Interviews

NATIONAL HOUSING BANK : Bank Of Confidence

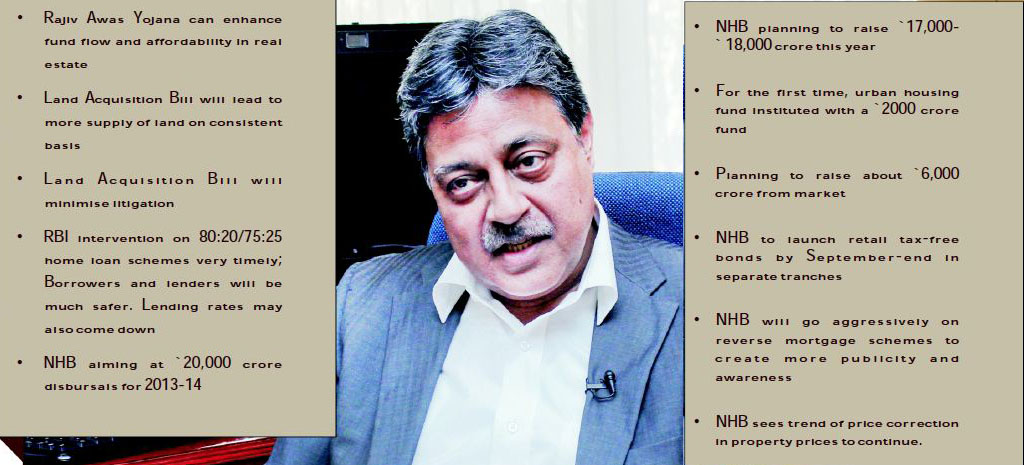

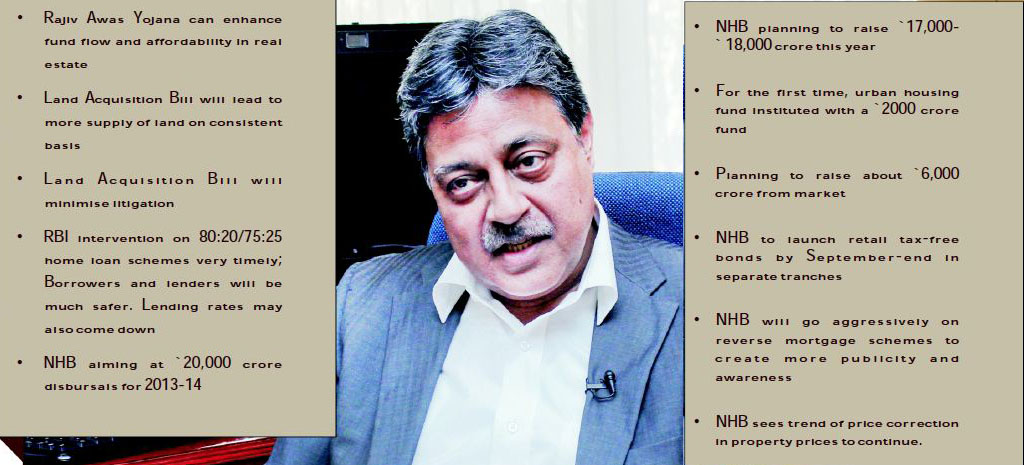

From the Rajiv Awas Yojana to the Land Acquisition Bill, with several key policy changes on the anvil, these are testing times for the National Housing Bank (NHB) dedicated as it were to promoting inclusive expansion with stability in the housing finance market within the overall financial system. Realty & More’s editor Palash Roy spoke to RV Verma, Chairman and Managing Director, NHB, on recent changes, their implications, NHB’s future plans and prospects in a free-wheeling chat. Excerpts from the interview:

PR : The Union Cabinet has approved the Rajiv Awas Yojana and the continuation of the Affordable Housing in Partnership scheme. How do you view on this? How far would it go to boost the realty sector?

RV : Definitely it would boost the sector. It can have a huge impact and it would have nationwide impact and visibility. It would be particularly good for the economically weaker sections. Low income housing will definitely give a big boost to the sector, and under RAY (Rajiv Awas Yojana) as you know, the effort is also to remove slums and mitigate slum dwelling in urban areas, so these will have far reaching effects. If implemented through the banking institutions and the housing finance companies, the reach and the depth of the financial market can be quite huge. Moreover, if the scheme is primed at channelising subsidies to these institutions also, who combine it with loans, there would be a vast improvement in both availability of funds to the sector, as well as affordability because of the subsidy component.

PR : Your take on Land Acquisition Bill passed by the Parliament?

RV : A lot has been spoken about the Land Acquisition Bill, both positive and negative. Taking everything into account, I think it would certainly generate more confidence amongst all the stake holders. It is possible that the initial impact on the compensation which proposed under this will lead to more supply of land and on a more consistent basis, litigation will be minimised. Upfront, there may be some kind of pricing issue in the beginning itself, but that I think will get neutralised by the fact that more land will come into the market, more steady supply would be there, and once the various provisions of the Bill get settled down, and is understood by all the

parties in the same language, I think the land market will get more streamlined, there will be more flow of land, more supply of land.

