News

WINTER FIRE

For the Indian realty sector, Diwali 2014 may indeed be a long and extended one. Fireworks are expected to continue well after the festival of lights. That is if Union Housing and Urban Development Minister M Venkaiah Naidu walks the talk and keeps his promise of ushering in the longstanding reforms in the long-beleaguered industry

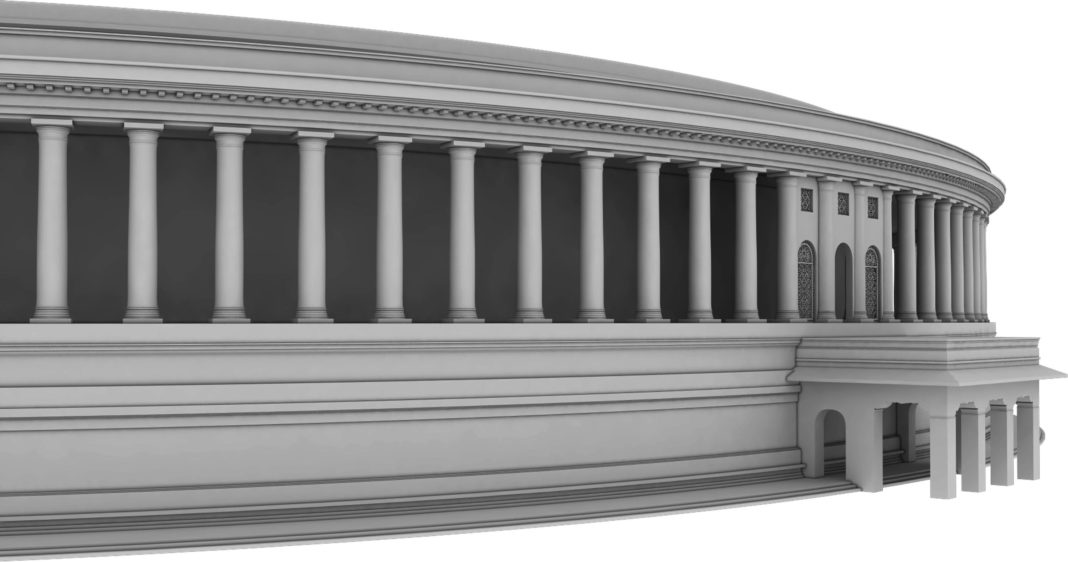

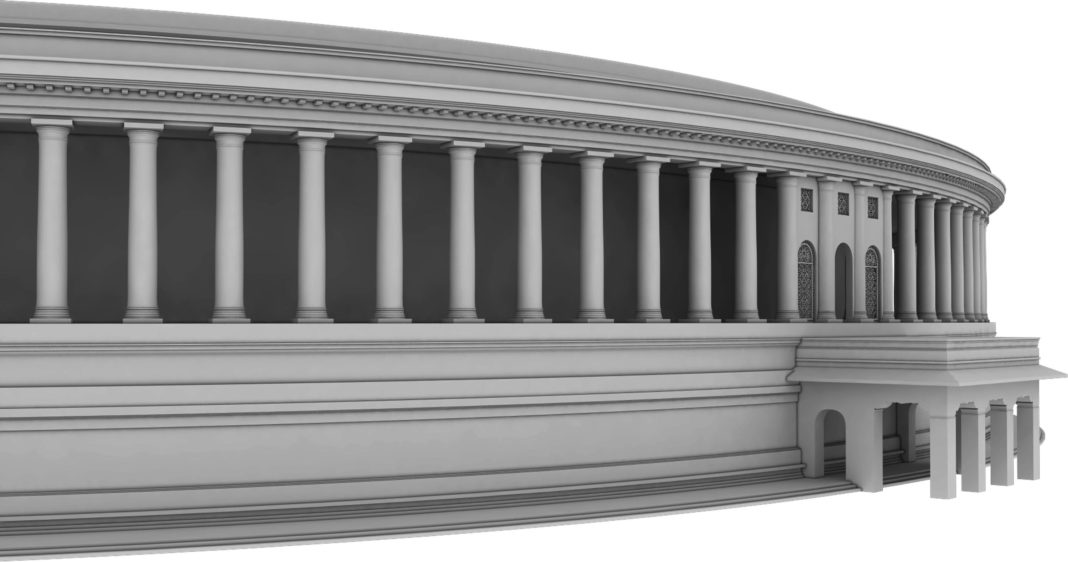

Within two months of holding the reins of power in New Delhi, the Narendra Modi-led Government signalled in the Union Budget 2014-15 its intent to steer the industry out of a prolonged slump. This spread cheer in the beleaguered industry long used to shouting itself hoarse over a long-pending list of unmet demands and overlooked concerns. The timeframe is now expected to be set in the remaining two months of the current year which is to be formalised in the coming winter session of Parliament.

Immediate Roadmap

A clear hint was provided by Naidu in his address at a recent real estate summit organised by the Associated Chamber of Commerce and Industry (Assocham) in the national Capital where he indicated a roadmap.

Declaring that the Government will introduce the Real Estate (Development and Regulation) Bill in the next session of Parliament (scheduled from November 24 to December 23), Naidu said: “We are proposing to bring the Bill in the next session. I already had discussions and consultations with various stakeholders, including consumer forums and also various ministries have addressed and given their responses and we had one round of discussion with real estate sector. I’ll be holding the final round of discussion with them and then preparing the Bill and then take it to Parliament.”

On the need for single-window clearance and an ‘infrastructure status’ to the real estate and housing sector, the minister sod: “I am already holding discussions with the Finance Minister. I am trying to impress upon them that housing should be priority sector lending for banks. The Finance Ministry is positive. I have to still take it forward.”

“We don’t want a tag of infrastructure but a bag of support from banks i.e. priority lending for the housing sector. We need more resources because ‘Housing for All’ by 2022 is a big challenge and unless the Government along with state governments, urban local bodies and private institutions participate in a big way, well not be able to reach this ambitious goal”.

Announcing that the process to identify locations for ‘smart cities’ will take off by January, Naidu said: “We are in the advanced stage of finalisation of the concept and I hope to take it to the Cabinet by November and then start identifying the cities in consultation with states from January onwards.”

