News

Big metros may see marginal drop in residential property prices over RBI ban on 80:20 scheme: JLL

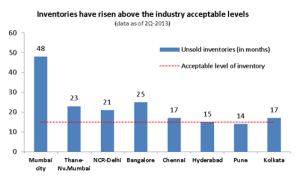

“The correction will account more on back of high inventory levels in the leading seven cities in India which is higher than comfortable industry levels seen around 8-10 months ago, which is between 14-15 months’ worth of unsold supply,” says Ashutosh Limaye, head, Research & Reis, Jones Lang Lasalle India.

According to the report, developers in these metros may resist price cuts as the cost of land in these metros is already at astronomical levels. Also, the recent change in the Land Acquisition and Rehabilitation & Resettlement Bill will raise land owners’ expectations, and the developers will have to negotiate hard for available land.

“The developers are likely to hold their prices at the current levels with the expectation of a marginal correction in the prices of few projects aimed at the mid-income segment .The price correction is likely to be within a range of 12-18 per cent, depending on project and their builders’ holding capacity and financial strength. A correction in prices beyond 12-18 per cent would affect developers’ profitability to a non-acceptable extent,” adds Limaye.

The property prices in real-time appreciation (adjusted for inflation) in tier-1 cities during the last few years (1Q12-current)have not exceeded 4-5 per cent – a fact that could resist developers from reducing property prices significantly, says report. It is also pertinent to note that most projects within the municipal limits of cities like Mumbai, Delhi and Bangalore these cities are targeted at HNIs or NRIs, who can afford to purchase these properties without availing of bank funding.

The timing of the announcement by RBI could not have been worse, as it did just before the festive season. As per the industry trend, in the festive season consumer spending is generally higher, and developers often announce schemes that could help them sell high-priced apartments. The 80:20 scheme was one of such scheme, wherein the buyer agrees to pay 20% of the flat cost upfront. The remaining amount is funded by the bank after signing a tripartite agreement between all three parties at stake here.

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoOlive Announces Dhruv Kalro as Co-Founder