PR : But supply of land would take a long time and the entire process of acquisition would get delayed, and also the land prices would increase 3-4 times?

RV : That’s what the critics have been saying. It’s likely that there would be some impact on prices. I am not ruling that out, I am not saying that there would be no impact on price. But it would take some time in understanding the nuances of it, but once the provisions get somewhat more normalised or become routine, the real benefit will start flowing into the sector. Initially it is possible that getting 80% people on-board may take time. There are different categories, there are certain projects to be taken up by the public agencies and the government itself, certain projects by the private sector, and certain projects under PPP. The provisions under these three formats also vary, and that’s being taken into account considering the strengths and weaknesses of the different sectors – public sector, private sector, or the government agencies, and the overall public interest. So public interest has been kept in view right throughout the various provisions of the Bill. We would think that eventually once the scheme gets going, there will be more streamlining and smoothening of the whole processes. Approvals initially may take time, getting 80% of the people, their willingness may take time, but once achieved, the momentum on the project can really gather steam.

PR : RBI has recently expressed its reservation against the 80:20/75:25 home loan schemes offered by banks. Don’t you think retail borrowers will now face problems in getting loans and buying a house?

RV: This is a very timely intervention by the RBI. I think it will generate more stability in the market. It will certainly generate more sense of responsibility and more sense of prudence amongst the lending institutions. The changes may take some time to really settle down for all the stake holders to accept it fully. But again, let me qualify it by saying that it was not a very widely prevalent mechanism or arrangement. It was happening only in certain segments of the market and with certain lending institutions. It is not in such a large scale as to become a systemic issue. Having said that, I think borrowers will now feel much more safer, because we know borrowers have become educated and they know the mechanics of construction, loan releases, etc. They would feel more confident and protected that all their money is not being put in the hands of the agency or construction agency, whose projects hasn’t come up yet. So they will feel in a way much safer and the risk perception of the lenders will also be reduced, as a result of which it is possible that the lenders may be able to give them loans at a lower rate of interest also, as compared to what they were giving earlier. So overall it will have a very positive effect on the sentiments of the buyers and the borrowers, as well as the lenders. They will have to come to terms with it and that may take a little time. This entire amount upfront was given to the builder not to the borrower, so in any case if the loan is sanctioned to the borrower, it will come to the borrower, but that has to be linked to the stage of construction, which is a very prudent sort of an approach, and which the RBI has reinforced. This should have been followed naturally by the market.

RV : Well, risk perception would come down and it can translate into pricing, I think the lenders would feel more protected also. Of course with the 80:20/75:25 home loan schemes, they were able to improve their balance sheet much faster, improve their total volume of lending much faster. But that was not very safe, it was not very prudent. So that correction in turn would improve the sentiments and also the risk perception of the lender.

PR : Do you also plan something similar for the HFCs (Housing Finance Companies)?

RV : We would think that the RBI cautioning should be imbibed by HFCs also. This is an observation by the central bank and this relates to the entire sector. It was not a widely prevalent practice among HFCs, but those who were engaging in it, I think they will definitely get some sense of guidance from this prudent advice from the RBI and in a way, it is a guideline issued by the RBI for the entire housing sector. We would also monitor and supervise its implementation.

PR : Coming to NHB, how have the disbursals been so far and what are the expectations for the remaining part of the fiscal?

RV : Our accounting year is from July to June. We have not even completed the first quarter. We are targeting disbursals of Rs 20,000 crore this year, that is, 2013-14, and we projected disbursals of `4,000 crore for this quarter, which we should be able to achieve. So far we have done almost close to `2,500 crore this quarter. By the time we close the quarter, I think we should achieve ` 4,000 crore.

PR : What is the response of CERSAI (Central Registry of Securitisation Asset econstruction and Security Interest of India) so far?

RV : CERSAI has been very good, and in two years time we have been able to achieve record filing of data and information on the portal of the Central Registry, and today it is in excess of 90 lakh transactions that have been reported by the banks and the housing finance institutions, who are giving mortgage loans. So under the act as you know all the lending institutions are obligated to place all the data on the central registry, the CERSAI portal. It was instituted little over two years ago in March 2011, and now we have more than 90 lakh transactions on the portal, and we already have provided connectivity of CERSAI portal

PR : Has there been a noticeable number of prevention of frauds due to CERSAI?

RV : Well, yes. We have now written letters to chief executives, CMDs of banks, housing finance institutions to ensure that all their branches who are in the business of sanctioning loan, etc, should visit the CERSAI portal invariably, and check the information on the land against which the borrower has come to take a loan. We are trying to reinforce this from time to time. So far the experience has been good. We are also trying to get specific data from them as to how many frauds or potential frauds they have been able to

detect, and which have been prevented because of this information being available to them. So we are in the process of collecting that as well, that will also give us some basis in our further improving and effecting innovations into the mechanism.