If Naidu can maintain the timelines, November-December may see some solid action on the realty front and 2015 may see the emergence of a more confident, upbeat and transparent real estate sector.

The minister’s assurance can also go a long may in battling key challenges of Indian realty in the form of increased land cost, delay in approvals and lack of availability of funds, both at buyers’ and developers’ levels.

• The timeframe and temporal assessment is now expected to be set in the remaining two months of the current year which is to be formalised in the coming session of Parliament

• A clear hint was provided by Naidu in his address at a recent real estate summit organised by the Associated Chamber of Commerce and Industry (Assocham) in the national Capital where he indicated a roadmap

• If Naidu can maintain the timelines, November-December may see some solid action on the realty front and 2015 may see the emergence of a more confident, upbeat and transparent real estate sector

Industry Status

Admitted perhaps for thefirst time publicly by a key minister, the infrastructure or industry status for realty will solve a number of problems developers currently face. First and foremost, it will lead to simplification of procedures. Currently, a developer is required to comply with a long list of regulations which include getting approval of development and building plans and ensuring compliance with fire, pollution control, electricity, environment, water and telephone norms. In addition, the developer has to register with the commercial taxes department, ESI and to on. The construction can begin only after all these clearances are obtained, which often takes as long as three years. Construction takes another few years.

As a result of the cumbersome red tape, a project therefore takes about five to six years to complete. If the sector gets infrastructure or industry status, developers can apply for single-window clearance instead of running around to different agencies.

Granting infra status will also enhance funds’ availability under the foreign dined investment (FDI), external commercial borrowing (ECB) and domestic bank lending routes. Industry status would lead to relaxation of lending norms to the sector, and banks would have a greater willingness to fund housing projects. In addition, developers may get Government help in taking possession of land through the acquisition route.

Real estate is similar to the infrastructure sector in that it requires large quantum of finance for purchase of land, development, construction as well as high maintenance costs. It also requires large quantum of funding over a span of a number of years.

It is precisely for these reasons that seeking infrastructure status has been a persistent demand of the real estate industry.

