Report

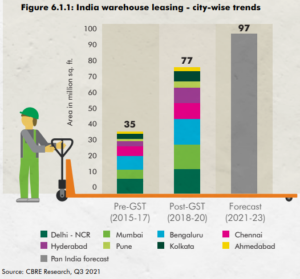

Warehouse leasing is likely to touch 100 mn sq. ft. over the next three years

CBRE South Asia on July 21 announced the findings of its report, tilted ‘India’s Industrial & Warehousing Sector: Tenacious amidst the Turning Tide’. Against the backdrop of robust growth of manufacturing, e-commerce, and third-party logistics (3PL) sectors, the report highlights how Industrial and Warehousing (I&W) activity has gained momentum over the past few years in India.

The report delves into the dynamics of the current manufacturing ecosystem in India and its improving prospects as an alternative supply chain destination on account of elements such as favorable demographics, relatively low labor costs, and continued thrust on infrastructure improvement and policy reforms. As a result, the business climate in the country has vastly improved, as is evident from the continued jump in India’s Ease-of Doing-Business rankings. This, in turn, has had a positive impact on the manufacturing sector of the country, which has attracted over USD 121 billion in FDI inflows over the past six years.

Even before COVID-19, the manufacturing sector was witnessing a visible shift: away from the previously established destinations towards alternative hubs. As a result, India has increasingly become an active player in the global manufacturing supply chain, on the back of improved domestic capabilities in recent years. This has also been supported by robust Government initiatives such as Make in India, Aatmanirbhar Bharat, Building India Campaign (through the National Infrastructure Pipeline) as well as policies such as the Production Linked Incentive Scheme, aimed at attracting investments across a diverse mix of industries such as electronics, automotive, pharmaceuticals, textiles and food processing among others.

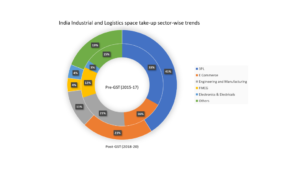

The report also described the current warehouse leasing scenario in the country. The warehousing space take-up over the past five years has crossed 100 million sq. ft. cumulatively, with a historic leasing peak of 32 million sq. ft. reached in 2019. 3PL players accounted for more than 40% of the total warehouse leasing in the post-GST period (2018-20), followed by occupiers from the e-commerce (21%) and engineering and manufacturing (11%) sectors. Occupiers across these sectors have started to increasingly prefer large-sized spaces to consolidate operations, especially post the implementation of the GST. Backed by increasing online retail demand amidst the pandemic, e-commerce and 3PL players are further expected to lead warehouse leasing over the next few years, the report added.

Following a large-scale expansion in tier I cities, occupiers have also started to expand their footprint in tier II and III locations due to improvements in infrastructure and growth of online retail in these areas. Warehouse supply addition over the past five years also crossed 75 million sq. ft. in the country.

In the current scenario, there is a rising demand for an agile supply chain that aims to enable end-to-end control and move from risk mitigation to risk management. As manufacturers focus on increasing CAPEX towards implementing tech in their facility / supply chain, technological advancements such as Artificial Intelligence (AI), Blockchain, Big Data and the Internet of Things (IoT) will ensure that the sector stays resilient in the times to come.

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoOlive Announces Dhruv Kalro as Co-Founder