PR : What are your fund raising plans for the current fiscal? What will be the mode?

RV : We propose raise close to `17000 – 18000 crore this year and that will be through various instruments. We have already been allocated rural housing funds of `6000 crore for this year. For the first time the urban housing fund has been instituted with a fund of about `2000 crore and tax free bonds which is another `3000 crore. So about `11,000 crore is through various allocations, and then we propose to raise about `6,000 crore from the market other than these allocations.

PR : This `6000 crore through the market?

RV : By issuing unsecured bonds, taxable bonds or even through some of the lines of credit which we already have from the World Bank, from KFW, and now we are working through DFID, which is a UK government agency, which is also working with us to explore a line of credit for the NHB for the low income states.

PR : You will be coming out with tax-free bond issue?

RV : The entire 100% of the private placement which we were to do, we have done. Now the retail taxfree bonds will be launched by us sometime towards the end of September, and we propose to do it in separate tranches.

RV : Yes. The scheme certainly needs more publicity and more awareness. As of now we are waiting for a clarification from the ministry of finance, department of revenue, on the status of annuities which we have built into the schemes as annuity-linked products, the cash flow of which would be available to the mortgager, the senior citizen for the entire period of his life. So this annuity which is going to come to him, will be actually in the form of a loan, which is expected to be realised from the value of the property and paid back to the lender, but it is just a technical clarification which we sought from the finance ministry. This annuity will not amount to income that will be subjected to tax by the senior citizen, so once we have that, we will go about it very aggressively. Moreover there is appetite in the market, there is a growing demand for it.

PR : Since you track property prices also, where do you see the prices going?

RV : The last quarter we saw some amount of correction in 22 cities out of the 26 cities we cover, and this was for various reasons, and we expect that this price correction trend to continue. We base our estimates or index on actual transactions which are taken from a very wide and broad based sample from across 26 cities.We are also getting the information from the lenders, from the banks and the HFCs, and as per this, the trend on price correction should continue for various reasons: Because the scenario of oversupply continues to a certain extent, particularly in some segments of the market, which includeMumbai and the NCR region as well; Builders are also under a certain amount of pressure for liquidity, and they are quite positive, they are quite willing to liquefy their existing assets, that is bring their properties into the market, sell them at a price at which the buyers are willing to take, and then generate liquidity for meeting their debt service requirements, as also liquidity for continuing with their other projects which they would have launched. We expect that this downward moment should continue in the coming quarter also.

PR : Do you see any bubble?

RV : No, we don’t think there is a bubble. The exposure of lending institutions to projects is very well contained. It is within 10 per cent of the total of their loans and advances. For the housing finance companies also, their exposure to the builders is very well contained, it is low. So there is no systemic threat to the financial sector. As far as the real estate sector is concerned, since there is not toomuch of inflated financing, maximum lending is happening to the retail borrowers. Retail borrowers are generating this demand, and the market which we see now is becoming more and more end-user driven, which is giving us comfort. Rather than the investors’

market, it is more of an end-user market which is a more stable market. It is less a cause of concern is compared to the investors’ market, which is speculation driven, very artificial price-driven, and artificial shortage-driven. So the changes, we expect, will be for the better of the health and stability of the sector.

PR : How do you see the rupee fall and its impact? The impact so far on the lending as well as on the real estate sector?

RV : We have not seen the housing or the real estate industry being impacted. Of course there has been some FDI in the real estate sector, but that is largely in the commercial real estate that may have impacted somewhat, but we don’t see any visible sign of unrest or discomfort in the housing sector. It was more local resource driven and domestic resource driven. There hasn’t been any unsettling impact on the housing or the real estate sector.

PR : There also hasn’t been any major impact on the disbursals due to the weakening rupee?

RV : That’s right. We have seen that quarterly disbursals from April to June quarter have been in the 18-19% range. The housing finance companies have registered a good growth of about 20%, and the bank growth is about 18% of the retail housing loan market. So that is good, and the quality of asset also continues to be good, the NPA level has been well contained.

PR : Lastly, your suggestions for the HFCs?

RV: They are a very steady lot. Their expansion in the retail housing market has been very steady, and is not explosive, and this is how it should be. There is no explosive growth, or sudden spikes in the housing finance market and housing finance companies. So as a regulator and as a creditor institution also, we are quite comfortable, and we see the growing interest of various corporates, including international investors in the equity of the housing finance companies, which is a good sign. They are seeing it as a stable market, as a paying market, and as a market where their funds will be safe. So they are expressing their willingness and interest to invest more in this sector. So that’s a good sign, and to my mind it is very positive.

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoOlive Announces Dhruv Kalro as Co-Founder