Current affairs

HOME LOAN RATES MAY HEAD SOUTH IN 2014

While the direction of home loan rates in the new year is a matter of discourse, its linkages to inflation is crucial. And riding on the back of a good monsoon, inflation may be heading downward, which therefore is good news for the setting in of a low interest rate regime

With the year 2013 being a lacklustre year on the home loan front due to sky-rocketing prices and a high interest rate regime, it would be interesting to see how 2014 looks.

Realtors are strongly in favour of rate-cuts for obvious reasons. Vijay Mirchandani, CREDAI secretary, feels that there must be reduction in the interest rate on home loan by 50 basis points in the New Year. “Mostly, people falling under economically weaker section (EWS) and lower income group (LIG) require the houses. Hence, a low interest rate on home loan will give a push in demand for such retail loans. Also, we are in favour of certain changes in the Real Estate Regulation Act (RERA) so as to make it more effective”, said Mirchandani.

According to a report by McKinsey, there is a demand for 2.7 crore houses in the country at present.

Another argument being given by the builder community for the need to go for a rate-cut is that regulations like RERA and Land Acquisition Bill will make their job a difficult proposition and hence the only solace lies in a lower interest rate on home loans.

Manoj Singh Meek, chairman and managing director (CMD) of a Bhopal-based realty firm Shubhalaya, says: “Daunted by the recent addition of the two regulations by the government, realtors are migrating to countries like Sri Lanka and Dubai where the real estate sector is booming at the moment. Therefore, the government must liberalise the norms by way of bringing down the lending rates. If the interest rate is kept low, the demand for home loan will increase for sure.”

There are hitches too. “On the supply side, the recently passed Land Acquisition Act will make it difficult for the builders to acquire land. Once the Real Estate Regulation Act becomes effective, the builders will find it difficult to maintain the supply of flats in the market. Taking these factors into consideration, I am of the view that the interest on housing loan may increase or may remain at the current level in 2014”, says Prakash Praharaj, founder and chief financial planner, Max Secure Financial Planners.

CPI continues as a major worry and unless inflation comes down. RBI may not reduce rates. Further, the nonperforming asset (NPA) level of banks have increased to alarming levels and combined with the restructured assets are actually more than the net worth in some banks. Increase in treasury yield has affected the treasury portfolio of banks and marked-to-market (MTM) losses have increased.

Good monsoon in the year gone by is likely to result in better rabi crop which will further put downward pressure on the consumer price index (CPI). And in that case, inflation will move down and interest rates will surely also fall. Another argument being given by the builder community for the need to go for a rate-cut is that regulations like RERA and Land Acquisition Bill will make their job a difficult proposition and hence the only solace lies in a lower interest rate on home loans. Since both the demand and supply increase, prices should not be affected much. The reality, as some studies suggest, is actually quite the contrary. If some economic intervention is introduced to encourage new supply, the demand – side responds more aggressively. The end result is that often prices will go up.

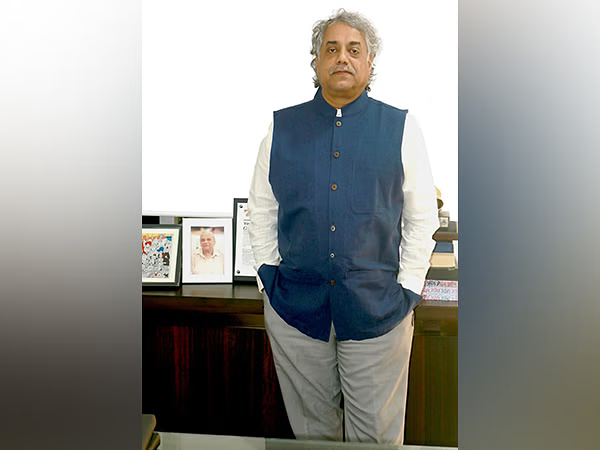

Vijay Mirchandani, CREDAI Secy

Prakash Praharaj, Founder & Chief Financial Planner, Max Secure Financial Planners

Usha Anant Subramaniyamm, CMD, BMB.

“Maintaining the net interest margin (NIM) of the banks is a big challenge in the current scenario”, added Paharaj. On their part, bankers are not sure about the rates coming down until and unless the food inflation comes down and supply side constraints start easing. Even though there is a likelihood of food inflation coming down in 2014 thanks to good monsoon in the year gone by, supply side constraints will ease only when the oil prices come down.