Soon after Jaitley’s presentation of the Union Budget 2014-15 in July, C Shekar Reddy, National President of the Confederation of Real Estate Developers’ Associations of India (Credai), had commented that “the Budget has given the real estate sector the due importance, although our long-standing demand for infrastructure status for the real estate sedan and an exemption of service for real estate projects is still awaiting the Government nod.”

Again, a week later, while partially welcoming the Reserve Bank of India’s decision to ease financing norms for affordable housing, the Credal chief had reminded the Government about the infra status for the industry.

Other industry bodies as well developers in general had been harping on this demand on various forums. The Government, it seems, has finally made up its mind now.

VENKAIAH NAIDU, Urban Development & Housing Minister

“The long-pending reform of bringing a real estate regulator is the need of the hour. This would bring more transparency in the market by making it mandatory for developers to disclose all the details of their projects.”

DEVINA GHILDIAL, Deputy Managing Director, RICS South Asia

SATYENDRA TOMAR, JMD, Proplarity Group

AMAN NAGAR, Director, Paras Builtech

VIKAS BHAGAT, Director, Airwil Group

Regulatory Authority

The winter session of Parliament is also expected to witness the tabling of another key legislation-the Real Estate (Development and Regulation) Bill.

The Bill is a pioneering initiative to protect the interest of consumers, to promote fair play in real estate transactions and to ensure timely execution of projects. It was first introduced in the Rajya Sabha in August 2013 by the then Housing and Urban Poverty Alleviation Minister Girija Vyas. Soon after its introduction, the Bill was referred to the Parliamentary Standing Committee for review and making suggestions. Earlier, the draft Bill was revised various times since 2009, when it was first formulated.

The Bill provides for a uniform regulatory environment, to protect consumer interests, help speedy adjudication of disputes and ensure orderly growth of the real estate sector and has been keenly awaited by aspiring homebuyers. Since the Bill has lapsed now, the Government plans to bring in a revised version of the Bill.

Though the industry has been flagging concerns about some of the clauses in the Bill,it is undoubtedly a landmark legislation that is set to change the face of the real estate sector in the country.

The Bill is also aimed at protecting buyers from erring developers and to usher in an era of transparency. It seeks establishment of state-level regulatory authorities called the Real Estate Regulatory Authorities (RERAs). Residential real estate projects, with some exceptions, need to be registered with RERAs. Promoters cannot book or offer these projects for sale without registering them. Real estate agents dealing in these projects also need to register with RERAs.

The Bill also prescribes stringent penalties for the developer if he fails to comply with certain provisions. It also makes it mandatory for developers to launch projects only after acquiring all the statutory clearances from relevant authorities. The Bill proposes stricter penalties and even jail term for a maximum of three years for developers. This assumes significance in the wake of rising consumer complaints against developers for delaying projects by well over four to five years, with no mechanism to curb the delays. On the contrary, if a buyer defaults on payment, he has to pay high interests while developers escape through loopholes in the sale agreements.

However, keeping developers’ limited reservations in mind Naidu has clarified that Bill was not meant to strangulate the real estate sector.. Stating that the Government believes in public-private partnership, Naidu has said that it does not intend to add one more ‘table’ to the many that already exist in the domain of obtaining necessary approvals.

• Admitted perhaps for the first time publicly by a key minister, the infrastructure or industry status for realty will solve a number of problems developers currently face

• As a result of the cumbersome red tape, a project takes about five to six years to complete. If the sector gets infrastructure or industry status, developers can apply for single-window clearance instead of running around to different agencies

• Granting infra status will also enhance funds’ availability under the foreign direct investment (FDI), external commercial borrowing (ECB) and domestic bank lending routes

“The Bill is drafted keeping in mind the interests of both developers and customers and it also addresses the core issues the sector is facing currently”

AMAN SINGH GEHLOT, Director, Ambience India

JKJAIN, CMD, Dasnac

“We are expecting a balance Bill to suit the requirements of both the land owners and developers…(lt) should contain single-window approvals for developers and smooth processes to simplify current procedures, which are full of complexity and hassles “

NAVEEN GOEL, MD, Radhey Krishna Group

DEEPAK KAPOOR, Director, Gulshan Homz

ASHOKGUPTA, CMD, Ajnara India

Smart Cities

With the Union Budget allocating Rs 7,060 crore for ‘smart cities’, there is understandably enormous curiosity about this new infrastructure facility. In November, this concept is likely to be taken up by the Union Cabinet. The plan for so many smart cities means a huge role for infrastructure and housing companies and that is why the Budget announcement got huge applause from the developer community.

There is also considerable jubilation in the sector over the bright work prospects over smart cities. While the Cabinet clearance for smart cities is targeted in November, the cities will be identified in January next year.

A city is defined as ‘smart’ when investments in human and social capitaland traditional (transport) and modern (ICT) communication infrastructure fuel sustainable economic development and a high quality of life, with a wise management of natural resources, through participatory action and engagement.

Smart cities are defined by their innovation and their ability to solve problems and use of ICTs to improve this capacity. The concept of such cities as the next stage in the process of urbanisation has been quite fashionable in the policy arena in recent years.

The evaluation of the bouquet of policy measures lined up by the Government for the next two months has rightly lent a festive air to the realty sector. The response received by Realty & More from eminent players across the sector is a testimony to that. Though expectedly varied, everyone was unanimous about the urgency and all-round implications of the proposed measures on the real estate sector in the country.

“With the kind of promise that this new Government has shown, we are very convinced and hopeful that they are pretty serious about working for the cause of people and might even pass the RERA Bill in the next session…With a regulator on board, there will thorough inspection of every activity in the sector”

PRADEEP AGGARWAL, Chairman, Signature Global

Expectations

Devina Ghildial, Deputy Managing Director of RICS South Asia, is convinced about the Government’s seriousness in carrying out these long-awaited reforms. The seriousness, she said, “is evident from the fact that the Government recently called a consultation over reforms such as the single window clearance mechanism and the real estate regulation.” Expressing optimism on the passing of the Bill on the real estate regulatory authority, she said: “While it is difficult to predict the time of its implementation, the Authority should be introduced soon”.

According to Satyendra Tomar, JMD, Proplarity Group, reforms like single-window clearance and industry status to the real estate sector are being keenly awaited. “Without implementation of single-window clearance and granting industry status to the sector, execution of initiatives like development of 100 smart cities and ‘Housing for All’ by 2022 would be an uphill task.”

Ruing the fact that the real estate sector has not been given infrastructure status despite being one of the major growth drivers of the country, Tomar said: “Infra status to housing will act as a major game-changer as it will ensure easy access of funds via routes like FDI, ECB and domestic banks and at affordable rates of interest.”

Paras Builtech Director Aman Nagar also doesn’t have “an iota of doubt” about the Government’s intention to carry out reforms spelt out by Naidu. “The only thing which we need to watch out is how much time it is going to take”, he said. But Nagar was not too confident about the passage of the RERA Bill in the next session. “We expect it to pass through in Budget session,” he said, adding as an afterthought: “But it the Government is really serious, who knows it may be passed in the winter session itself!”

Admitting that the industry has some reservations on a few clauses, the proposed real estate regulator will lend the much-needed credibility to the sector, Nagar said. “Given the general perception of real estate sector among the masses, we expect the regulator to flush out the unscrupulous elements from the market, thus creating ground for credible players to flourish.”

On the infra status, Nagar said: “It is a long-pending demand and the realty sector will never be the same again post-infra status.”

Said Vikash Bhagat, Director, Airwil Group: “We remain highly optimistic about the seriousness of the Government and the direction it is moving.” On the infrastructure status to the realty sector, he said: “It is a much desired policy change which will lead to healthy growth of the housing sector.” The proposed real estate regulator “will ensure transparency at each and every step of the real estate dealings, thereby ensuring that no unscrupulous activities take place,” said Bhagat.

Aman Singh Gehlot, Director of Ambience India, is another developer who is “very positive” about the impending reforms as he believes “these will introduce standardization and transparency in business practices.” He is also confident about the passage of the RERA Bill. He told Realty & More, “The Bill is drafted keeping in mind the interests of both developers and customers and it also addresses the core issues sector is facing currently.” His confidence about the early passage of the Bill stems from the fact that “the Opposition parties also have a very positive attitude towards it and will not raise any objections during the session.”

