Guest Column

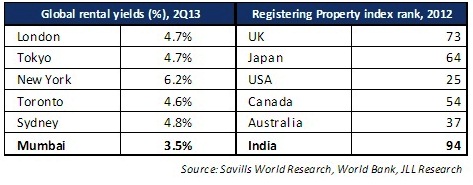

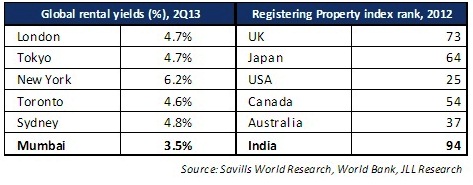

Mumbai sees 3.5% rental yields, lower than London, Tokyo, New York

In Mumbai, yields have fallen by 50-90 basis points (bps) across various precincts during the period 2007and second quarter 2013. After property prices took a beating during the global financial crisis (GFC), they bounced back quickly, resulting in yield compression. More recently, during first quarter of to second quarter of 2013, yields have risen moderately, owing to marginally higher growth in capital values over rental values.

Similar trends have been witnessed in Hong Kong, Singapore and Beijing, where rental yields fell by 50-100 bps during the same six-year period. Manila and Jakarta exhibited a similar trend, though the rates of fall were quite different. While rental yields in Manila fell 30-35 bps, the fall was much sharper in Jakarta at 250 bps. This is attributable to the steep rise in capital values beginning second quarter of 2010, which was the result of escalating cost of transaction and construction material.

The intra-regional comparison of various Asian cities reflects a logical differentiation between rental yields. However, the same logic does not seem to apply in developed markets. It is widely believed that emerging Asian countries are relatively more risky for real estate investment than developed economies. Yet, the rental yields in emerging Asia do not reflect the relative risk-return differential.

Despite stronger regulations and a better legal framework in the developed economies, comparison with emerging Asian yields reveals a different picture. Lower penetration of financial markets, higher inflation and larger population creating a constant demand for housing could be reasons for this.

Also, households in emerging nations generally prefer to channel a large proportion of their savings into physical assets such as gold and real estate. According to India’s central bank data, the country’s household investments in physical assets are over 50 per cent of the total household savings. In a country like the United States, the figure is below 30 per cent.

The question is – how long will this continue? Can the existing yield differential between emerging Asia and developed markets sustain? Over the past few years, rental yields have been on a decline across various Tier-I cities in Asia. So far, it has been the faster rise in capital values over rents across much of Asia that has led to a compression in yields.

This differential in rental yields is a crucial consideration for global investors for whom the diversification of markets is an important criterion. Also, higher yields in Asia might tempt global investors, particularly from the West, to invest while they have access to cheaper funds onshore. Local investors also benefit, because higher yields mean a rising rental value, offsetting moderated capital values – the former rise faster than the latter.

(The author is Head, Research & Reis, Jones Lang Lasalle India)

-

News3 weeks ago

News3 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News3 weeks ago

News3 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News1 week ago

News1 week agoOlive Announces Dhruv Kalro as Co-Founder