Top Stories

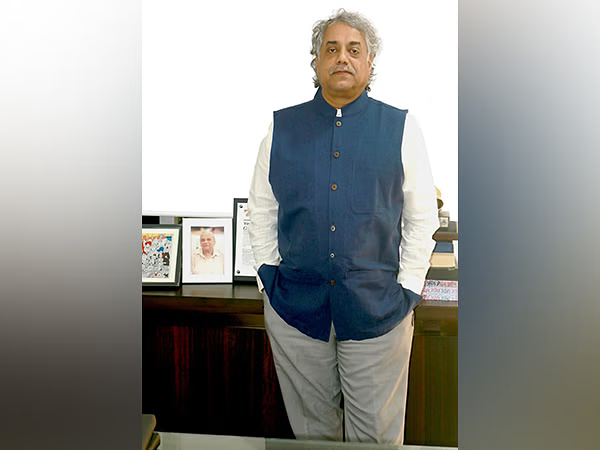

Upheaval year of reforms is through, 2018 likely to witness liberalisation

For real estate sector in the country, 2017 has been a year of upheavals. The two-tree structural reforms, including GST and RERA, carried out by the Government caused turbulence and directly impacted the real estate industry. Apart from these two, the demonetisation measure announced in November 2016 also impacted the sector in 2017.

These three reforms caused some setbacks to the real estate industry. Its capability to develop was affected. But I personally don’t observe this negatively because even if these were setbacks, they were temporary setbacks. Already there are indicators in the market which signal that these were temporary setbacks. So the setbacks are by and large passed now.

Having said that, I would still say that these reforms need further improvisation and fine-tuning, which I am sure, the Government being sensitive, would carry out modifications. We also keep on putting our demands, consumers’ demands, in front of the Government and the Government keeps on taking actions on those, though not as quickly as we would like it to be.

So, to wrap up, we can classify 2017 as a year of structural reforms, especially for the real estate industry as it has definitely been directly impacted by these reforms. But, undoubtedly, these reforms would prove to be beneficial in the long term.

As we can see that demonetisation was a good move and the effect of it has gradually started surfacing as people are getting disciplined, and paying taxes. Corruption levels though haven’t reduced much, but that will also come down as the system moves more towards cashless economy.

The GST though being a good measure, it definitely needs improvement. First, the rate itself is too high. Secondly, apart from 12 per cent GST, stamp duty is also there. So, the total tax impact has substantially increased. There is a need to subsume the stamp duty, so that there is a single tax. And the input credit is not enough to offset the tax increment.

Another reform of 2017 was enactment of RERA. The philosophy of RERA to protect the interests of the homebuyers and regulate the development activity is very good. But these two good intentions are not happening on ground, because RERA is a state matter and it varies from state to state. Also the kind of infrastructure needed to implement is huge which every state is not having. When I say infrastructure, it means IT infrastructure and administrative infrastructure, which every state is not able to provide.

Also the RERA websites are flooded with consumer complaints but the Authorities are not able to address all of them due to lack of proper infrastructure. Similarly the developers are also facing problems as the Authorities are not being able to redress their grievances. Different states have different efficiencies, like Maharashtra RERA is much more efficient than others. So on ground, there are serious issues. The state governments have to see how to address these. Till then, it is actually a pain for everyone.

- These three reforms caused some setbacks to the real estate industry. Its capability to develop was affected. But I personally don’t observe this negatively because even if these were setbacks, they were temporary setbacks.

- We can classify 2017 as a year of structural reforms, especially for the real estate industry as it has definitely been directly impacted by these reforms.

- The GST though being a good measure, it definitely needs improvement. First, the rate itself is too high. Secondly, apart from 12 per cent GST, stamp duty is also there.

- The philosophy of RERA to protect the interests of the homebuyers and regulate the development activity is very good. But these two good intentions are not happening on ground.

- On ground there are serious issues. The state governments have to see how to address these. Till then, it is actually a pain for everyone.

- I think more judicial people like retired judges shall be brought in RERA because RERA is essentially legal, so judicial people taking charge within RERA is more important.

- The year 2017 can be dubbed as a great year of structural reforms which are intrinsically good but they need much better implementation. And if the implementation is overlooked, then they will bite the economy.

- The New Year will see some consolidation within the industry. We also expect interest rates to come down further which will propel growth in the economy.

We on our part, through our Association Credai, are constantly taking up with these issues with respective ministries and the authorities etc. And they understand our problems also. But being a new Act, I think it will take one or two years for things to get streamlined. Also, the control is more with administrative people, not judicial. I think more judicial people like retired judges shall be brought in RERA because RERA is essentially legal, so judicial people taking charge within RERA is more important.

Also RERA will result into more litigations, as every state has some real estate related laws, which have some requirements, which the industry needs to meet. And there are RERA requirements, which need to be met. Then, there are some conflicts between these requirements which are legal in nature. Also, there are issue related to interpretations of the provisions. All these will result into increased litigations.

So, 2017 can be dubbed as a great year of structural reforms which are intrinsically good but they need much better implementation. And if the implementation is overlooked, then they will bite the economy.

In December 2017, we saw post-reforms some stability has started coming into the market. I think the Government has taken all the tough measures in 2017 and now the vision of the Government is likely to be liberalisation. Reforms always need to be supported by liberalisation.

The real estate sector shall be given some tax incentive in 2018, which is likely as the statements which have started coming indicate so. The year will see some consolidation within the industry. We also expect interest rates to come down further which will propel growth in the economy.

This year, as earlier, we will focus more on delivery of our on-going projects. We are not planning to launch any new project until there is clarity on many issues, until new changes settle down. Once there is clarity on issues, we will consider coming up with new projects. We intend to foray into senior living as well.

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder