Experts' Take

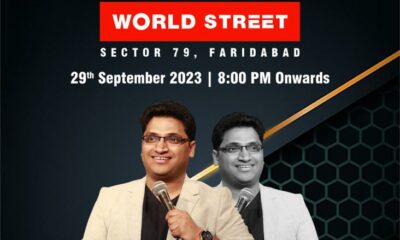

Gaurav Gupta, Director, SG Estates

It is very disappointing that an addition burden of VAT has been levied on builders in addition to the plethora of taxes that realty is already burdened with. Also, the VAT is applicable with retrospective effect. This will lead to increased litigation as buyers who have taken possession and got the sales deed executed will not pay for the proportionate share of VAT, and builder will not pay if he can’t recover from the old buyers. On one hand, the government wants to promote housing and on another, it further increases its cost by burdening with other form of taxes.

Gaurav Gupta, Director, SG Estates

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoManasum Senior Living Launches IKIGAI GOA, A Senior Living Community in North Goa, in collaboration with Prescon Homes

-

News4 weeks ago

News4 weeks agoBridging India Divide: Top 5 Tier- 2 Cities to Focus On

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News4 weeks ago

News4 weeks agoMultipoint Connection – A Definite Boon

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoOlive Announces Dhruv Kalro as Co-Founder