Gehlot said, “It is high time the real estate industry got infrastructure status. And having single-window clearance will certainly be an added advantage as it will drastically bring down the overall cost of the housing.”

JK Jain, CMD of Dasnac, said that the long-awaited reforms like the Real Estate Regulation and Development Bill have their pros and cons on the largely obscure and unregulated real estate sector in the country. “The industry will surely welcome reforms if the proposed mechanism is dealing smartly with the present jurisdiction of development authorities of the states in a transparent and coordinated manner.” Jain added that a fair play of transaction and timely execution of projects through RERA reforms is keenly expected by the real estate industry as well as aspirant homebuyers.

Ashok Gupta, CMD of Ajnara India Ltd, said: “RERA Bill and single-window clearance system have been long-awaited decisions and we are feeling glad that at least the Government has shown a lot of interest to work on them.” Gupta said: ”As soon as the RERA Bill is passed, there will be complete transparency in the sector and continuous supervision and monitoring of transactions which will secure the interests of the customers.”

According to Deepak Kapoor, Director, Gulshan Homz, the real estate sector is in dire need of the single-window clearance system “as most developers are failing the test of timely delivery.” He said: “Since there is no regulator in the sector, it is becoming tougher for the customers to gain trust…With the Government now actively looking out to curb these issues, the developers and customers will have a great time in transacting in this sector and will also help in reshaping the lost demand”.

Naveen Goel, MD, Radhey Krishna Group, is quite vociferous about the need for serious reforms in housing and realty as the sector “has got the impression of contractors and mediators in Tier 2 & 3 cities although it has gone far ahead than this.” He said:

- The (RERA) Bill provides for a uniform regulatory environment, to protect consumer interests, help speedy adjudication of disputes and ensure orderly growth of the real estate sector and has been keenly awaited by aspiring homebuyers

- There is also considerable jubilation in the sector over the bright work prospects over smart cities. While the Cabinet clearance for smart cities is targeted in November, the cities will be identified in January next year

RAJESH GOYAL, Chairman, RG Group

“Today professional and organised companies are working to provide affordable houses to the population…The Government should create meaningful infrastructure, industry and job opportunities also in Tier 2 & 3 cities.”

The Radhey Krishna Group MD added: “We are expecting a balanced Bill to suit the requirements of both the land owners and developers…(It) should contain single-window approvals for developers and smooth processes to simplify current procedures, which are full of complexity and hassles.”

Said Rajesh Goyal, Chairman, RG Group: “We have no qualms about its seriousness in carrying out these reforms.” He said the Government was planning to give infrastructure status to real estate and housing sector “to revive the sagging economy and we are confident that Parliament will grant the same in the next session”.

“The infra status will prove to be a real game changer as this will pave way for both developers and individuals to avail easier funding from banks and that too at lower rates and for longer duration,” Goyal said. On the proposed regulator, he added: “The move will help in improving the image of real estate, bring better transparency in the system and attract more FDI.”

Pradeep Aggarwal, Chairman, Signature Global, said: “With the kind of promise that this new Government has shown, we are very convinced and hopeful that they are pretty serious about working for the cause of people and might even pass the RERA Bill in the next session…With a regulator on board, there will thorough inspection of every activity in the sector”.

“The credit of granting such a status had been long due and it is good to see that our Government is taking steps to recognise the sector”

CHAMAN PANWAR, CMD, Visava Group

MK GUPTA, Chairman, KPDK Buildtech

On the possibility of infra status, Chaman Panwar, CMD, Visava Group, said: “The credit of granting such a status had been long due and it is good to see that our Government is taking steps to recognise the sector.” Panwar added: “The plan to finally pass the RERA Bill and the execution of a single-window clearance system will be graciously welcomed by the sector as every developer today has an aim to enhance the quality and standard of living of the society which is possible if the construction and development work is carried on in a problem-free manner.”

MK Gupta, Chairman, KPDK Buildtech, summed up the optimism of the real estate sector aptly when he said: “It is now in the Government’s hands to execute the RERA Bill and set up a single-window clearance system as soon as possible so that the developers can work efficiently and effectively. This will also allow a flow of positive market sentiments in the sector thereby increasing the faith and demand amongst the customers”

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News2 weeks ago

News2 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder