Report

Residential sales post robust Y-o-Y growth of 75 pc in H12021

CBRE South Asia on August 9 announced the findings of its recent report, ‘Residential Real Estate in India – Challenges And Future-Proofing Strategies For Developers’.

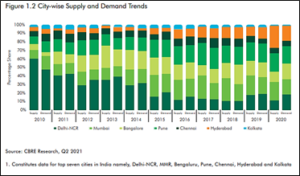

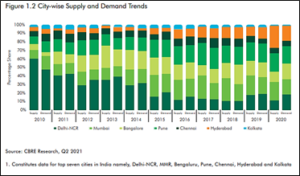

On the back of measured policies announced by the central and state governments, and the RBI coupled with the incentives provided by the developers, the report cites that the residential segment has been showing green shoots of recovery as housing sales grew by 73% on a q-o-q basis across India’s top seven cities in Q42020.

The recovery continued in H1 2021, as sales recorded over 75% growth on a y-o-y basis. Pune led sales activity with an approximately 26% share, followed by Mumbai (19%). It was closely followed by Hyderabad and Delhi-NCR with 18% and 17% shares respectively.

While the report captures the recovery of residential real estate, it also highlights the factors that led to the growth of affordable and mid-housing sales in India, over the last decade.

Affordability at its highest

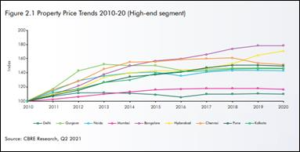

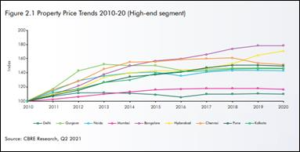

While property prices have grown at a CAGR of 1-6% across high-end segment and around 2–7% across mid-segment since 2010, the per capita GDP grew at a CAGR of 4.0% between 2010 and 2020.

Further, the growth in GDP per capita for the top seven cities was above the national average, with Bangalore reporting the highest CAGR (6.6%). Hence, the income growth overtook the average rise in the price of properties, further contributing to housing affordability.

Moreover, the RBI gradually brought down the repo rate from 6.25% in February 2019 to 4.0% in May 2020, which has led to interest rates on home loans come down to 6.7-6.9%

Government’s initiatives

Affordable housing has consistently been on the Central Government’s agenda ever since the policy on ‘Housing for All by 2022’ was announced in 2014. The reduction in GST on under-construction projects from 8% to 1% in 2019, coupled with various incentives announced in the Budget 2021-22 has helped affordable housing become the major contributor to the sector’s growth.

Although the residential sector is witnessing green shoots of recovery, developers are still navigating through issues such as limited availability of credit, tax and regulation complexities, construction delays due to labor shortage caused by reverse migration (though abated to a large extent), higher input costs leading to rising construction costs; highly leveraged balance sheets of several developers have added another layer of challenge for the sector. The report discusses these challenges and how developers can navigate through these constraints to future proof their portfolios. Some of the key factors that developers should consider are maintaining financial discipline, investing in technology to expedite construction timelines and move in line with the emerging trends in the RE segment, some of which are listed below:

Future trends:

- Demand for bigger homes on the rise- To accommodate the trends of WFH and e-schooling, homebuyers could opt for larger homes

- Developers moving towards flexible homes- To keep up with the homes that can accommodate home offices and classrooms, developers might have to come up with flexible home designs

- Housing demand moving towards peripheral locations- As the commute time is expected to reduce owing to hybrid and satellite offices setups, cities’ peripheral locations are expected to witness a higher demand as they offer more accommodative homes at relatively lower prices

- Green and smart homes-Demand for sustainable and smart home designs could increase as consumers become more conscious of energy costs

- Re-assessment of labor practices- With health and safety of the labor force gaining more attention, developers are likely to safeguard the well-being of their labor pool by ensuring sanitization and social distancing at construction sites

Way forward

Going forward, developers would have to foresee and plan for any future disruption to the workforce and project delivery. According to CBRE, below are some practices that could assist developers to emerge stronger and resilient post the pandemic

- Timely delivery to create brand loyalty and add-on services to build trust with customers

- Accelerate adoption of modern technology and construction techniques

- Embrace strong corporate governance and inculcate the ESG model

- Maintain financial discipline

- Diversify development portfolio; re-align portfolio with market dynamics and market cycles

- Invest in upgrading labor force skillset

-

News4 weeks ago

News4 weeks agoKW Delhi 6 Mall Onboards New Brands

-

News4 weeks ago

News4 weeks agoCommercial Realty Gets Tech Savvy: Fast Construction, Enhanced Convenience

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells Rs 3k cr+ Homes of Godrej Zenith, Gurugram, within 3 days

-

News3 weeks ago

News3 weeks agoRBI’s Status Quo on Key Policy Rates to Help Maintain the Real Estate Growth Momentum, Say Industry Stalwarts

-

News2 weeks ago

News2 weeks agoOlive Announces Dhruv Kalro as Co-Founder

-

News1 week ago

News1 week agoNoida’s High-Rise Societies Face Multiple Challenges Despite Rapid Urban Growth

-

News3 weeks ago

News3 weeks agoGodrej Properties Sells 5000+ Homes of Rs 9.5 cr in Q4FY24, Bookings up 84% YoY

-

News2 weeks ago

News2 weeks agoVestian: Domestic Investors Dominate Institutional Investments in Jan-Mar’24