Main

Naredco Hails The Overall Budget, Says It Will Also Provide Impetus For Housing And Real Estate Sector

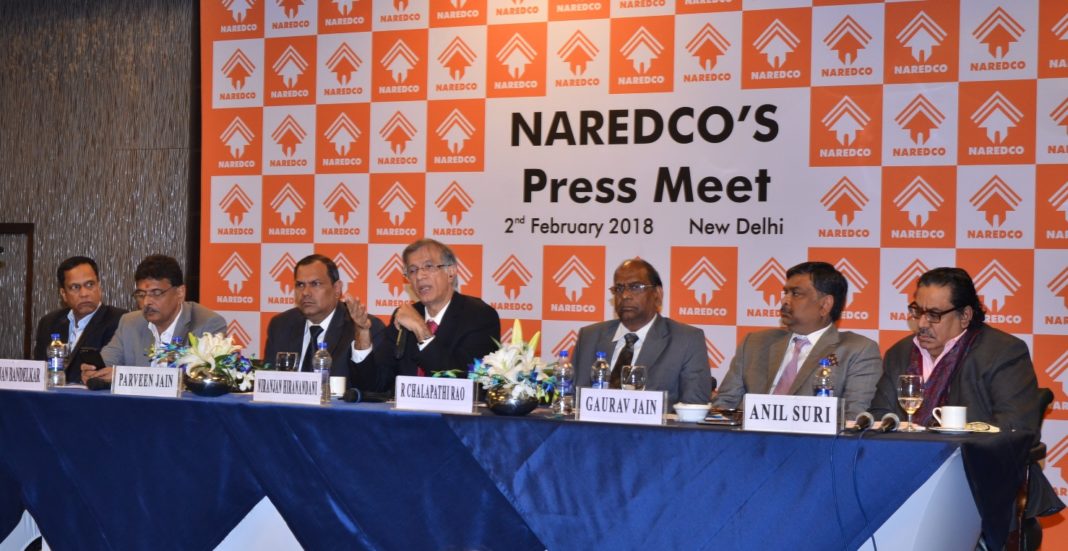

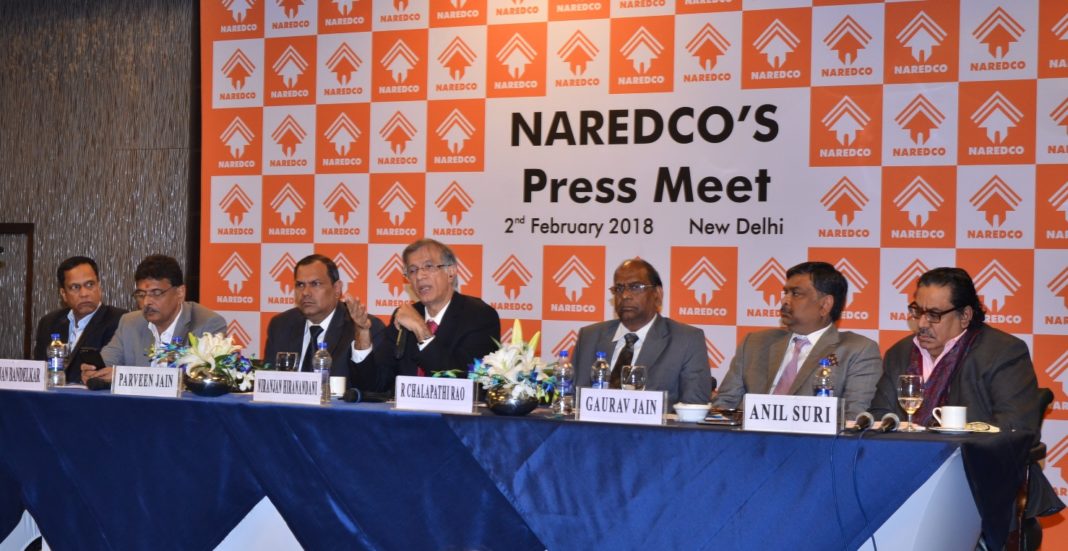

New Delhi, 2nd February 2018: India’s premier apex body for real estate sector, National Real Estate Development Council (NAREDCO) has hailed the overall budget presented by Finance Minister, Mr. Arun Jaitley and feels that the Government has continued making announcements that will take the country on the path of growth as across sectors, namely, Agriculture, Food Processing, health insurance industry, textile and the affordable housing. The affordable housing sector which already has received Government of India’s positive reforms shall continue to grow in years to come. Affordable housing shall witness increased growth in across Tier 1, Tier 2 and Tier 3 cities. Consequent to this, with real estate having forward and backward linkages, supply chain industries – Cement, Steel, Iron, Construction Materials and Transportation, will also witness growth. This will boost economy, create employment and avenue for housing and real estate.

NAREDCO President Mr. Niranjan Hiranandani said, “I think the Budget is an Realistic Budget. The provisions for Agriculture, especially 11 lakh crores for Fisheries, Aquaculture and Animal Husbandry; 5.97 lakh crores for Infrastructure; National Health Protection Scheme for 10 crore families; 3 lakh crores for Mudra loans; 1 lakh crores for the RISE Scheme; Medical Colleges; 10,000 crores for an affordable housing fund; provision for Education; lower tax rates of 25 % for MSMEs with a turnover upto 250 crores; are all measures which will give a huge boost to the economy and GDP. These will all in turn uplift housing and real estate. “

Mr. Hiranandani further added, “The government has in any case been taking steps for promoting housing, especially affordable housing separately ever since 2014. It is therefore equally possible that steps for promotion of Rental Housing and for removal of distortions in some provisions of the Income Tax Act to allow investment in multiple homes upon sale of an old house, can be taken during the discussions on the Budget in the Parliament or during the course of the year.”

“We would like to compliment the Finance Minister, Shri Arun Jaitley for announcing an overall good budget for the country. The budget announcements are leaps to the future for agriculture, health, infrastructure, rural and MSME sectors. These announcements shall prove to be the drivers of economic growth and showcase government’s focus on fiscal prudence and reforms. We are indeed grateful to the Government for considering NAREDCO’s request of lowering GST rate from 18% to 12%, which is effectively 8% now, after considering land abatement at 30 percent. The beneficiaries will be houses built as Affordable Housing; houses under Credit Linked Subsidy Scheme for Economically Weaker Sections (EWS); lower-income group (LIG), middle income group-1 (MlG-1) and middle income group-2 (MlG-2) under the Housing for All (Urban) Mission or Pradhan Mantri Awas Yojana (Urban).” Mr. Hiranandani added.

Mr. Hiranandani further said, “The Finance Minister’s announcement of a dedicated affordable housing fund (AHF) in National Housing Bank, funded from priority sector lending short fall and fully service bonds, authorized by Government of India, is a welcome decision. This will help in achieving the vision of Housing for All by 2022.”

According to NAREDCO Vice-Chairman, Mr. Parveen Jain, “We welcome a comprehensive and well structured budget announced by Finance Minister. Positive announcements across sectors are contributors towards economic growth and shall boost these sectors, simultaneously, creating opportunities for real estate sector. NAREDCO also welcomes the decision of the Government for amending Section 43 CA of the Income Tax Act, that no adjustment shall be made in respect of transactions in immovable property, where the Circle Rate value does not exceed 5 percent of the consideration. In other words, by allowing it to be valued at up to 5% below circle rates for calculation of stamp duty and capital gains tax.”

NAREDCO top brass had met the finance ministry officials during the process of budget preparations and submitted a memorandum to them regarding the demands of the real estate sector. The major demands included rationalization of GST for real estate, Industry status for the complete real estate sector and streamlining of procedures and procedural hurdles. NAREDCO is hopeful that in near future, the government will fulfill these demands as well.

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoOlive Announces Dhruv Kalro as Co-Founder