News

Modest Supply Expansion to Continue in FY25, Coupled With Steady Absorption Rate Rise in Commercial Real Estate: Ind-Ra

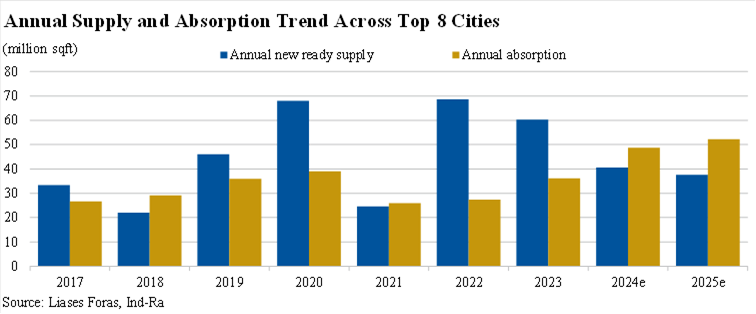

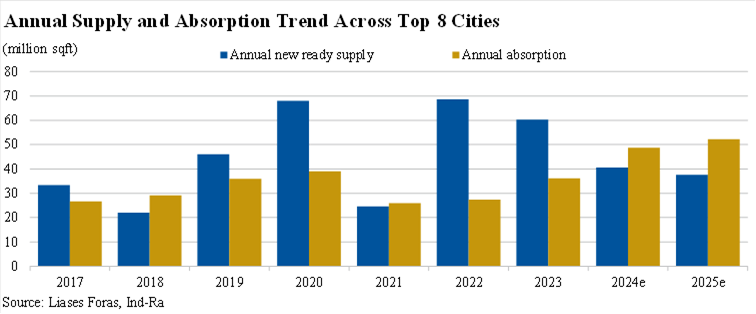

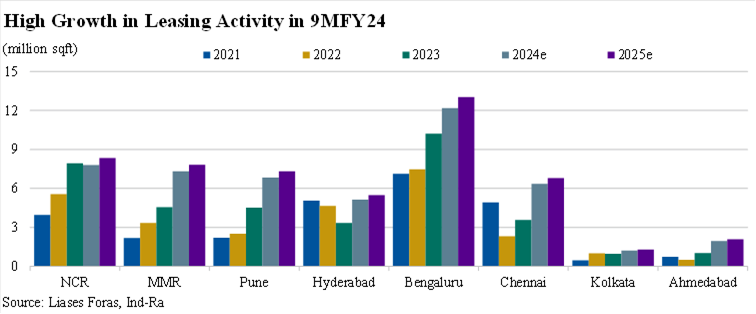

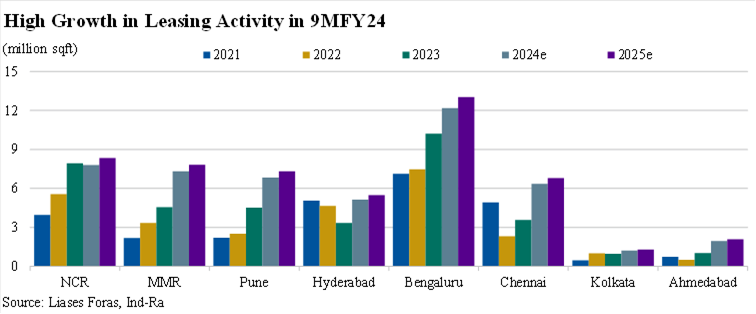

Mumbai, April 23, 2024: India Ratings and Research (Ind-Ra) has maintained a neutral outlook for the Indian commercial real estate (CRE) sector for FY25 on back of steady growth in absorption and rentals. The agency assumes new supply and absorption rates will grow at 5%-6% yoy and 7%-8% yoy, respectively, in FY25. The absorption demand is likely to come from various sectors, especially flex operators, BFSI and engineering, seeking Grade A office spaces. Similarly, rental growth is likely to be modest in the band of 3%-5% in FY25, due to the high supply over FY22-FY24 leading to sticky vacancies. Ind-Ra however believes India will continue to benefit from the structural advantages made available by its skilled talent pool and cost-effective office spaces. According to Liases Foras, demand for the sector in the top eight tier 1 cities has reached unprecedented levels, with around 39 million square feet (msf) of absorption in 9MFY24 (9MFY23: around 24msf).

“Bangalore is likely to continue to lead the Indian CRE micro-markets, with its start-up ecosystems and broad economic bases. Hyderabad and the National Capital Region may cool down which was noticed during FY24, following the strong supply and increases in rentals during FY22-FY23”, said Mahaveer Jain, Director, Corporates Ratings, Ind-Ra.

Ind-Ra expects overall the lease rental rates to grow 3%-5% yoy across the top eight cities in FY25, largely driven by the rollover reset and customer churn. Rental rates for office spaces were growing steadily in FY24 wherein developers were maintaining reasonable rental yields of 8%-10% due to a high demand. Ind-Ra expects the vacancy levels to remain stable or slightly improve during FY25 across the top eight cities. Even the lowest vacancy levels seen in IT hubs such as Bengaluru and Pune however in FY24 are likely to inch-up due to the high supply. The vacancy levels in NCR and Mumbai dropped to the range of 15%-16%, amid a slowdown in new projects launched in the past two years. However, Hyderabad witnessed a spike in FY24 amid a large number of launches and a drop in the absorption levels. Ind-Ra expects renewals to not be a challenge for FY25, as the physical attendance has improved.

Ind-Ra expects global capacity centres to continue growing in FY25, led by the BFSI and engineering & manufacturing industries owing to India’s strategic advantages, such as its vast pool of technological talent, advancements in digital infrastructure, and a flourishing start-up ecosystem. Ind-Ra expects a further expansion of co-working spaces which reflects a move towards more flexible and collaborative environments, meeting the changing requirements of start-ups and small businesses. Ind-Ra also expects REIT assets to keep performing much better than non-REIT in FY25, as the former is typically diversified in terms of both assets and tenants, and therefore has much better ability to handle a tenant churn. Conversion of SEZ area into domestic tariff area may also overwhelm the demand-supply balance and keep vacancy at elevated levels.

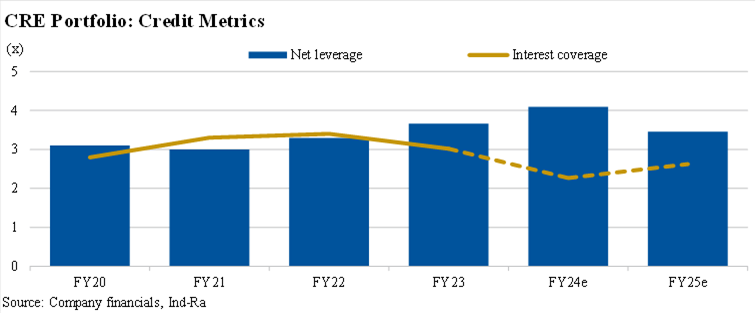

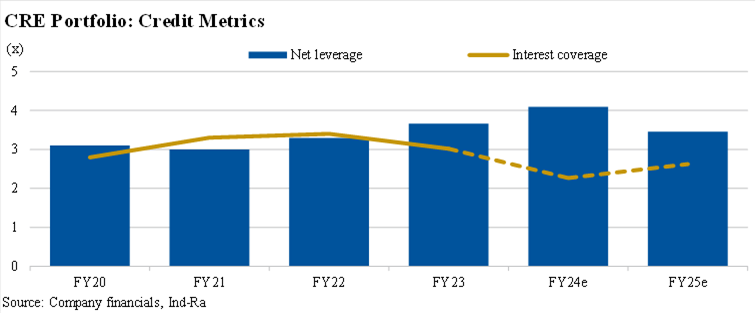

Ind-Ra has maintained a Stable rating Outlook for CRE entities for FY25, given their strong credit metrics and moderate under-construction risk. It expects the net leverage and EBITDA interest coverage ratios of its rated portfolio of operational assets to marginally improve, but be in the band of 3x-4x.

-

News4 weeks ago

News4 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoNoida’s High-Rise Societies Face Multiple Challenges Despite Rapid Urban Growth

-

News3 weeks ago

News3 weeks agoOlive Announces Dhruv Kalro as Co-Founder

-

News4 weeks ago

News4 weeks agoGodrej Properties Sells 5000+ Homes of Rs 9.5 cr in Q4FY24, Bookings up 84% YoY

-

News3 weeks ago

News3 weeks agoVestian: Domestic Investors Dominate Institutional Investments in Jan-Mar’24

-

News2 weeks ago

News2 weeks agoIndia to become the fastest-growing silver economy, housing up to 17% of the world’s elderly population by 2050: CBRE Report

-

News3 weeks ago

News3 weeks agoHRERA Gurugram Rejects Godrej Properties’ Project Extension Application, Account Frozen For Prolonged Non-compliances