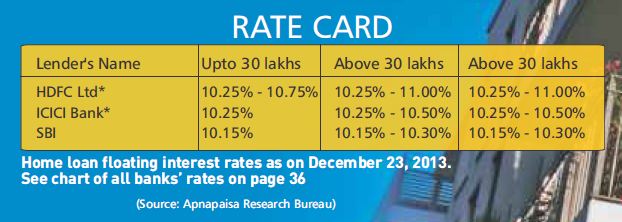

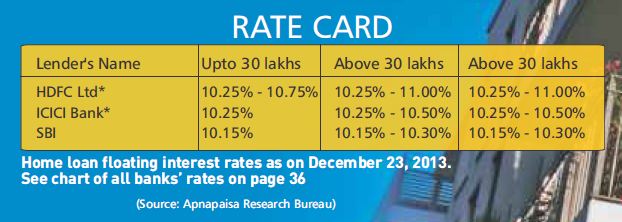

Then there are mortgage lenders, which have cut their home loan rates, after having hiked the same early in December. Housing finance major HDFC first increased its interest rate on home loans in December. However, it was quick to bring down its rates up to `75 lakh to 10.25% later during the month. “This is a limited period offer and is valid for all new applications submitted before January 31, 2014 and first disbursement taken by February 28, 2014”, HDFC said in a statement.

Country’s largest lender, State Bank of India too has cut its home loan rates to 10.15% and 10.10% in case of women borrowers. Similarly, country’s largest private sector lender ICICI Bank and Kotak Mahindra Bank have also reduced its interest rates on home loan by 15 and 25 basis points respectively recently for new borrowers.

However, Keki Mistry, vice-chairman and chief executive officer of HDFC, is of the view that the rates will come down in 2014, when food prices see a substantial decline as a result of good monsoon. Mistry also believes that RBI will have a leeway to lower interest rates April onwards.

One good thing has happened in the industry in the past few years. Bankers have stopped offering home loans at a fixed rate of interest and are now offering the product at a floating rate of interest alone, which is further directly linked to the base rate.

Says KR Kamath, chairman of Indian Banks’ Association (IBA) and CMD of Punjab National Bank: “The interest rate on housing loan is now directly dependent on the level of inflation. Hence, it will come down once the inflation starts falling. But, I can’t tell you exactly when will this happen”.

Experts do believe that lower interest rate spurs demand. People find loans cheaper and demand more homes. Also, they do agree that lower interest rates also offer cheaper debt capital to home production (construction). Therefore, even the supply side gets encouraged. Either side – home buying or construction – improves the economy, but creates a fear of inflation, experts add. On the other hand, when demand increases, so does the supply to match the demand.

Our intuition would say that since both the demand and supply increase, prices should not be affected much. The reality, as some studies suggest, is actually quite the contrary. Real estate markets are known for short term demand-supply disequilibrium. Thus, although the demand for homes increases, the supply is unable to match it. To put it differently, if some economic intervention is introduced to encourage new supply, the demand-side responds more aggressively. The end result is that often prices will go up.

“Interest rates in India were low during the ‘sub-prime’ periods (2002-2004), but some discipline was introduced in the post-crisis era (2009-2010). It appears that during the most of 2011, the interest rates were raised to discourage overheating. Since early 2012, the rates, however, seem to have stabilized. What direction it takes in near future depends on whether the government is satisfied with current prices or it wants to make the debt more expensive. I personally do not expect to see any drastic fall in the interest rates”, said Dr Prashant Das, assistant professor of Real Estate Finance at Ecolehotelere de Lausanne, Switzerland.

KR Kamath, Chairman, IBA & CMD, PNB

Another intriguing issue here is the widening gap between the sanction and the disbursement of home loans, which often disturbs the applecart due to increase in interest rates during the period. The newly launched all-women Bharatiya Mahila Bank (BMB) is seriously working towards reduction of the turnaround time while disbursing the home loan.

Usha Anant Subramaniyam, CMD, BMB, says: “In the present economic scenario, even predicting the interest rate on home loan for a month in advance is difficult. Still, housing will continue to be a priority for every Indian. What we are looking at BMB is to reduce the turnaround time while providing loans.”

However, chances are acute that interest rates will come down when it comes to commercial real estate as the regulator believes it to be a sensitive sector and hence leaves no stone unturned to keeping rates low.

Loans for the commercial real estate segment grew 21 per cent year-on-year to `1,43,700 crore as on October 18, 2013. Although this is less than 3 per cent of total bank credit, it is a concern for the regulator as loans to real estate forms part of lending to sensitive sectors.

Not to mention that for the same period, loans for consumer durables and vehicles grew by 32% and 22% respectively. Hence, it doesn’t seem if the banks’ ‘Doubting Thomases’-like attitude will change in the new year.

A property site, makaan.com, had conducted a survey ‘Property Forecast 2014’ which concluded that property market in 2014 will be driven by end users. The November 2013 survey conducted among 2058 home buyers across Mumbai, Delhi-NCR, Bengaluru, Chennai, Hyderabad, Pune, Kolkata, Ahmedabad, Chandigarh, Indore and some more cities, also revealed that residential property prices will either stabilize or will appreciate marginally in the new year.

M Narendra, CMD, IOB

Dr Prashant Das, AsstProfessor, Real Estate Finance, Ecolehotelere de Lausanne, Switzerland

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder