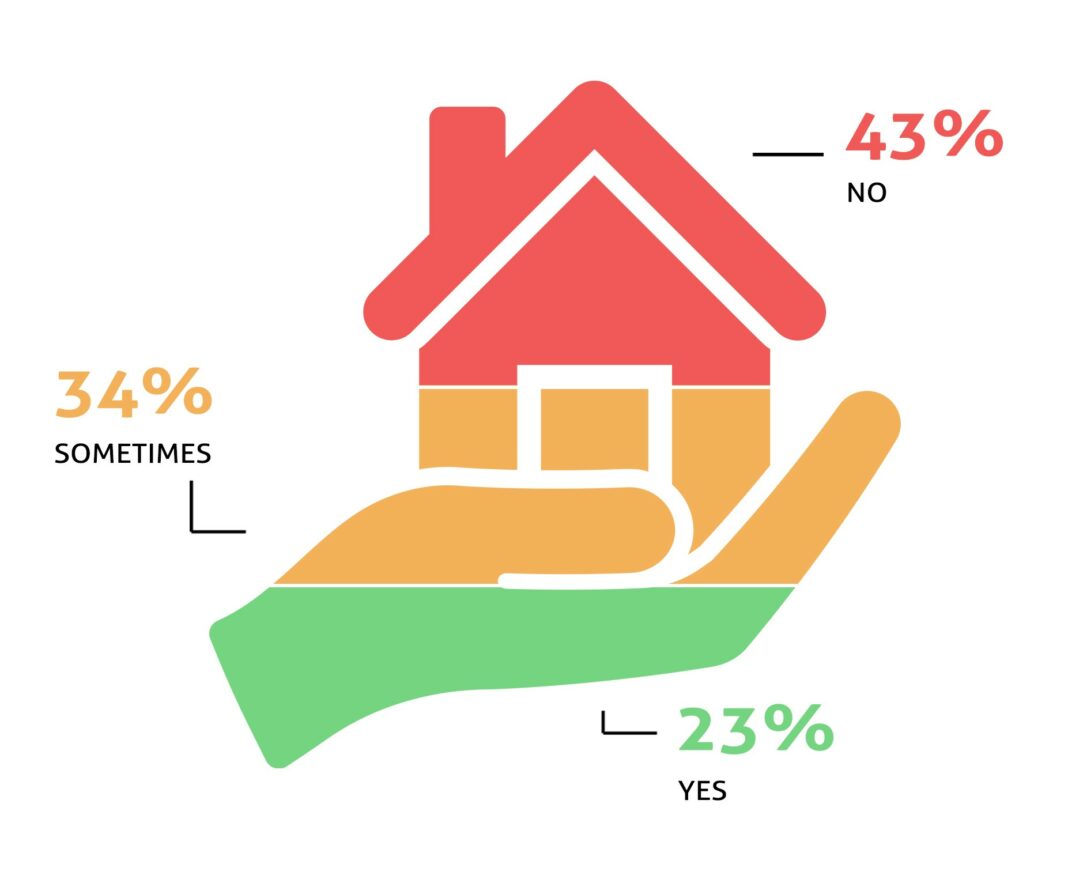

Easy to shift houses

68% of tenants felt that relocation has become easier due to the real estate websites and apps as they offer the benefit of brokerage-free properties and some of these websites are a one-stop-shop for all real estate needs (including packers & movers, home services such as cleaning and painting, home interiors, etc.). These websites also democratise the home search process in the true sense by eliminating biases and pressures brought in by brokers.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News3 weeks ago

News3 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoMultipoint Connection – A Definite Boon

-

News2 weeks ago

News2 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News4 days ago

News4 days agoOlive Announces Dhruv Kalro as Co-Founder